Where Will AGNC Investment Be in 3 Years?

Key Points

AGNC Investment is a mortgage REIT.

Its dividend yield is a shockingly high 14%, but dividend investors need to tread with extreme caution.

AGNC still won't be a reliable dividend payer in three years.

- 10 stocks we like better than AGNC Investment Corp. ›

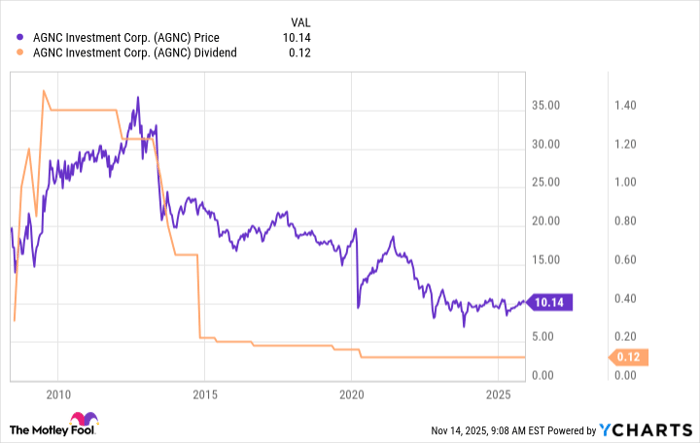

The first thing that most investors are likely to notice about AGNC Investment (NASDAQ: AGNC) is the stock's humongous 14% dividend yield. The interesting thing about this yield is that it isn't abnormal for the stock, historically speaking. The yield has been in the double digits for most of the history of this mortgage real estate investment trust (mREIT).

The problem is that this stock really isn't a dividend stock today. It wasn't one three years ago, and it won't be one three years hence, either. Here's what you need to know before buying AGNC Investment.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

What is AGNC Investment trying to achieve?

AGNC says that its objective is to provide "favorable long-term stockholder returns with a substantial yield component." The word "yield" is in that sentence, but the more important part is "favorable long-term stockholder returns." That is another way of saying "total return," and there's nothing wrong with the goal of providing investors with strong total returns.

Image source: Getty Images.

As it stands, AGNC has done a fairly good job of living up to the goal of strong total returns. Since its inception, its total return has been roughly similar to that of the S&P 500 index (SNPINDEX: ^GSPC), but with a different path over much of that span. Zigging when the S&P 500 index is zagging means that the REIT can help add diversification to your portfolio if you are looking to use an asset allocation model.

So there's nothing inherently wrong with the results. There's just one small problem for dividend investors: The high yield is somewhat misleading.

The dividend has been highly volatile over time -- and worse, has been in a long-term downtrend over the past decade or so. The stock price has followed the dividend lower. Total return assumes dividend reinvestment. If you spent those dividends to pay for living expenses, what you ended up with is lower dividends and less capital.

AGNC data by YCharts.

Dividend yield math at work

The dynamic between the consistently high yield, the dividend, and the stock price shouldn't be a big surprise. The math behind dividend yield is just the current annualized dividend divided by the current stock price. If the dividend is falling and the stock price is falling, then the yield will stay elevated. This kind of volatility is actually pretty normal for an mREIT.

Although mREITs such as AGNC Investment are designed to pay out dividends like traditional property-owning REITs, they don't operate in the same manner. Instead of buying properties, mREITs buy mortgages that have been pooled into bond-like securities. They operate somewhat like mutual funds, but the self-amortizing nature of mortgages means that the monthly payments AGNC collects to support its dividends contain both interest and principal repayment. If you use those dividends to cover living expenses, you are consuming your own capital.

That's perfectly fine to do, as long as you understand what's going on. Another approach would be to reinvest dividends and then sell shares of AGNC to generate the desired income. If you did that, you could control the cash you take out and help ensure that the value of your capital isn't eroded over time.

However, that's a more complex investment tactic to employ; most dividend investors would likely be better off buying a lower-yielding stock with a history of rewarding investors with regular dividend increases.

AGNC isn't likely to change

It is entirely possible that the dividend could increase in the next three years. Its peer, Annaly Capital Management (NYSE: NLY), recently increased its dividend after years of cuts. But even if that were to happen, AGNC Investment's dividend wouldn't be any more reliable in three years than it is today or it was three years ago.

Due to the nature of the business, investors should expect AGNC's dividend to be volatile all the time. That's fine if you understand this and adjust for it. But it could be a rude shock if you don't dig in to fully consider what the mREIT's dividend history is clearly warning you about as to the reliability of the dividend.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.