What's the Chance of 3% Mortgage Rates Returning?

Key Points

3% mortgage rates are unlikely to return soon.

Current low-rate mortgages are causing a "locked-in" effect.

Housing affordability remains a significant challenge, especially for first-time buyers.

- These 10 stocks could mint the next wave of millionaires ›

It's a good question, and the fact that it resonates reveals a lot about the U.S. housing market and its prospects for recovery. Here's a look at why both matter, and what the housing market needs right now.

3% mortgage rates?

Unfortunately, it's unlikely to happen for a while. For an idea of what the markets think, or instead, the bond markets think, here's a look at long-term U.S. Treasury yields and the 30-year mortgage rate.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Mortgage rates tend to trade at higher yields to reflect the greater risk of lending to homeowners compared to lending to the U.S. Treasury. Interpolating the chart below, the 10-year Treasury yield will have to decrease to approximately 1.5%, on the most optimistic assumption, for 30-year mortgages to return to 3%.

30 Year Mortgage Rate data by YCharts

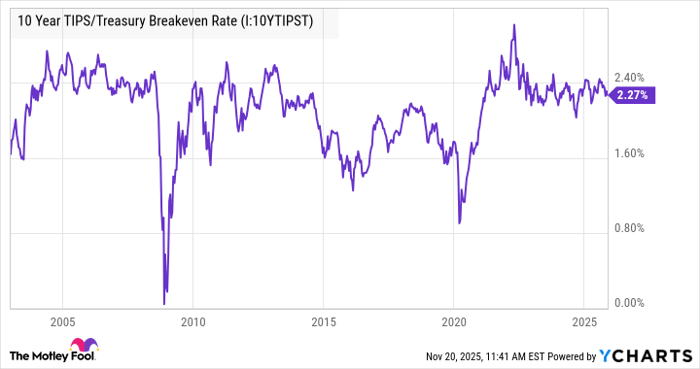

That doesn't look likely anytime soon, according to another useful indicator of what the bond market is thinking about inflation. The 10-Year Treasury Inflation-Protected Security (TIPS) is a bond whose principal value is adjusted according to the inflation rate. It follows that we can subtract its yield from the 10-year Treasury yield to get the market's view on where inflation will be in 10 years. This is known as the 10-Year TIPS/Treasury Breakeven Rate.

As you can see below, the market is pricing in long-term inflation of 2.27%. Again, based on this, the usual spread to the 10-year yield, and another spread to the 30-year mortgage yield, it's tough to see 3% mortgage rates in the near future.

10 Year TIPS/Treasury Breakeven Rate data by YCharts

What about real mortgage rates?

Another way to look at matters is to look at real mortgage rates, in other words, adjusted for inflation. We can do this by comparing current mortgage rates to the break-even inflation rate (in this case, the 30-year break-even inflation rate). This is useful because it helps adjust mortgage rates for inflation. Whichever way you look at it, mortgage rates are unlikely to drop to 3% anytime soon.

Data source: Freddie Mac, Federal Reserve. Chart by author.

Why the question matters so much

The fact that the question matters is, in itself, highly illuminating of current housing market dynamics. According to JPMorgan research, "half of current U.S. mortgage borrowers are still enjoying sub-4% rates and about 80% are paying under 6%." These relatively low rates are creating a so-called "locked-in" effect, in which homeowners are reluctant to sell their properties because they know they will have to pay a higher rate given current mortgage rates.

Image source: Getty Images.

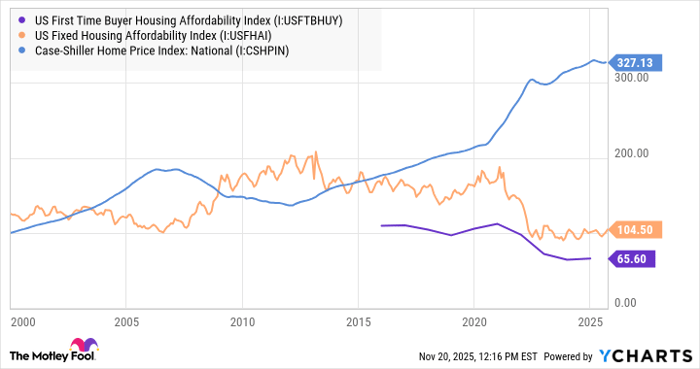

This reluctance to sell is buoying house prices and creating a pincer movement of rising housing prices and rising mortgage rates, which is reducing housing affordability, notably so for first-time buyers. The housing affordability index is the ratio of the median family income to the qualifying income necessary to obtain a mortgage on the median-priced home.

Therefore, an index of 100 indicates that the average family has just enough income to meet the average mortgage, and a number below 100 indicates that they do not. As such, a lower housing affordability index means housing is less affordable for the average income earner.

US First Time Buyer Housing Affordability Index data by YCharts

JPMorgan estimates a 2.8 million shortage of housing units in the U.S., and the best solution to the problems of housing affordability and availability lies in a gradual reduction in rates and a concomitant rise in housing starts. That's happening, but at a slower pace than many had expected previously, and 3% mortgages aren't likely to be part of the mix for some time to come.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 981%* — a market-crushing outperformance compared to 187% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of November 17, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.