1 Risky ETF You Want to Avoid Buying in December

Key Points

The Vanguard Information Technology ETF (VGT) has outperformed all three major indexes through November.

Nvidia, Apple, and Microsoft account for over 45% of VGT.

- 10 stocks we like better than Vanguard Information Technology ETF ›

The technology sector has been on a roll over the past few years, especially as the artificial intelligence (AI) boom has brought many investors into tech companies, hoping to take advantage of the new growth opportunities the technology promises.

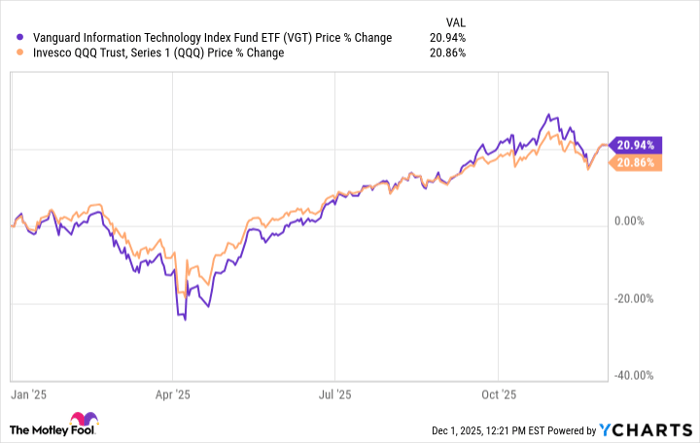

With many tech stocks flourishing, tech exchange-traded funds (ETFs) have naturally followed suit. One in particular, the Vanguard Information Technology ETF (NYSEMKT: VGT) is up nearly 21% year to date through November, outpacing the S&P 500 and tech-heavy Nasdaq Composite.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Despite VGT's success through the first 11 months of the year, it's an ETF I would steer clear of this month. Let's take a look at why.

Image source: Getty Images.

Why I'm hesitant about VGT right now

VGT tracks the U.S. information technology sector, containing 314 companies across a range of industries in the sector. The top five industries are semiconductors, systems software, technology hardware, application software, and semiconductor materials and equipment.

A key aspect of VGT is that it's weighted by market cap, meaning larger companies account for a greater share of the ETF than smaller ones. And that brings me to why I'm avoiding VGT in December. The explosion of megacap tech stocks has led a few stocks to account for too much of VGT for my liking.

Below are VGT's top three holdings and how much they account for of the ETF:

| Company | Percentage of VGT | Market Cap |

|---|---|---|

| Nvidia | 18.18% | $4.366 trillion |

| Apple | 14.29% | $4.144 trillion |

| Microsoft | 12.93% | $3.630 trillion |

Data source: Vanguard and Google Finance. Market cap as of 11 a.m. ET on Dec. 1.

There's no doubt that all three of the above companies are world-class. Nvidia has a strong hold on GPUs and other hardware essential to the AI ecosystem, Apple has revolutionized tech hardware as we know it, and Microsoft is the tech Swiss Army knife, with its hands in virtually every tech industry.

That said, having three companies account for over 45% of a 314-stock ETF isn't ideal.

There are "safer" options to choose from

There are several tech-focused ETFs you can invest in that hold a good amount of Nvidia, Apple, and Microsoft, without being so dependent on their performance. Take the Invesco QQQ Trust ETF, which mirrors the Nasdaq-100, for example. The above three stocks make up about a quarter of the ETF, yet QQQ's performance almost mirrors VGT's so far this year.

VGT data by YCharts

High concentration works out in the investor's favor when those companies are flourishing (which they have been), but all it takes is a slump from them to weigh the whole ETF down. With increased uncertainty surrounding the market to begin December, I would prefer not to be so reliant on a few companies.

Should you invest $1,000 in Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $556,658!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,124,157!*

Now, it’s worth noting Stock Advisor’s total average return is 1,001% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.