Is Plug Power Stock a Buy Now?

Key Points

Plug Power has a new initiative to transition from a growth-at-all-costs model to a more efficient approach.

It hopes to achieve annual savings of $150 million to $200 million and improve profitability.

The company has secured substantial deals, including a liquid hydrogen supply contract with NASA.

- 10 stocks we like better than Plug Power ›

For more than 25 years, Plug Power (NASDAQ: PLUG) has been carving out a place in the hydrogen energy sector, yet it still hasn't achieved profitability. The company has consistently burned cash, diluted shareholders, and failed to deliver for investors.

But things could be turning around. Project Quantum Leap is Plug Power's pivot from growth at all costs to a more efficient operating model, focusing on high-growth opportunities and targeting $150 million to $200 million in annual savings. Here's what investors need to know.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Plug Power looks to become a more efficient operation

Plug Power develops hydrogen and fuel cell solutions, aiming to build a vertically integrated ecosystem of products that produce, transport, store, handle, dispense, and utilize hydrogen for mobility and power applications. The company cast a wide net across the hydrogen energy industry, prioritized growth over anything else, and has bled capital year after year as a result.

For example, Plug Power has built production plants, like its large-scale green hydrogen and fuel cell manufacturing plant in western New York. However, the company acknowledged that the pace of development in the hydrogen economy has been slower than expected, prompting it to pause certain projects.

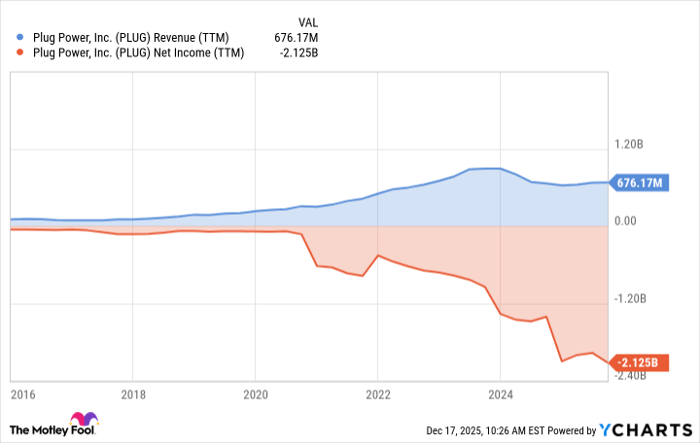

PLUG Revenue (TTM) data by YCharts

The company initiated Project Quantum Leap to transform it into a leaner and more efficient business. To do so, it will simplify the business and focus investments on higher-profit products. Some of its highest-value markets include electrolyzers, material handling, and hydrogen plants.

Its electrolyzers use proton exchange membrane technology to split water into hydrogen and oxygen using electricity. This appeals to heavy industrial producers, such as refineries, chemical, steel, fertilizer, and commercial refueling stations, because these companies can produce fuel on-site and bypass markets altogether.

Through Sept. 30, Plug Power has generated $119.5 million in electrolyzer sales revenue, representing 61% year-over-year growth and one-quarter of its net revenue.

The company has scored some big wins

Plug Power is focusing on large-scale deals to leverage its existing footprint. One major deal that happened last month was with Carlton Power, a green energy developer in the United Kingdom. The company selected Plug Power for an equipment supply and long-term service agreement totaling 55 MW across three green hydrogen projects.

This award (subject to a final investment decision) would be the largest combined electrolyzer supply contract in the U.K. to date and help establish a regional infrastructure blueprint for the technology. The country aims to achieve up to 10 GW of low-carbon hydrogen production capacity by 2030, with approximately half of that coming from green hydrogen.

Image source: Plug Power.

Another significant development for Plug Power is its liquid hydrogen supply contract with NASA, which will deliver up to 218,000 kilograms of liquid hydrogen to NASA's Glenn Research Center and Neil A. Armstrong Test Facility.

This contract, valued at up to $2.8 million, is the first order to supply liquid hydrogen to the U.S. and validates Plug Power's ability to meet NASA's stringent hydrogen standards, which require high purity to avoid contamination in spaceflight.

Is Plug Power a buy?

Plug Power is taking steps through Project Quantum Leap to enhance its business efficiency and improve its bottom line. The company aims to strengthen its balance sheet and reduce costs this year. Management is hopeful of ending the year with a breakeven gross margin and expects to achieve positive earnings before interest, taxes, depreciation, and amortization (EBITDA) by the second half of next year.

Management says the quality of project engagements is much higher than previously seen and that projects have a much higher probability of reaching a final investment decision compared to a few years ago, when fewer project opportunities advanced.

That said, Plug Power has its work cut out for it. Through the third quarter, the company still has a net loss of $789 million on $485 million in revenue. Investors should monitor Plug's initiatives going forward to see whether cost-cutting and a narrower focus on growth improve profitability. Until then, I believe investors are best advised to avoid the stock.

Should you buy stock in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,039!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,506!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 20, 2025.

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.