Should You Buy Quantum Computing Stocks in 2026?

Key Points

The sector is soaring because of a narrative around commercialization and disruption.

The technology claims a lot of promises, but has failed to ever commercialize.

These stocks are wildly expensive, burning cash, and heavily diluting shareholders.

- 10 stocks we like better than IonQ ›

Quantum computing is an investing theme that has delivered massive returns for shareholders. In the last three years, the big four pure-play quantum stocks -- IonQ (NYSE: IONQ), Quantum Computing Inc. (NASDAQ: QUBT), Rigetti Computing (NASDAQ: RGTI), and D-Wave Quantum (NYSE: QBTS) -- have all generated at least 500% cumulative stock returns.

Catalyzed by an optimistic tone in the business world around quantum computing technology, these stocks have investors betting on a quantum revolution changing the world. With the stocks dipping from highs set in October of this year, should you buy quantum computing stocks as we get ready to flip the calendar to 2026?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The answer is clear if you look at the underlying financials.

Building for a quantum future?

When business leaders such as Nvidia founder Jensen Huang say quantum computing is reaching an inflection point, you can understand why these pure-play stocks are getting so much hype.

Quantum computing uses quantum mechanics to exponentially improve processing power over traditional computers, promising users immense computing capabilities that are limited by even the most advanced computers today. These include technologies such as artificial intelligence (AI).

Companies like IonQ have research labs dedicated to commercializing quantum computing, as it could be a game changer for the computing world (and society as a whole). It is building hardware and software for quantum computing projects.

However, given that current quantum computers are highly unstable and can generally only operate in extreme cold and extremely clean environments, they are expensive and not reliable for everyday tasks. This has prevented the full commercialization of the technology and has remained a bottleneck for years.

Image source: Getty Images.

A strong narrative, but lacking fundamentals

Telling the story of disrupting the entire computing industry is enticing, which is why a stock like IonQ is up 1,000% in the last three years and has a market cap of $19 billion.

But if you actually look at the underlying business, you will be greatly disappointed. Through the first nine months of 2024, IonQ generated $68 million in revenue. That is a tiny fraction of its current market value. On this revenue, it posted an operating loss of $405 million. Just looking at stock-based compensation, the company had over $200 million in share-based employee expenses, or more than 200% of its revenue.

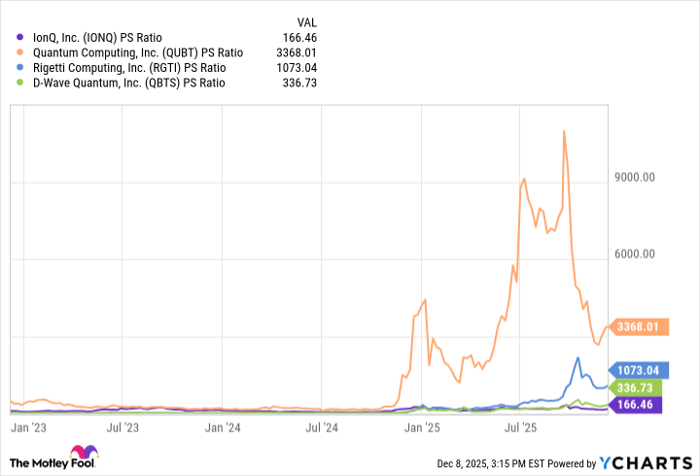

Or, we can look at Quantum Computing, Inc., which generated just $384,000 in revenue last quarter. That's not a typo. The stock currently has a market cap of $2.9 billion, giving it a trailing price-to-sales ratio (P/S) of over 3,000. That is one expensive stock.

These are horrendous financial figures. This is why companies like IonQ are raising a boatload of funds through share offerings, which have grown their shares outstanding by 77% in the last three years, diluting existing shareholders. Quantum Computing stock has grown its shares outstanding by an astounding 300% in the last three years alone.

IONQ PS Ratio data by YCharts

Should you buy quantum computing stocks?

The short answer: no. The longer answer combines these four stocks -- as well as any other quantum computing pure play -- and their huge shareholder dilution, massive premium valuations to current revenue levels, and uncertainties around commercialization timelines.

It may take decades for quantum computing to finally be commercialized. Or, it may never happen; the technology is that complicated. As an investor, you do not want to ever bet on an unproven technology, no matter how exciting it sounds. Quantum computing is an overhyped investing theme that is bound to disappoint investors who buy these stocks in 2026.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $499,978!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,126,609!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends IonQ and Nvidia. The Motley Fool has a disclosure policy.