Should You Buy Shares of UnitedHealth in November?

Key Points

UnitedHealth stock has tumbled 35% this year amid a series of headwinds.

The company has addressed certain challenges in recent months, and efforts are starting to bear fruit.

- 10 stocks we like better than UnitedHealth Group ›

This year hasn't been the easiest for UnitedHealth Group (NYSE: UNH). The biggest U.S. health insurer has faced several challenges, from the unexpected departure of its chief executive officer back in May to higher-than-expected medical cost trends, and even a Justice Department probe into its Medicare billing system.

So, it's not surprising that stock performance has suffered, with the shares heading for a decline of about 35% this year. But there also have been some bright spots for UnitedHealth. The company has identified the problems weighing on earnings and is making moves to turn things around. And UnitedHealth made headlines after billionaire investor Warren Buffett bought shares in the second quarter -- Buffett is known for snapping up quality companies for a bargain.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Considering the positive and negative elements in the UnitedHealth story, is the stock a buy in November? Let's find out.

Image source: Getty Images.

Health insurance and services

UnitedHealth includes two businesses -- the UnitedHealthcare insurance unit and Optum, a healthcare services unit that includes prescription services management and data analytics, for example. UnitedHealth's dominant position in the U.S. health insurance market and its ownership of these two units offer the company a strong moat, or competitive advantage. It would be difficult for another provider to develop a similar offering and threaten UnitedHealth's position.

This might have been a point that pleased Buffett, as he appreciates companies with a solid moat -- they more easily stay ahead of rivals.

As mentioned, UnitedHealth felt pressure on its earnings in recent times as the price of medical costs trended higher than expected and the use of medical services also was greater than forecasts. But the company is tackling those and other problems. It's exited certain plans, adjusted benefits, and has made pricing and cost management a priority.

Efforts so far have helped UnitedHealth lift its full-year earnings-per-share guidance to at least $14.90 -- that's up from the earlier forecast of $14.65. And in the recent quarter, revenue advanced 12% to more than $113 billion.

Next year, the focus will be on margin recovery and expansion -- and the company says its actions taken now and into the coming quarters should lead to "sustainable" growth in the double-digits as of 2027.

A challenging environment

All of this sounds promising, but UnitedHealth still must follow through on this plan and achieve results -- and this involves some risk as the environment, with high medical costs persisting, remains challenging. UnitedHealth also has spoken of ongoing pressure from the government's cuts to Medicare in recent years.

Meanwhile, the Justice Department probe into UnitedHealth's Medicare business also continues to be a headwind for the company.

Now, let's return to our question: Should you buy shares of UnitedHealth in November? As mentioned, the stock involves some risk, but UnitedHealth also has a strong market position, and the company's efforts to address its earnings headwinds are progressing nicely.

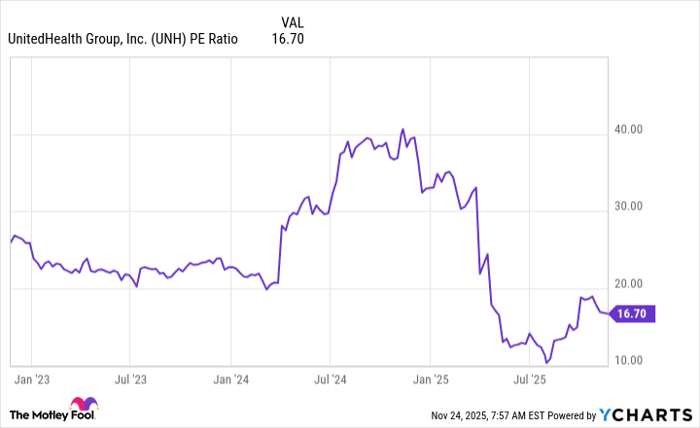

On top of this, the company has something else that may have encouraged billionaire investor Warren Buffett to scoop up the shares earlier this year: It's trading for a bargain price. The stock trades for 16x trailing 12-month earnings, down from more than 40 last year and lower than its average range over the past three years.

UNH PE Ratio data by YCharts

When to buy?

It may take some time for UnitedHealth shares to gather positive momentum and soar to a higher level -- or the stock could soon roar higher on any bit of good news. It's impossible to predict the timing of a rebound, and that's why it's a great idea to get in on a promising recovery story when the price looks reasonable and the company has offered evidence that better days may lie ahead.

Right now, UnitedHealth has reached this point. Though some risk remains, the company has outlined its recovery plan, taken action, and made some progress. At the same time, the stock price remains cheap, offering investors an interesting entry point. All of this means, right now, in November, it's a great time for investors to buy UnitedHealth stock and potentially accompany this top healthcare player along its path to full recovery and growth.

Should you invest $1,000 in UnitedHealth Group right now?

Before you buy stock in UnitedHealth Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UnitedHealth Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.