Prediction: This Spectacular Vanguard ETF Will Crush the S&P 500 Again in 2026

Key Points

The S&P 500 Growth index invests exclusively in 216 of the best-performing growth stocks from the regular S&P 500, and disregards the rest.

Its unique portfolio composition typically leads to market-beating returns, although the index can also experience a higher degree of volatility.

The Vanguard S&P 500 Growth ETF tracks the performance of the Growth index, and I predict it will beat the S&P 500 again in 2026.

- 10 stocks we like better than Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF ›

The S&P 500 (SNPINDEX: ^GSPC) index is made up of 500 companies from 11 different sectors of the economy. Information technology is the largest sector, because it's home to three of the world's most valuable companies: Nvidia (NASDAQ: NVDA), Microsoft, and Apple, which have become artificial intelligence (AI) juggernauts in their own unique ways.

The S&P 500 has delivered a total return of 17.8% this year, but had you invested in the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) instead, you would be sitting on a return of 22.7%. This exchange-traded fund (ETF) tracks the performance of the S&P 500 Growth index, which exclusively holds 216 of the best-performing growth stocks from the regular S&P 500.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The outperformance of the Vanguard ETF in 2025 isn't a one-off, because it has actually beaten the S&P 500 every year, on average, since it was established. Here's why I predict 2026 will be another strong year.

Image source: Getty Images.

A unique portfolio composition

The S&P 500 Growth index selects stocks based on factors like their momentum and the sales growth of the underlying companies. It rebalances once per quarter, removing stocks that no longer meet its criteria and replacing them with better candidates.

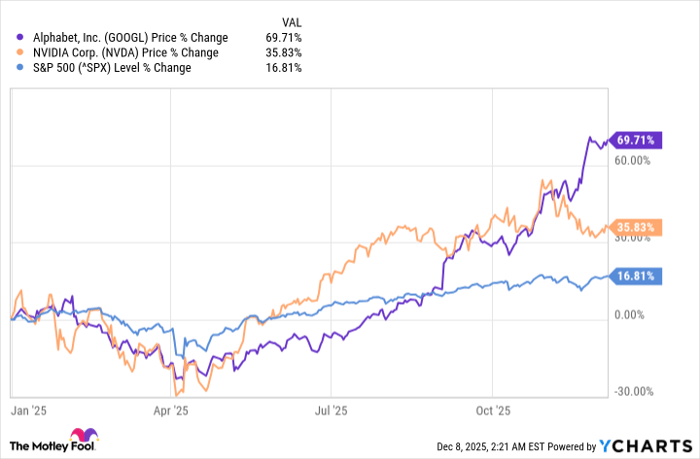

Compared to the S&P 500, the Growth index holds much larger positions in the tech giants that consistently push the broader market higher. For example, the Vanguard S&P 500 Growth ETF assigns a whopping 15.2% weighting to Nvidia, and a 9.1% weighting to Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), whereas those two stocks represent just 8.4% and 5.1% in the S&P 500, respectively.

Those two stocks have delivered blistering returns this year, so it's no surprise an ETF or index that assigns them higher weightings would outperform one that assigns them lesser weightings:

Data by YCharts.

In fact, almost 50% of the entire value of the Vanguard S&P 500 Growth ETF is parked in two high-growth sectors: Information technology and communication services, which are home to many of the tech giants leading the AI revolution.

But some of the magic is in what the Growth index (and Vanguard ETF) doesn't own, like the following S&P 500 stocks: Charter Communications, which is down 41% this year, LyondellBasell, also down 41%, Dow Inc, down 42%, Molina Healthcare, down 47%, and Alexandra Real Estate Equities, down 53%.

Therefore, not only does the Growth index invest aggressively in top-performing stocks, but it also dodges many of the market's biggest underperformers, which is a big reason for its strong returns relative to the S&P 500.

The Vanguard ETF could beat the S&P 500 again in 2026

The Vanguard S&P 500 Growth ETF has produced a compound annual return of 16.8% since its inception in 2010, beating the average annual return of 13.8% in the S&P 500 over the same period.

AI stocks have driven the Vanguard ETF higher over the last couple of years, but other technologies like cloud computing and enterprise software have also contributed to its strong gains since it was established. Even if the AI boom starts to slow, the Growth index's quarterly rebalance will ensure the ETF always has exposure to the themes that take over to fuel broader market returns instead.

Looking to the future, industries like autonomous vehicle manufacturing, robotics, and quantum computing could become major sources of growth for the stock market.

The S&P 500 also rebalances on a quarterly basis, but performance isn't part of its criteria for selecting stocks. Instead, it focuses on companies with robust profitability, and it has a minimum market capitalization requirement of $22.7 billion to ensure it only holds large companies. These metrics help reduce extreme volatility.

On that note, the Vanguard ETF does have a tendency to suffer sharper corrections during market sell-offs. It plunged by as much as 22% earlier this year after President Donald Trump announced his "Liberation Day" tariffs, whereas the S&P 500 experienced a lesser decline of 19%. Therefore, this ETF is best suited for investors who are comfortable with volatility.

With all of that said, I think the Vanguard ETF's track record and its high degree of exposure to the best-performing stocks in the market point to another S&P 500-beating return again in 2026.

Should you invest $1,000 in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alexandria Real Estate Equities, Alphabet, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.