If You'd Invested $10,000 in Oklo's Initial Public Offering, Here's How Much You'd Have Today

Key Points

Oklo has seen its stock surge since going public just last year.

The company may be able to provide clean and affordable power, which is currently viewed as a high priority due to global warming and the significant demand from artificial intelligence.

Oklo recently broke ground on its first reactor and is still pre-revenue.

- 10 stocks we like better than Oklo ›

Investors in the nuclear power company Oklo (NYSE: OKLO) have made significant gains, as the market bets that nuclear power can prove to be a reliable and clean source of energy that helps meet the substantial demand expected from artificial intelligence (AI).

Oklo currently has three sites where it is developing nuclear reactors: Oklo Aurora at the Idaho National Laboratory and two sites in southern Ohio. However, the company has only recently broken ground on the Aurora site, where it is building a 75-megawatt electrical (MWe), liquid metal-cooled fast reactor.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The company initially expected to have this site operational in late 2027 or early 2028. However, the project has been fast-tracked by the U.S. Department of Energy, which may accelerate this timeline.

Still, Oklo has no revenue, while trading at a roughly $13 billion market cap. The company also recently announced a $1.5 billion capital raise that will dilute shareholders, and many questions remain about the ultimate energy needs of AI.

If you'd invested $10,000 in Oklo's IPO

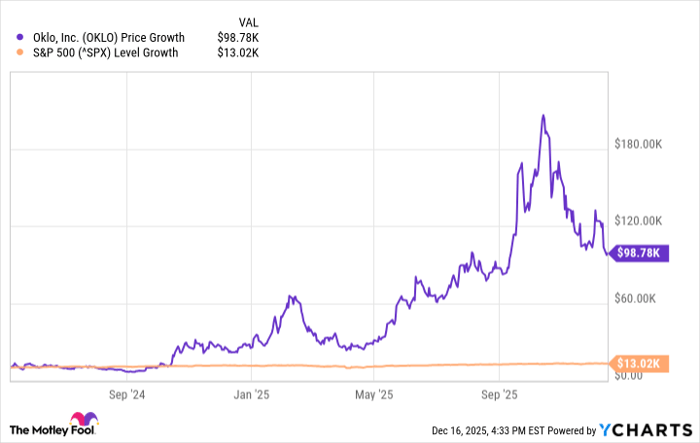

Oklo went public through a special purpose acquisition company (SPAC), but began trading publicly on May 10. Since then, the stock has skyrocketed higher and is now up over 730%. At one point, just a few months ago, the stock traded at nearly double its current price, making it a volatile investment.

OKLO data by YCharts

As you can see above, $10,000 invested in Oklo's IPO is now worth close to $99,000. Meanwhile, the same $10,000 invested in the broader benchmark S&P 500 index would only be worth slightly over $13,000, which is by no means a bad return over roughly a year and a half.

Should you buy stock in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $511,196!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,047,897!*

Now, it’s worth noting Stock Advisor’s total average return is 951% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 19, 2025.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.