This AI Chip Stock Could Be the Real Winner as Data Center Demand Explodes in 2026

Key Points

Spending on data centers is expected to increase by billions in the coming years.

TSMC is the go-to company for manufacturing advanced AI chips used in data centers.

Its stock is reasonably priced compared to top artificial intelligence chip designers.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

If you said that artificial intelligence (AI) has taken the tech world by storm, you'd probably be underselling it. It seems it has consumed every tech-related conversation and caused pivots for many companies in the industry.

The AI boom has been multifaceted. You have consumer-facing applications like ChatGPT that have driven much of its mainstream popularity, massive investments in data centers and cloud infrastructure, and high-performance hardware companies like Nvidia that supply many critical pieces that power data centers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The data center portion of it seems to be on the earlier end of what many are expecting (or, rather, hoping) it can be. Many companies -- especially hyperscalers like Alphabet, Amazon, and Microsoft -- have committed to spending billions to build them out in the next year and beyond.

Although there are many moving parts to these anticipated data center build-outs, one company in particular stands to gain a lot: Taiwan Semiconductor Manufacturing (NYSE: TSM), also known as TSMC. Here's why.

Image source: TSMC.

The importance of data centers in AI

For AI to work on the scale we see today, it must be trained on tons of data -- and that's putting it lightly. This data can't be stored in traditional ways, either. It must be stored in data centers that can process massive amounts of information at high speeds and supply the electricity that's needed to power them 24/7. Some estimates say an AI query uses 10 times as much electricity as a standard Google search.

Data centers' importance to training and scaling AI is why we've seen an explosion in spending related to them. Nvidia's CEO, Jensen Huang, has said that he anticipates companies spending $3 trillion to $4 trillion by 2030 on building out this AI infrastructure. This spending should trickle down, and at the beginning of the AI supply chain, TSMC will be waiting.

Why TSMC stands out as the real potential winner

Companies like Nvidia, Advanced Micro Devices, Alphabet, and Amazon design the AI chips used in data centers. However, every single one of them relies on TSMC to manufacture the chips and bring them to life. If we're using cars as a comparison, those companies are the designers and brands, but TSMC is the factory that actually builds the engines.

There's a good reason for that, too. No company compares to TSMC's efficiency and scale, which is why its market share on advanced AI chips is well into the upper-90% range. Samsung and Intel both manufacture chips, but neither comes close to TSMC.

The reliance on TSMC for its AI chip manufacturing has also begun to show in its financials. In the third quarter, high-performance computing (HPC) accounted for 57% of TSMC's $33.1 billion in revenue. Three years ago, in Q3 2022, HPC was only 39% of TSMC's revenue.

Before HPC, smartphones accounted for most of TSMC's revenue. This new shift in demand works in TSMC's favor because smartphones tend to be more about consumer upgrade cycles, while AI chips are poised to be sustained investments.

Playing into the hands of the electricity-conscious tech companies

TSMC's moat is already wide, but one thing that's furthering its advantage is that its chips are not only faster, but also more power-efficient. Its new A14 manufacturing process is expected to produce chips that are 15% faster and use 30% less power. That should be music to data center operators' ears because it could noticeably reduce energy consumption.

Aside from the original build-out, maintaining a data center costs companies millions annually. Being able to run it with more power-efficient chips could mean meaningful savings.

TSMC seems to be fairly priced

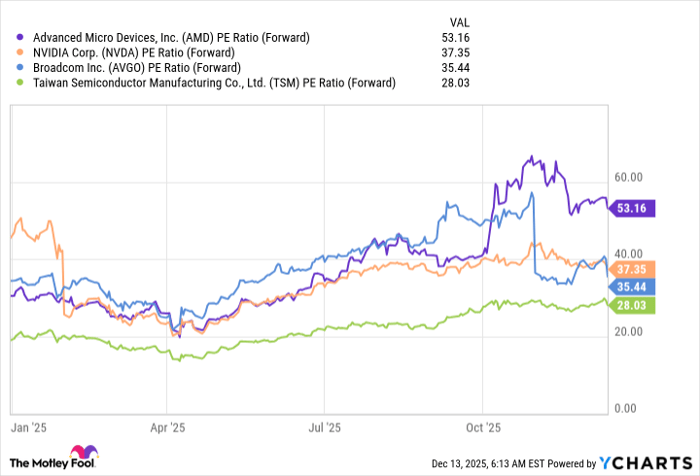

For a company operating in a virtual monopoly, TSMC's stock isn't as expensive as one might expect it to be. At the time of this writing, it's trading at 28 times its projected earnings over the next 12 months. That's much cheaper than companies like Nvidia, AMD, and Broadcom, while still delivering strong earnings growth.

AMD PE Ratio (Forward) data by YCharts

There's no doubt that TSMC stands to gain from the projected data center build-outs. However, even if plans change (such as companies reducing their anticipated spending), TSMC remains a great investment because its business is vital to virtually all technology, not just the AI boom. It's a stock I personally plan to hold for the long haul.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2025.

Stefon Walters has positions in Microsoft and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Intel, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.