What to Know Before Buying Build-A-Bear Stock

Key Points

Build-A-Bear stock has soared 1,020% over the past five years.

In a challenging retail environment, Build-A-Bear just had its most profitable first half.

A diversified retail business model has accelerated revenue and earnings growth.

- 10 stocks we like better than Build-A-Bear Workshop ›

In this age of e-commerce, a brick-and-mortar retail chain making customized stuffed animals might sound like a business model that's barely hanging by a thread. But that couldn't be further from reality for Build-A-Bear Workshop (NYSE: BBW).

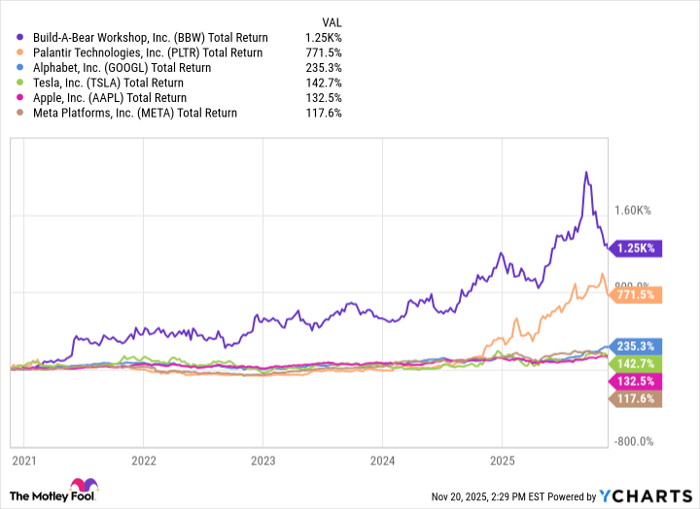

Build-A-Bear is flourishing, the business is growing, and long-term investors have enjoyed plush returns. Over the past five years, Build-A-Bear stock has outperformed the likes of Alphabet, Apple, Meta Platforms, Palantir, and Tesla by a wide margin, delivering a total return of 1,250%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Data by YCharts.

Thinking of starting a position in Build-A-Bear? Here are three things you should know.

1. The first half of 2025 was the best in company history

Build-A-Bear just notched its most profitable second quarter and first half in company history. Revenue for the first half of fiscal 2025, which ended Aug. 2, hit an all-time high of $252.6 million, an 11.5% year-over-year increase. First-half pre-tax income jumped 31.5% to nearly $35 million, and diluted earnings per share (EPS) catapulted 44.5% to $2.11 -- both company records.

Build-A-Bear's first-half momentum prompted management to raise its full-year guidance for revenue, pre-tax income, and new store growth. This wasn't an outlier, either. Build-A-Bear has posted four consecutive years of record results, and management is expecting fiscal 2025 to be another record-setting year, assuming no dramatic shifts in tariff policy or the economy.

Image source: Getty Images.

2. Build-A-Bear is diversifying its business model

Expanding beyond its traditional retail model of corporately managed, mall-based stores has given Build-A-Bear multiple levers to accelerate revenue and earnings growth. For example, partner-operated stores like those at Great Wolf Lodge, Kalahari Resorts, and Girl Scouts Shops now comprise 25% of Build-A-Bear's total store count. These stores shift much of the capital expenditures burden to the operators and enable Build-A-Bear to generate higher-margin revenue through wholesale merchandise sales.

Commercial revenue -- primarily generated by wholesale distribution to partner-operated stores -- has increased at a 63% compound annual growth rate over the past five years. International franchise stores have become another growth lever, with revenue soaring 177% in that same period.

Build-A-Bear has been amping up its social media presence to drive digital sales. The brand now has more than 800,000 Instagram followers and 2.8 million Facebook followers. Online sales were down 12% last year, but they jumped 15% in Q2 2025.

3. Build-A-Bear is cozying up to shareholders

Build-A-Bear's shift to a more capital-light retail model has increased free cash flow by 44% over the past four years, and the company seems to delight in returning cash to shareholders. In the first half of 2025, it repurchased $7.3 million worth of its common stock and paid $5.8 million in quarterly cash dividends. Build-A-Bear repurchased $31 million worth of its stock last year.

Build-A-Bear's small float -- 12.2 million shares based on the latest available data -- has made it a popular target for short sellers and meme stock enthusiasts. But don't let that distract you. This is a high-quality company with strong brand equity, improving margins, and consistent growth -- and it's trading at a modest forward price-to-earnings (P/E) ratio of 11.5. While the exponential gains from its penny stock days may be hard to replicate, I still think there's a decent bull case for Build-A-Bear Workshop.

Should you invest $1,000 in Build-A-Bear Workshop right now?

Before you buy stock in Build-A-Bear Workshop, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Build-A-Bear Workshop wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Josh Cable has positions in Alphabet and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Palantir Technologies, and Tesla. The Motley Fool recommends Build-A-Bear Workshop. The Motley Fool has a disclosure policy.