Is D-Wave Quantum Stock a Buy Now?

Key Points

D-Wave Quantum's technology could be used to strengthen AI software.

In 2025, the company reached quantum advantage, a key industry milestone.

D-Wave's sales rose sharply in Q3, but its operating costs increased as well.

- 10 stocks we like better than D-Wave Quantum ›

Quantum computing stocks are hot. Just look at D-Wave Quantum (NYSE: QBTS). Its share price is up more than 1,000% over the past 12 months through the week ending Nov. 14.

D-Wave's stock gains are driven by the accomplishments attained with its annealing quantum computers. This technology focuses on optimization, which is ideal for building artificial intelligence models. Considering AI is a booming industry with years of growth ahead, D-Wave's shares could soar higher.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Does this mean the stock is a worthwhile investment at this time? To answer that question, here's a deeper look into the company.

Image source: Getty Images.

D-Wave's technological achievements

D-Wave's annealing quantum computers have elevated AI performance for its customers. For example, automaker Honda's innovation lab used the tech to boost the results of its AI neural network. Researchers at the Jülich Supercomputing Centre in Germany were so impressed with D-Wave's quantum machine, they bought one earlier this year to use with their AI tools.

D-Wave claims to be the first company to achieve quantum advantage, and it did so in March of this year, although tech veteran International Business Machines, which is working on a different type of quantum computer, also claims to have achieved that milestone back in 2021. Quantum advantage is the point at which a quantum device can solve practical, real-world problems with greater efficiency than the most powerful classical computers.

Which company was first is not as important as the ability to achieve quantum advantage, because without it, there's no reason to adopt a quantum computer over a classical one. D-Wave reaching this distinction sets up the company to grow customer adoption.

D-Wave's financial situation

Despite its successes, D-Wave's sales have been slim so far. While the company announced an impressive 100% increase in year-over-year sales in the third quarter, that amounted to a mere $3.7 million.

Of course, quantum computing is still in its infancy, so D-Wave's sales have the potential to grow in the years ahead. That's assuming the company remains in business, which is a valid concern given its operating costs are rising. Consequently, it suffered an operating loss of $27.7 million in Q3, up from $20.6 million in 2024.

D-Wave is working to strengthen its finances. It executed a $400 million equity offering over the summer. This contributed to the company exiting Q3 with a cash balance of over $836 million, the highest in its history.

In November, it's redeeming all outstanding stock warrants, which will streamline its capital structure. I see this as a positive, considering D-Wave's Q3 net loss surged from $22.7 million last year to $140 million in 2025, primarily due to the change in value and redemption of its warrants as the stock price soared.

Weighing whether to buy D-Wave stock

D-Wave's substantial cash hoard should sustain its operations in the short term while it builds up revenue. Here, some encouraging signs have emerged. In October, it signed an agreement with Swiss Quantum Technology (SQT) worth 10 million euros. In addition, it gained new customers and renewed others, resulting in Q3 bookings of $2.4 million. Bookings represent customer orders expected to generate revenue in the future.

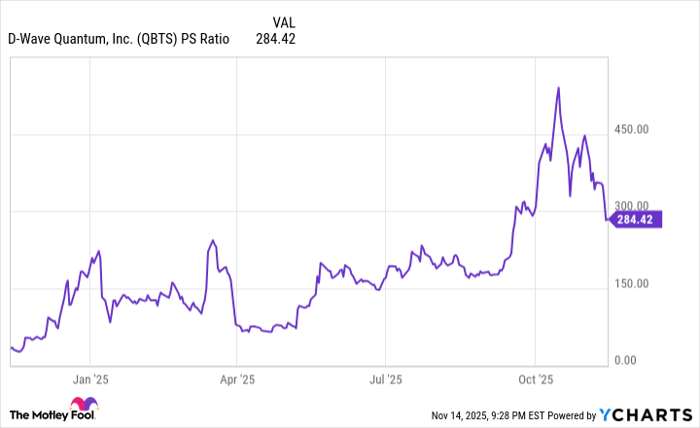

The bookings total suggests its Q4 sales are likely to improve over 2024's $2.3 million, perhaps substantially considering its deal with SQT. Even so, D-Wave's share price valuation is elevated when examining its price-to-sales (P/S) ratio, which measures how much investors are paying for every dollar of revenue generated over the trailing 12 months.

Data by YCharts.

The chart shows D-Wave's P/S multiple is higher than it's been for most of the past year, indicating its stock has gotten pricey. The company's accomplishments make it an appealing investment, but the elevated valuation is questionable.

After all, it's competing against rivals with deep pockets, such as IBM, which has a P/S ratio around four. Moreover, D-Wave's operating losses are growing, and are far greater than the revenue it's taking in. The company's sales will need to accelerate, costs must be reduced, or both for its business to create long-term shareholder value.

Consequently, investing in D-Wave comes with high risk. While the company is making strides, the prudent approach is to wait for its small sales to grow into meaningful revenue, one with the potential to eventually offset its operating expenses, before choosing to invest.

Should you invest $1,000 in D-Wave Quantum right now?

Before you buy stock in D-Wave Quantum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and D-Wave Quantum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $594,786!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,832!*

Now, it’s worth noting Stock Advisor’s total average return is 1,021% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Robert Izquierdo has positions in International Business Machines. The Motley Fool has positions in and recommends International Business Machines. The Motley Fool has a disclosure policy.