Ethereum Price Forecast: ETH eyes $3,470 as ETF inflows show returning demand, derivatives remain muted

Ethereum price today: $3,370

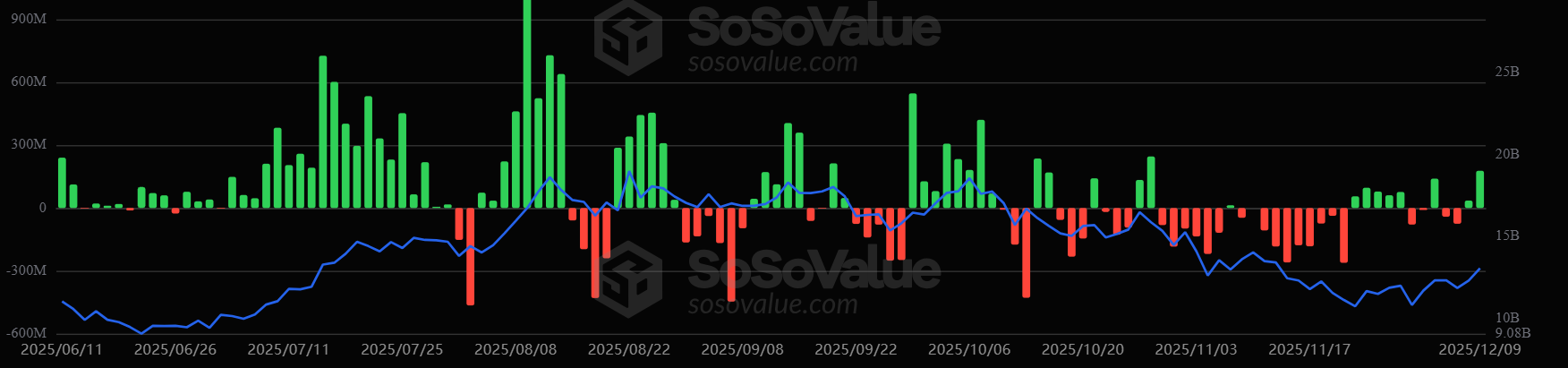

- Ethereum ETFs highlight a return of TradFi interest, pulling in $177.6 million on Tuesday, their highest inflow since October.

- Funding rates have remained modest despite the recovery from under $2,800.

- ETH is reattempting a move toward the $3,470 resistance.

Traditional investors are playing a key role in Ethereum's (ETH) recent recovery after weeks on the sidelines.

Ethereum exchange-traded funds (ETFs) drew in $177.6 million on Tuesday, marking a second consecutive day of positive performance and their highest inflow since October 28, according to SoSoValue data.

The products have been hinting at a resumption of TradFi interest after breaking an outflow trend on November 21. Notably, the day also marked a halt to ETH's six-week price decline.

Despite the recent recovery, market confidence isn't yet strong considering the mix of outflows seen last week. This is also evident in Ethereum's average funding rates across all exchanges.

Funding rates remain modest despite recovery signs

Despite the recent recovery from below $2,800, funding rates have remained lower compared to levels seen during notable price spikes earlier in the year.

"This subdued funding environment indicates that the derivatives market is not yet showing the same level of speculative leverage," wrote CryptoQuant contributor ShayanMarkets in a Tuesday note. "Buyers are present, but the demand is modest relative to past impulsive phases, and the rally is being driven more by spot accumulation than derivative exuberance."

The analyst highlighted that the modest funding conditions indicate a recovering market and leave room for further price growth if demand rises. On the flip side, it implies that "momentum remains vulnerable if resistance rejects the price."

-1765390587582-1765390587583.png)

Open interest (OI) has also remained flat, hovering around 12 million ETH — the same level as May lows, according to Coinglass data.

Ethereum Price Forecast: ETH reattempts a move toward $3,470

Ethereum has experienced $56.3 million in liquidations over the past 24 hours, with long liquidations leading at $31.8 million.

ETH is attempting another move toward the $3,470 resistance, which is near the 200-day and 100-day Exponential Moving Averages (EMAs). The move comes after seeing a rejection near the 50-day EMA on Tuesday.

ETH could rally toward $3,800 if it can sustain a firm move above all its key EMAs. Further up, it could reclaim $4,000 if it clears the $3,800 level.

On the downside, ETH could find support near $3,100, around the 20-day EMA. The top altcoin could decline toward $2,850 if it falls below $3,100 and an ascending trendline support.

The Relative Strength Index (RSI) is above its neutral level while the Stochastic Oscillator (Stoch) has crossed into overbought conditions. This signals rising bullish momentum, but there is a chance of a short-term pullback given that the Stoch is in the overbought region.