Proven Strong Demand Growth Lifts Confidence in GE Vernova’s Valuation

TradingKey - GE Vernova (GEV) is one of the most prominent beneficiaries of the AI data center buildout—and the power infrastructure required to support it. Anchored by its gas turbine business, the stock has surged 120% year-to-date, a performance that has outpaced nearly all of its peers.

On Tuesday, the company held its annual Investor Day and significantly raised expectations across both fundamentals and long-term outlook. That update reignited investor enthusiasm. The following day’s 25bps rate cut only added to the momentum: GEV rallied another 15% to hit new all-time highs.

Updating the Macro Playbook for Power

GE Vernova continues to be at the center of two of the biggest structural tailwinds in energy: global electrification and the exponential power demand from AI data centers. Both themes are actively rewriting baseline power forecasts for the U.S. and elsewhere—pushing up expected demand for gas generation, transmission, and grid-scale power equipment.

GEV is deeply embedded in both ends of the power value chain—from supply (gas turbines) to demand (electrification hardware)—and is emerging as a critical hardware design partner to the world’s top cloud and AI infrastructure players. The company’s experience in medium- and high-voltage switchgear, combined with integrated grid solutions, positions it well to capture a structural slice of long-term AI capex.

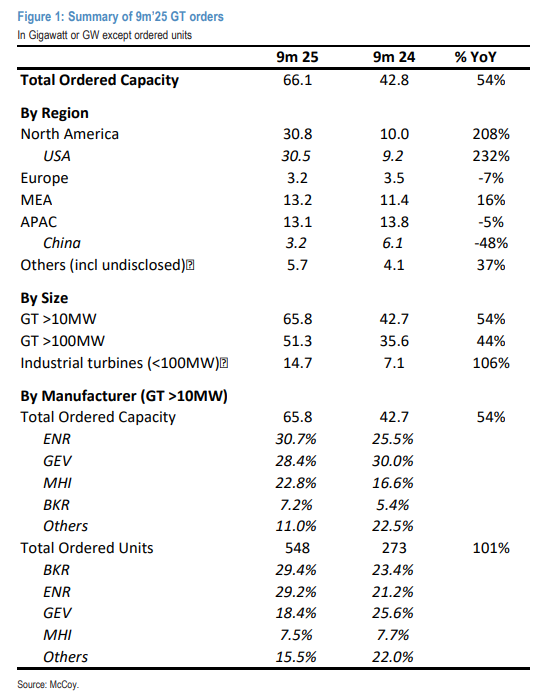

According to McKoy’s report on Monday, global gas turbine orders rose 54% year-on-year during the first nine months of 2025 (measured in GW). The U.S. alone saw order volume triple—up 230% from 9.2 GW to 30.5 GW—driven largely by power-hungry data center expansion. GE Vernova gains nearly one-third of those new orders cross the whole world.

A Market Moving Toward Fewer Winners

Power generation equipment is a high-barrier industry, with few players controlling share. Together, GE Vernova, Siemens Energy, and Mitsubishi Power hold more than half of new global orders and installed capacity. GEV is dominant in North America; Siemens leads in Europe.

That makes GE Vernova the most direct beneficiary of the current North American AI power buildout.

And its Tier-1 client count is growing. NVIDIA recently highlighted GEV as a launch partner in its 800V DC Alliance—a power architecture standard designed to reduce copper loss, simplify conversion, and increase rack density. Other partners on the initiative include Eaton and Siemens.

GE Vernova has also signed a strategic infrastructure agreement with AWS, providing electrification and substations across AWS’s AI and cloud deployments in the U.S., Europe, and Asia.

At the same time, GEV is supplying Crusoe’s AI-dedicated datacenter campuses in multiple U.S. locations with large-scale gas turbines. Through this relationship, GE Vernova is indirectly connected to Crusoe’s top-tier client roster, which includes Microsoft, Oracle, and OpenAI.

