Want $10,000 in Passive Income? This Vanguard ETF Could Be Your Ticket to Making It Happen.

Key Points

The Vanguard High Dividend Yield ETF holds companies with high forecast dividend yields over the next 12 months.

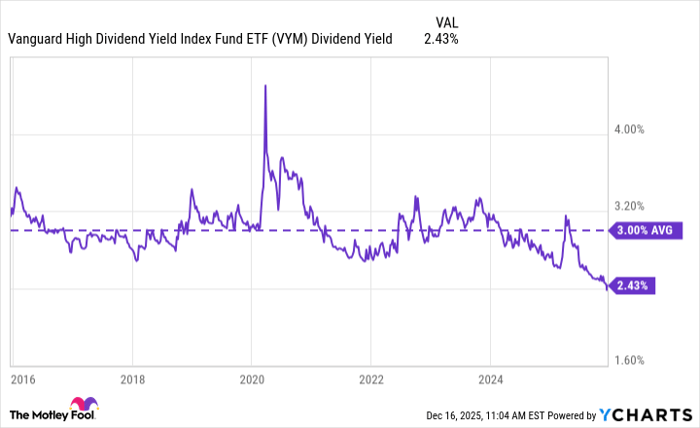

This ETF has averaged a 3% dividend yield over the past decade.

Its average annual total returns have been around 11.5% over the past decade.

- 10 stocks we like better than Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF ›

The beauty of passive income is that you can earn money in your sleep with virtually no effort. Yes, it may take some work to get to that point, but once it's set up, the income continues to flow.

In the stock market, the primary source of passive income is through dividends. You invest in a dividend stock or exchange-traded fund (ETF) and get rewarded for simply holding on.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Any amount of passive income is welcome, but if $10,000 sounds appealing, there are straightforward ways to make it happen in the stock market. There's one dividend ETF in particular that has shown it has the historical returns and dividend payout to get you to the five-figure mark. It won't be instant for most people, but it's very much attainable.

Image source: Getty Images.

The Vanguard High Dividend Yield ETF is a good go-to

The Vanguard High Dividend Yield ETF (NYSEMKT: VYM) is one of the top dividend ETFs on the market, with over $70 billion in assets under management. It has been around since November 2006 and tracks the FTSE High Dividend Yield Index, which selects companies with high forecast dividends over the next 12 months (excluding REITs).

This ETF includes companies from all major U.S. sectors, but the top five most represented are financials (21%), technology (14.3%), industrials (12.9%), healthcare (12.8%), and consumer discretionary (9.7%). From a sector standpoint, it's much more diversified than indexes like the S&P 500 and Nasdaq Composite, which have become very top-heavy with large tech companies.

Below are its top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Broadcom | 8.69% |

| JPMorgan Chase | 4.06% |

| ExxonMobil | 2.34% |

| Johnson & Johnson | 2.32% |

| Walmart | 2.24% |

| AbbVie | 1.88% |

| Bank of America | 1.69% |

| Home Depot | 1.66% |

| Procter & Gamble | 1.62% |

| Cisco Systems | 1.43% |

Data source: Vanguard. Percentages as of Nov. 30.

Dividend payouts from the Vanguard High Dividend Yield ETF will fluctuate because its holdings pay out their respective dividends at different times, but its past four payouts have been: $0.84 (November), $0.86 (June), $0.85 (March), and $0.96 (December 2024).

How $10,000 in passive income is possible with this ETF

Over the past decade, the Vanguard High Dividend Yield ETF has averaged a 3% dividend yield. Dividend yields fluctuate inversely with stock prices, but for the sake of illustration, let's assume it maintains its 3% average yield. In that case, you would need around $333,334 invested in this ETF to generate $10,000 in passive income.

VYM Dividend Yield data by YCharts

At the time of this writing on Dec. 16, the ETF's price is $144.82, meaning you would need to purchase 2,302 shares if you were starting from scratch.

Let time do the heavy lifting

Admittedly, most people don't have $333,000 just sitting around waiting to be invested, so the "buy all the shares at once to make it happen" scenario is far-fetched. What's not far-fetched, though, is using consistency and the power of compound earnings to make it happen.

Compound earnings occur when the money you make on an investment begins to make money on itself. It's a snowball effect that grows over time, turning relatively small investments into much larger ones.

To see it in action, let's assume the ETF averages 11% annual total returns going forward (it has averaged 11.5% over the past decade). By investing $500 a month, you could reach $333,000 in about 19 years. If you doubled your contributions to $1,000, you could reach the mark in around 14 years. Even with more modest $250 monthly investments, it can be done in 25 years, with only $75,000 invested personally during that time.

These results will, of course, vary based on returns and investments, but the greater point is how consistency and time can do a lot of heavy lifting to get you to where you're trying to be.

Should you buy stock in Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF right now?

Before you buy stock in Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $511,196!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,047,897!*

Now, it’s worth noting Stock Advisor’s total average return is 951% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 18, 2025.

JPMorgan Chase is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie, Cisco Systems, Home Depot, JPMorgan Chase, Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF, and Walmart. The Motley Fool recommends Broadcom and Johnson & Johnson. The Motley Fool has a disclosure policy.