Thinking of Buying Beyond Meat Stock? These Are 3 Numbers You'll Want to Think About First

Key Points

The stock's sudden popularity has virtually come out of nowhere; the business has been struggling for years.

Poor sales growth and margins make it difficult to see a path to profitability for the company.

The maker of meat substitutes has burned through nearly $100 million in just the past three quarters.

- 10 stocks we like better than Beyond Meat ›

Food company Beyond Meat (NASDAQ: BYND) has been struggling for multiple years. But recently, the stock has become a hot buy with retail investors, with it looking as if it may become the next big meme stock set to take off.

Its shares went parabolic last month, only to come down sharply from those highs afterwards. There's been a lot of noise surrounding the stock of late, which may have you wondering whether it is indeed a good buy and due for another strong rally, or if it has just been a trendy stock to own of late.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Here are the three most important numbers you need to know if you're considering Beyond Meat's stock for your portfolio.

Image source: Getty Images.

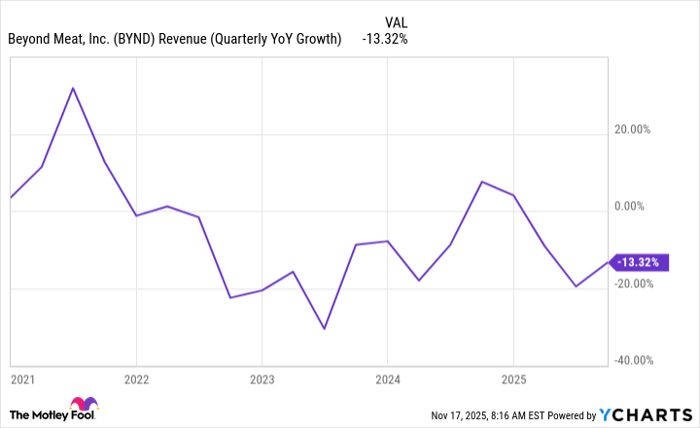

1. $70.2 million in sales last quarter represented yet another year-over-year decline

On Nov. 10, Beyond Meat released its third-quarter numbers for the period ending Sept. 27, which showed the company's revenue totaling $70.2 million. That's a decline of 13% from the same period a year ago, which may not come as a big surprise given the apprehension in the economy these days and consumers scaling back on discretionary expenditures. While Beyond Meat sells food products, its plant-based alternatives may not be necessities for consumers, and it may be hard to justify buying them when there are cheaper options.

However, it's not just recently that Beyond Meat has been struggling with growth. Declining sales are unfortunately nothing new for the business, and it's something investors shouldn't be surprised to see continue.

BYND Revenue (Quarterly YoY Growth) data by YCharts

2. $7.2 million in gross profit means the company's margins are incredibly thin

If it were only declining sales due to economic conditions that were the problem, I could see the case for betting on a recovery for Beyond Meat in the long run. However, its issues run deeper than that as the company's gross profit was just $7.2 million last quarter, which was just over 10% of its top line. With margins that low, it's going to be hard for a business to turn a profit unless it is seeing significant sales growth -- which it's not.

Its sales, general, and administrative expenses for the quarter totaled $37.2 million and easily eclipsed the gross profit. Beyond Meat's poor margins also reflect weak pricing power; the company has to rely on low-price offerings to get consumers buying its products, and even then, sales aren't looking strong. If there were strong demand, Beyond Meat's margins would be healthier than they are today, as the company would be able to raise prices to strengthen its gross profit, but that doesn't appear to be happening.

3. $98.1 million in cash burn over the past three quarters means dilution is a big risk

For growth investors, a key figure to focus on is a company's cash flow from operating activities. This tells you how much the business is raking in (or burning) from its day-to-day operations. If it's negative, that can mean the business isn't sustainable as it is and may require cash infusions via debt or stock offerings to ensure it stays afloat.

Over the past nine months, Beyond Meat's cash burn totaled $98.1 million, which is an increase from $69.9 million in the same period a year ago. Meanwhile, the company's cash and cash equivalents totaled $117.3 million as of the end of the quarter. This suggests that at its current burn rate, Beyond Meat could run out of money within a year, especially once you factor in any spending on growth-related initiatives. As a result, the risk of ongoing offerings and share dilution is high.

Beyond Meat is nothing more than a meme stock right now

Shares of Beyond Meat surged briefly in October and trading volumes were also up heavily, but that may prove to be just a brief rally for the stock. It's still down more than 70% thus far in 2025, and over a five-year period, it has crashed 99%.

There are plenty of reasons to be worried about the stock's future, and I only listed the three most pressing ones to focus on. Without stronger financials and at least some sort of path to profitability, you're likely better off avoiding the stock as Beyond Meat comes with significant risk. I think it's nothing more than a meme stock these days.

Should you invest $1,000 in Beyond Meat right now?

Before you buy stock in Beyond Meat, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Beyond Meat wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $615,279!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,111,712!*

Now, it’s worth noting Stock Advisor’s total average return is 1,022% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Beyond Meat. The Motley Fool has a disclosure policy.