3 Unstoppable Vanguard ETFs to Buy Even if There's a Stock Market Sell-Off in 2026

Key Points

The Vanguard S&P 500 Growth ETF doubles down on the top growth stocks contained in the S&P 500.

The Vanguard Information Technology ETF focuses on the best-performing market sector of the last decade.

The Vanguard Dividend Appreciation ETF invests in high-quality companies that increase their dividend payouts.

- 10 stocks we like better than Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF ›

The S&P 500 has jumped 78% since the start of 2023 -- far above its historical average annual return of 9% to 10%. Investors worried about a sell-off in 2026 may be considering selling growth stocks and piling into value stocks. But overhauling your financial portfolio on a hunch is a great way to miss out on long-term gains. And perhaps most costly is the fact that timing the market requires two great decisions -- when to sell and when to buy back in -- which can leave money on the table.

A better approach is to adjust your portfolio to align with your risk tolerance and financial goals, rather than taking extreme action. Buying growth-focused exchange-traded funds (ETFs) that hold dozens or even hundreds of stocks provides growth stock exposure and diversification so that if there is a sell-off, a few companies won't lead to irrecoverable losses in your portfolio.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here's why the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG), the Vanguard Information Technology ETF (NYSEMKT: VGT), and the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) are top funds to buy even if there's a stock market sell-off next year.

Image source: Getty Images.

1. Vanguard S&P 500 Growth ETF

One of the simplest ways to outperform the S&P 500 in recent years has been to bet big on growth stocks. The Vanguard S&P 500 Growth ETF does exactly that.

A staggering 65.3% of the ETF is concentrated in just 15 stocks: Nvidia, Microsoft, Apple, Alphabet, Broadcom, Amazon, Meta Platforms, Tesla, Eli Lilly, Visa, JPMorgan Chase, Netflix, Palantir Technologies, Mastercard, and Oracle.

If there's a stock market sell-off in 2026, chances are it will be driven by the current market leaders due to valuation concerns or a slowdown in artificial intelligence (AI) spending. This would make the Vanguard S&P 500 Growth ETF particularly vulnerable to a pullback.

So you may be wondering why the ETF is worth buying anyway. Well, that comes down to how you view stock market sell-offs. If you're trying to bolster your portfolio with value stocks that hold up well no matter what the economy or market is doing, this ETF isn't for you.

But if you're trying to build a diversified portfolio of growth stocks to buy and hold for at least the next three to five years, then the S&P 500 Growth ETF is an excellent choice.

2. Vanguard Information Technology ETF

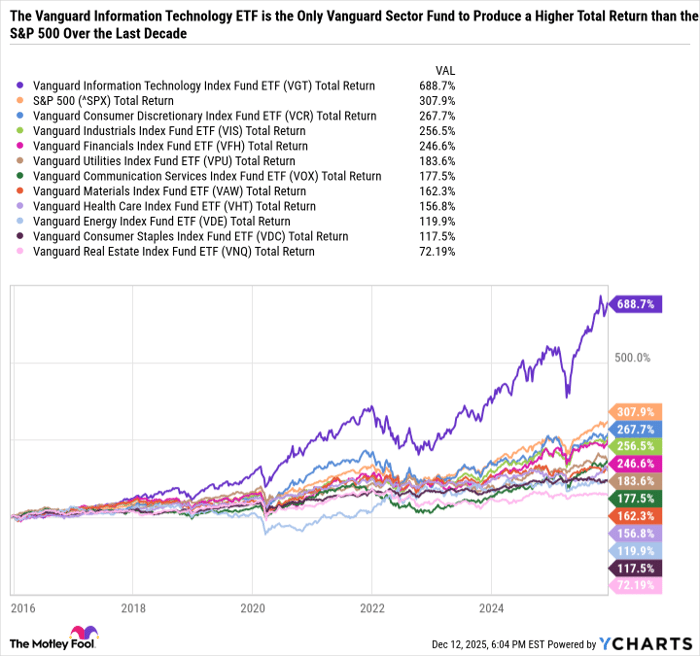

The Vanguard Information Technology ETF is the only Vanguard sector fund to outperform the S&P 500 over the last decade.

VGT Total Return Level data by YCharts

The technology sector comprises 34.6% of the S&P 500 and has been driving broader index gains. Investors who believe that trend will continue may want to take a closer look at the Vanguard Tech ETF even if there's a stock market sell-off next year.

The ETF has become increasingly concentrated in just a handful of stocks, such as Nvidia, Apple, Microsoft, Broadcom, Palantir, Oracle, and Advanced Micro Devices. The concentration has been a net positive, though, as these stocks have crushed the S&P 500 over the long term.

However, valuations are extended, as the Vanguard Tech ETF sports a sky-high price-to-earnings ratio of 39.3 compared to 28.8 for the Vanguard S&P 500 ETF.

3. Vanguard Dividend Appreciation ETF

The Dividend Appreciation ETF only yields 1.6%, which is far from high-yield territory and only moderately higher than the S&P 500's 1.1% yield. But the point of the ETF isn't to maximize current yield, but rather, invest in companies with earnings growth potential.

The ETF's top three holdings include Broadcom, Microsoft, and Apple -- none of which yield over 1%. And yet, all three companies have extensive track records of returning capital to shareholders through dividend raises and stock buybacks, as well as tons of growth potential in their underlying businesses.

Similarly, Eli Lilly is the fifth-largest holding in the ETF, not for its 0.6% dividend yield -- but because it is the most valuable drugmaker in the world and has an extensive existing portfolio and pipeline of leading drugs.

The Dividend Appreciation ETF targets companies with clear runways for future earnings growth that use dividends as a key means to return capital to shareholders. This is a distinctly different strategy from funds that focus more on yield, like the Schwab U.S. Dividend Equity ETF, which is heavily concentrated in stodgy sectors like energy, consumer staples, and healthcare. Whereas the largest sector in the Dividend Appreciation ETF is tech with a 28.5% weighting.

Buying and holding stocks through volatile periods

Temperament and patience are just as important as picking winning stocks. Investors who can stay on an even keel even when stock prices are plummeting stand a better chance at unlocking the value of compounding over the long term.

Growth-focused ETFs, like the S&P 500 Growth ETF, Information Technology ETF, and Dividend Appreciation ETF, could underperform the index during a broader sell-off. However, they also possess the necessary qualities to outperform the index over the long term.

There's also a psychological element to holding growth ETFs during a sell-off. Instead of casting blame on an individual company, it can be easier to hold a basket of stocks through an ETF wrapper.

However, it's important to have high conviction in the stocks that make up those ETFs. In this case, Microsoft, Apple, and Broadcom are all major holdings in the Vanguard S&P 500 Growth ETF, the Vanguard Information Technology ETF, and the Vanguard Dividend Appreciation ETF. So these funds should only be considered if you're looking to build a holding around these top tech stocks.

Should you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2025.

JPMorgan Chase is an advertising partner of Motley Fool Money. Daniel Foelber has positions in Nvidia, Oracle, and Schwab U.S. Dividend Equity ETF and has the following options: short March 2026 $240 calls on Oracle. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, JPMorgan Chase, Mastercard, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Palantir Technologies, Tesla, Vanguard Dividend Appreciation ETF, Vanguard S&P 500 ETF, and Visa. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.