Will Bitcoin Crash in 2026?

Key Points

Enthusiasm around Bitcoin has waned in 2025.

Price targets keep getting made, but volatility in both directions is the only certainty, given how much leverage is in the system.

Nobody knows for certain whether Bitcoin will crash next year.

- 10 stocks we like better than Bitcoin ›

What a difference a year makes.

At the beginning of 2025, investor enthusiasm around Bitcoin (CRYPTO: BTC) was at a fever pitch. The U.S. government was supposedly going to create a Bitcoin strategic reserve, exchange-traded funds (ETFs) were going to keep buying Bitcoin like there was no tomorrow, and publicly traded companies like Strategy (NASDAQ: MSTR) (formerly known as MicroStrategy) were going to keep piling up Bitcoin on their respective balance sheets.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

As we sit here today, sentiment is not as rosy. The price of Bitcoin has fallen year over year to a little more than $90,000 as of this writing on Dec. 8. Government initiatives around cryptocurrencies have fallen by the wayside, and investors are getting more and more bearish on the currency, known colloquially as digital gold.

Does that mean a Bitcoin crash is coming in 2026?

Deflating sentiment

Bitcoin is all based on sentiment. If more people believe in the story around Bitcoin and how it can protect your wealth in an era of high inflation and money printing, then more people will buy Bitcoin, driving the price higher.

For most of 2025, investors were so bullish on Bitcoin that they were using extreme forms of leverage to bet on it and other cryptocurrencies. Exchanges for cryptocurrency trading such as Coinbase now offer as much as 50 times leverage on your deposits, which can reap huge rewards, but also mean wiping out your account with just a small decline in prices.

This is exactly what happened earlier this fall, when Bitcoin crashed on a surprise tariff threat against China by President Donald Trump. These leveraged traders then got margin calls, which led cryptocurrency exchanges to sell client cryptocurrency holdings, which further drove down prices. This led Bitcoin to fall from $120,000 to $80,000 in just a short while.

It has since recovered a bit, but is still down during the past 12 months, with a lot of leveraged bets left in the system.

Image source: Getty Images.

Price targets are not prophecies

Almost daily, you will see price targets promoted by Bitcoin bulls (or bears) in financial media. Some even think the price will go up 10-fold from here, reaching $1 million a coin. Based on Bitcoin's total possible supply of 21 million coins, that would imply a total market capitalization of $21 trillion, and would make early adopters (as well as Strategy shareholders) immensely rich.

Too bad that price targets are not prophecies. Generally, what you will find is that the price target for Bitcoin aligns with the financial interests of the individual. If they own Bitcoin, they will have a bullish price target. If they are betting against it, they will say it is going to zero. Incentives drive forecasts.

Just because someone makes these proclamations does not automatically mean they will come true. Price targets for Bitcoin are made all the time. They rarely come true with any precision.

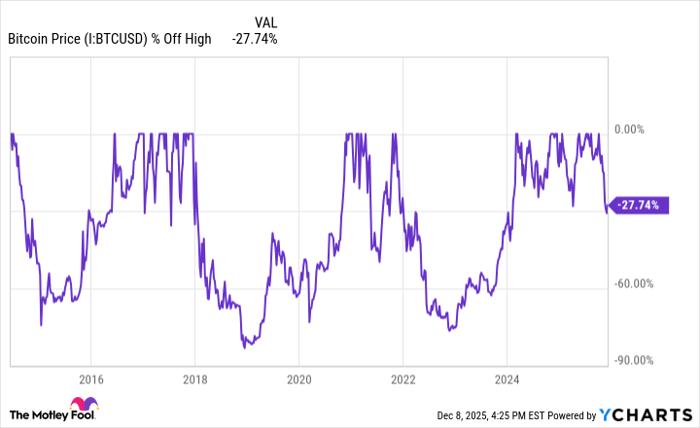

Bitcoin Price data by YCharts

Will Bitcoin crash in 2026?

Maybe. Or, maybe not. Bitcoin has crashed at least three times during the past 10 years. Using this data as a reference, there is a 30% chance in any year that the price of Bitcoin will fall out from under itself. That makes it an incredibly risky investment, and it may crash again in 2026 after spending many years in a bull market.

Even so, it might begin to soar again. With no underlying financials tying the cryptocurrency to an intrinsic value, Bitcoin can trade wildly. Add in all the debt-driven traders, and volatility should be expected as the norm, not an exception. In fact, given its historical performance, the only thing you truly can bet on with Bitcoin is that it will swing violently.

Individual investors shouldn't ask whether Bitcoin will crash in 2026. What they should ask is whether you are a long-term believer in the cryptocurrency as a store of value in their portfolios. If so, then maybe now is a good time to add it to your portfolio.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool recommends Coinbase Global. The Motley Fool has a disclosure policy.