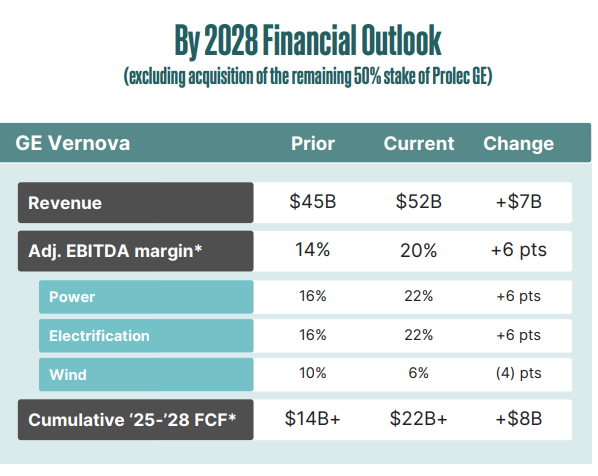

At the Investor Day, management raised its 2028 revenue outlook from $45 billion to $52 billion and now forecasts delivering 24 GW of gas turbine capacity by then.

CEO Scott Strazik made headlines with a key disclosure: GE Vernova has completely sold out its turbine capacity through 2028—and just 10% of 2029’s production slots remain. He directly dismissed market concerns over an “AI bubble,” stating that there are “no signs of slowdown.”

Margins Tell a Bigger Story

Alongside top-line growth, GEV updated its margin outlook as well.

By 2028, GE Vernova aims to push its Power and Electrification segment margin from 16% to 22%. On a consolidated basis, total margins are projected to reach 20%.

That would place the company well beyond prior peak-cycle margins, enabled by tight markets, durable demand, and institutional pricing power—particularly in “short-supply, high-urgency” categories like gas generation, grid systems, and electrification solutions.

GEV’s scale advantage and productivity gains allow it to pass through cost pressures and widen margins at the same time. Even as it continues sourcing nearly $20 billion annually in raw materials and components from 100+ countries, the current pricing environment provides a sufficient buffer to offset inflation. Volume-linked efficiencies tied to backlog conversion further enhance margin upside.

Cost discipline is also playing a role. The company highlighted that gas and electrification segments are now growing double-digits organically—and newer revenues from higher-margin services and long-term O&M contracts are compressing the returns curve upward from the same fixed capacity base.

Backed by those structural tailwinds, management raised its long-term free cash flow forecast from $14 billion to $22 billion.

An Overlooked Strategic Signal: Rare Earths

Amid earnings excitement, one headline was easy to miss but could carry long-term weight.

According to Reuters, GE Vernova is now in active partnership with the U.S. government to build strategic reserves of yttrium—a rare earth metal widely used in ceramics, jet engines, electronics, semiconductors, and lasers.

Today, virtually all yttrium used in the U.S. is imported from China. Under the Trump administration, rare earths became a strategic priority. The government has since taken equity positions in efforts to localize mining and processing—such as MP Materials.

GE Vernova’s involvement signals its growing importance not only in infrastructure but in the broader push for energy and materials security.

The Market Responds: Price Action Confirms the Narrative Shift

Investors welcomed the update without hesitation. As of this week, GEV trades near $723—materially above its 50-day moving average ($593) and 200-day average ($509). The price structure shows a clear breakout, with short-term, medium-term, and long-term trend lines now aligned in a bullish configuration.

Over the past 30 days, GEV posted gains on around 60% of trading days. Volatility remains contained near 5%, and momentum signals are decisively tilted positive. Combined with margin upgrades, orderbook visibility, growing dividend, and increased buyback scope, market sentiment has reset meaningfully upward.

Pre-Investor Day, the stock was largely priced around a narrative of mid-single-digit margins with partial growth visibility. Post-event, the company repositioned itself with a long-term path to high level.

This new earnings-anchored narrative structurally lifts GEV’s valuation baseline—and puts it squarely in the long-duration growth camp for AI’s power backbone.