Guardian Wealth Takes $5.1 Million Stake in Viper Energy, According to Recent SEC Filing

Key Points

Initiated new stake of 133,874 shares, an estimated $5.12 million trade based on quarterly average pricing

The new stake makes Viper Energy 3.02% of fund AUM, which places it outside the fund's top five holdings

Guardian reported 61 equity holdings valued at $169 million as of September 30, 2025.

- These 10 stocks could mint the next wave of millionaires ›

Guardian Wealth Management, Inc. disclosed a new position in Viper Energy (NASDAQ:VNOM) worth an estimated $5.12 million, according to a November 14, 2025, SEC filing.

What Happened

According to a Securities and Exchange Commission (SEC) filing dated November 14, 2025, Guardian Wealth Management, Inc. opened a new position in Viper Energy during the third quarter. The fund reported ownership of 133,874 shares, with a market value of $5.12 million as of September 30, 2025. This addition brought its total reportable U.S. equity holdings to $169.26 million across 61 positions.

What Else to Know

The position in Viper Energy was initiated in the third quarter and now accounts for 3.02% of the fund's 13F reportable assets under management.

Top holdings after the filing:

- NASDAQ: STRL: $11.55 million (6.8% of AUM)

- NYSE: ANET: $9.98 million (5.9% of AUM)

- NYSE: AZO: $8.61 million (5.1% of AUM)

- NYSE: ABBV: $6.98 million (4.1% of AUM)

- NYSE: NNI: $6.21 million (3.7% of AUM)

As of December 05, 2025, shares of Viper Energy were priced at $40.65, down 15.9% over the past year, trailing the S&P 500 by 30.4 percentage points.

Company Overview

| Metric | Value |

|---|---|

| Revenue (TTM) | $1.15 billion |

| Net Income (TTM) | $311.51 million |

| Dividend Yield | 5.79% |

| Price (as of market close 2025-12-05) | $40.65 |

Company Snapshot

- Owns and manages mineral and royalty interests in oil and natural gas properties, primarily in the Permian Basin and Eagle Ford Shale.

- Operates a royalty-based business model, generating income from oil and gas production without direct drilling or operating costs.

- Serves oil and gas exploration and production companies that operate on its mineral acreage, focusing on upstream energy sector participants.

Viper Energy leverages its royalty-based model to generate steady cash flows, benefiting from exposure to commodity price upside while avoiding the risks and expenses of direct operations. Its portfolio is concentrated in prolific U.S. basins, providing a stable revenue stream tied to oil and gas production volumes and prices.

Foolish Take

Guardian Wealth Management, a registered investment advisor (RIA) based out of Peoria, Illinois, recently took a new stake in Viper Energy stock, worth roughly $5.1 million. Here's what retail investors need to know.

To start, let's cover some background on Viper Energy. The company is U.S. oil and gas company, with mineral and royalty interests in the Permian Basin and Eagle Ford Shale, located across portions of Texas and New Mexico. Due to the nature of its royalty-based model, Viper is somewhat insulated from volatility associated with the price of crude oil and natural gas.

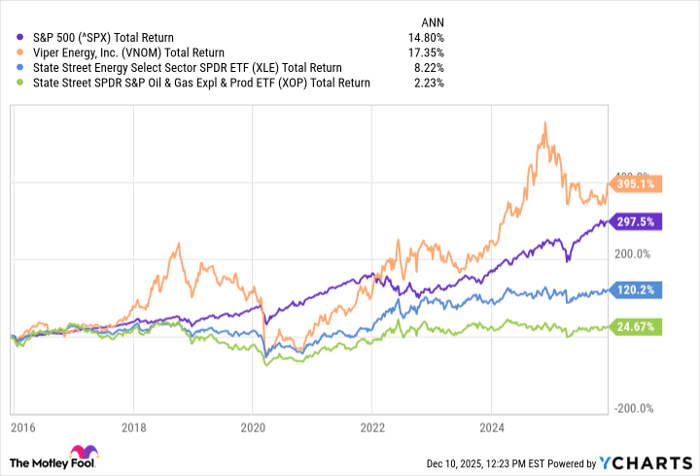

Consequently, Viper stock has delivered solid gains in recent years. For example, over the last 10 years, Viper stock has increased by 298%, equating to a compound annual growth rate (CAGR) of 17.4%. Not only has that outpaced energy sector exchange-traded funds (ETFs) like the State Street Energy Select Sector SPDR ETF (XLE) and State Street SPDR S&P Oil & Gas Expl & Prod ETF (XOP), Viper stock has also outperformed the S&P 500 during this same period.

^SPX data by YCharts

What's more, much of the stock's total return comes in the form of dividends. The stock has a current dividend yield of 5.8%, granting it significant appeal for income-oriented investors.

To sum up, Viper Energy is a stock with many positive attributes, including its lofty dividend yield and solid performance history. Retail investors would be wise to take note of this recent institutional purchase and may want to consider Viper going forward.

Glossary

13F reportable assets under management: The portion of a fund's assets that must be disclosed in quarterly SEC Form 13F filings.

Assets under management (AUM): The total market value of investments managed on behalf of clients by a fund or firm.

Stake: The amount of ownership or investment a fund or individual holds in a particular company.

Quarterly average pricing: The average price of a security over a specific quarter, used to estimate trade values.

Dividend yield: The annual dividend payment expressed as a percentage of the current share price.

Mineral and royalty interests: Ownership rights to receive a portion of revenue from the production of oil or gas on a property.

Permian Basin: A major oil- and gas-producing region in western Texas and southeastern New Mexico.

Eagle Ford Shale: A large oil and gas producing geological formation in South Texas.

Royalty-based model: A business structure where income is generated from royalties rather than direct operations or production.

Commodity price upside: The potential for increased profits if the market price of a raw material, like oil or gas, rises.

TTM: The 12-month period ending with the most recent quarterly report.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 981%* — a market-crushing outperformance compared to 194% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of December 8, 2025

Jake Lerch has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie, Arista Networks, Nelnet, and Sterling Infrastructure. The Motley Fool recommends Viper Energy. The Motley Fool has a disclosure policy.