Wall Street Has a Federal Reserve Problem -- and Things Could Get Ugly for the Stock Market in 2026

Key Points

It's been another banner year for the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, with all three indexes climbing by double digits.

The nation's central bank made dubious history in late October.

The ingredients needed for stagflation to take shape are present, which is potentially worrisome news for Wall Street.

- 10 stocks we like better than S&P 500 Index ›

For well over a century, the stock market has been the premier wealth creator. Although other asset classes, such as bonds, commodities, and real estate, have increased in value over time, nothing has come close to challenging the annualized return of stocks over extended periods.

This year has been a perfect example of patience paying off handsomely for investors. As of the closing bell on Dec. 4, the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and innovation-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) have respectively rallied by 12%. 17%, and 22% since the beginning of 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, a repeat performance may not be in the cards in the new year.

Fed Chair Jerome Powell speaking with President Donald Trump. Image source: Official White House Photo by Daniel Torok.

Though there are always headwinds threatening to weigh down Wall Street's major indexes, some of these potential speedbumps and potholes are rarer than others. As we near the closing of 2025 and prepare to open the book on 2026, the greatest threat to Wall Street might be one of its historical stabilizing forces: the Federal Reserve.

The Federal Reserve is making dubious history

The Federal Reserve is tasked with overseeing our country's monetary policy, with the goals of maximizing employment and stabilizing prices. In an ideal world, the U.S. unemployment rate would be historically low, and the inflation rate would be no higher than 2%, which is the central bank's long-term target. But conditions are rarely ideal for the U.S. economy.

Fed Chair Jerome Powell and the 11 other members of the Federal Open Market Committee (FOMC) have several "tools" at their disposal to influence the U.S. economy to attain their desired outcome(s). The most well-known of these actions is to raise or lower the federal funds rate, which impacts interest rates on borrowing and can indirectly affect mortgage rates.

The FOMC can also purchase or sell long-term Treasury bonds, which would raise or lower long-term yields depending on the action (note: bond prices and bond yields are inversely related).

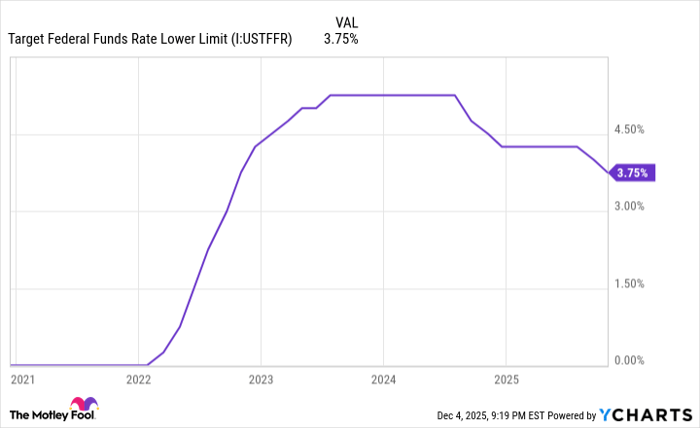

Target Federal Funds Rate Lower Limit data by YCharts.

In late October, the FOMC voted 10-2 to reduce the federal funds rate by 25 basis points to a range of 3.75% to 4.00%. While non-unanimous FOMC votes have occurred from time to time, what Wall Street and investors witnessed in October was truly dubious.

Fed Governor Stephen Miran was one of the two dissenting votes, with his view that the fed funds rate should have been cut by 50 basis points. Meanwhile, Kansas City Fed President Jeffrey Schmid dissented, believing that no reduction should have been made at all. This marks only the second time in 35 years that we've witnessed multiple dissents in opposite directions within the FOMC.

Wall Street and investors look to the Fed for stability, transparency, and consistency. However, with President Donald Trump feuding with Jerome Powell over the FOMC's policy decisions, and Powell's term as Fed chair ending in May 2026, this typically stabilizing force for the stock market has turned into a liability.

Image source: Getty Images.

The Fed's lack of a consistent message can fan the flames of stagflation

Although the U.S. economy and stock market don't move in unison, weakness in the former typically translates into an eventual decline in corporate earnings for the latter. Maintaining a strong economy is often a necessity for bull markets to continue.

What could make things ugly for stocks in 2026 is that the puzzle pieces for stagflation have fallen into place. While Powell has previously commented that "we have warned of it [stagflation], but it is not something that we are facing or that we expect to face," the Fed isn't exactly the ironclad stabilizing force it typically is.

Stagflation is the nightmare of all nightmares for the nation's central bank, because there's no defined blueprint to combat it. Stagflation is characterized by a period of high inflation and rising unemployment, coupled with stagnant or slowing economic growth.

If the FOMC chooses to lower interest rates to boost economic growth and employment, it may inadvertently fuel an already high inflation rate. Conversely, raising interest rates and making borrowing costlier can lower the inflation rate, but it may also worsen unemployment and economic growth.

Since the effects of Donald Trump's tariff and trade policy began to be felt in the U.S. economy, the trailing-12-month inflation rate has been moving noticeably higher (from 2.31% to 3.01%, based on the Consumer Price Index for All Urban Consumers (CPI-U), as of September 2025). This inflationary effect is primarily the result of input tariffs -- i.e., duties assigned to unfinished goods being imported into the country to complete the manufacture of products domestically. Input tariffs can increase costs for U.S. producers, which are then passed along to consumers.

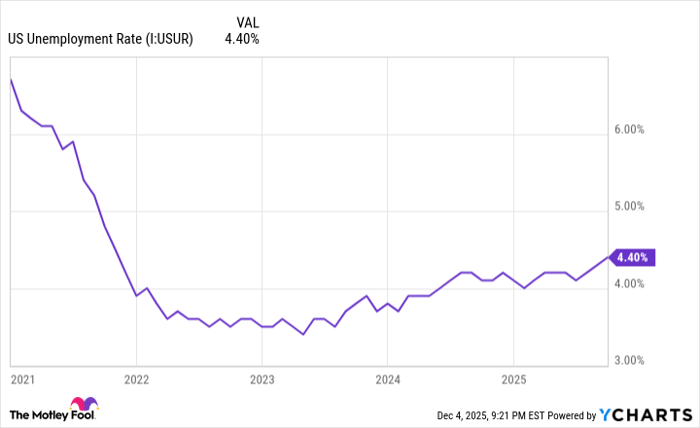

US Unemployment Rate data by YCharts.

We're also witnessing a slow but steady weakening of the job market. Initial six-figure job gains in both May and June were significantly revised down in subsequent reports. The 4.4% unemployment rate for September is the highest level since October 2021. This is up 100 basis points from the 3.4% unemployment rate achieved in April 2023.

On the economic growth front, the Federal Reserve Bank of Philadelphia and Fitch Ratings expect U.S. gross domestic product (GDP) to grow by 1.9% and 1.8%, respectively, in 2025, which would be down from the 2.8% GDP growth recorded in 2024. Though still signaling an expanding economy, these estimates point to slower economic growth.

In other words, the ingredients needed for stagflation to take shape are present. All that's missing is a catalyst.

The appointment of a new Fed chief in 2026 -- perhaps one that Wall Street doesn't have complete confidence in -- coupled with ongoing dissent among the FOMC's board of governors, can be the spark that lights the proverbial match and leads to a disappointing year for the stock market in 2026.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.