Toncoin Price Forecast: TON steadies near $1.45 as weak momentum keeps downside risks in focus

- Toncoin price hovers around $1.45 on Friday, rebounding slightly after hitting a two-month low of $1.42 on the previous day.

- xStocks launches on TON, enabling tokenized US equities such as Apple, Tesla, and Microsoft to be held directly in wallets.

- Technical indicators remain fragile, suggesting downside risks persist amid bearish momentum.

Toncoin (TON) steadies around $1.45 on Friday after hitting a two-month low on the previous day. The bearish momentum persists despite the launch of xStocks on TON, a development that could improve the network’s long-term fundamentals. On the technical side, deteriorating momentum indicators suggest further downside.

xStocks launches on TON brings tokenized US equities directly

xStocks has launched on TON this Thursday, bringing tokenized US equities directly into the wallets. Major US companies such as Apple, Tesla, and Microsoft, along with hundreds of other stocks, can now be traded within TON Wallet, Tonkeeper, and MyTONWallet, without separate trading apps, brokerage accounts, or geographic restrictions.

“Bringing xStocks fully on-chain represents a major advancement for real-world asset adoption on TON. Over one billion users can now hold and trade tokenized US equities with the same ease as sending a message in Telegram, instantly, globally, and entirely in self-custody,” said the TON Foundation blog post.

This development is bullish for Toncoin in the long term as it expands real-world utility, drives on-chain activity, and strengthens TON’s adoption. Despite the bullish news, TON continued its correction, dipping nearly 3% that day to a two-month low of $1.42.

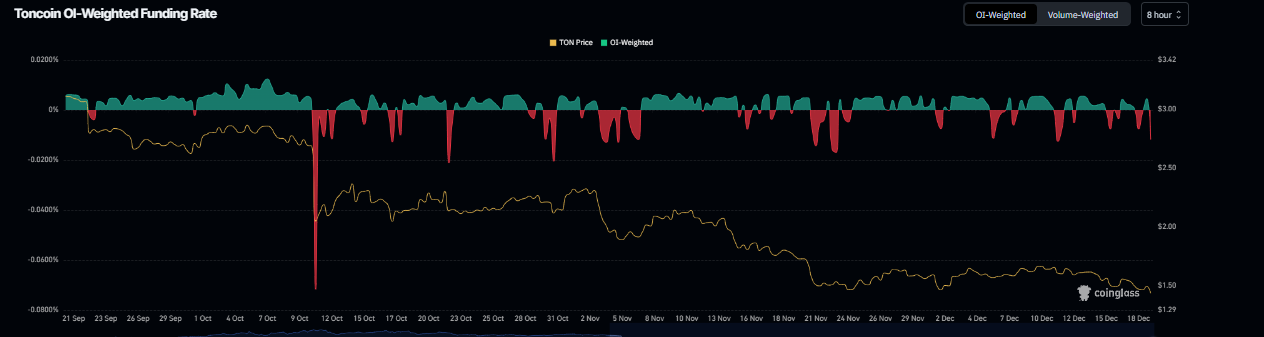

Toncoin’s derivatives data shows bearish outlook

On the derivatives front, data supports a negative outlook for Toncoin. Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of TON will slide further exceeds those anticipating a price increase.

The metric turned negative on Friday, down 0.011%, suggesting that shorts are paying longs. Historically, when the funding rates have flipped negative, Toncoin prices have fallen sharply.

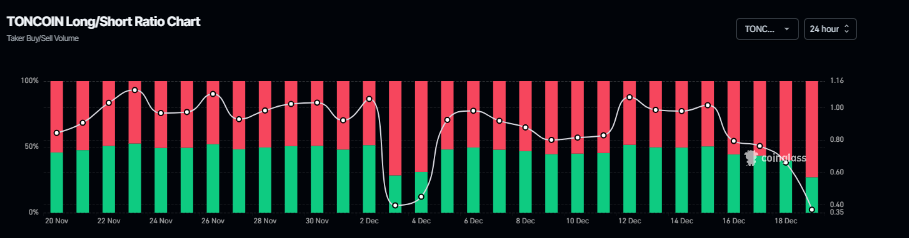

Moreover, the long-to-short ratio of TON reads 0.36 on Friday, the highest level in a month. A ratio below one indicates rising bearish sentiment, as traders are betting on the asset price to fall.

Toncoin Price Forecast: TON hits a two-month low

Toncoin price was rejected from the upper trendline of the falling wedge pattern on December 10 and declined nearly 14%, reaching a two-month low of $1.42 on Thursday. As of Friday, TON hovers around $1.45.

If TON continues its downward trend, it could extend the decline toward the next daily support at $1.31.

The Relative Strength Index (RSI) on the daily chart is at 34, below its neutral level of 50, indicating bearish momentum gaining traction. Moreover, the Moving Average Convergence Divergence (MACD) showed a bearish crossover on Wednesday, further supporting the bearish view.

On the other hand, if Toncoin recovers, it could extend the advance toward the 50-day EMA at $1.76.