Could This AI Stock Hit a $1 Trillion Valuation Before 2030?

Key Points

Palantir has been rapidly growing its business, with both U.S. government and commercial revenue.

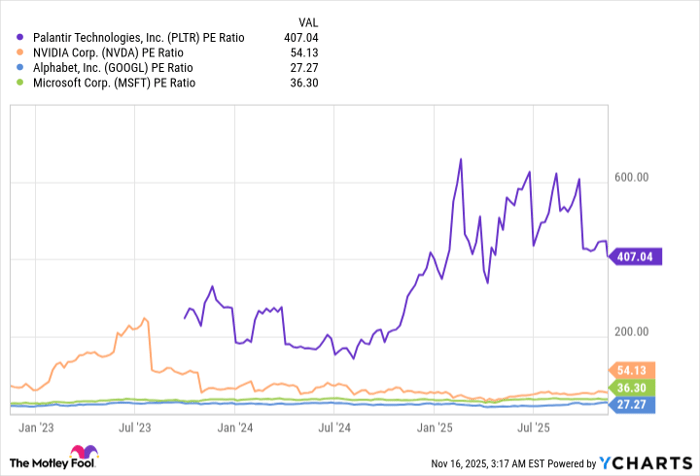

The company's P/E ratio of over 400 makes it an outlier even among high-growth tech businesses.

Palantir can't slow down if it's going to reach $1 trillion in value.

- 10 stocks we like better than Palantir Technologies ›

A market cap of $1 trillion, while more common than it used to be, is still a major milestone. Only the 11 most valuable companies in the world have accomplished it so far.

At its current value, Palantir Technologies (NASDAQ: PLTR), an artificial intelligence (AI) data analytics company, doesn't look like it will join the trillion-dollar club in the near future. It's worth $410 billion (as of this writing), meaning it would need to more than double. However, Palantir stock has increased by nearly 2,000% in the last three years, so it's no stranger to big jumps.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Palantir has a little over three years to hit a $1 trillion valuation before 2030. Is it likely to get there? Let's find out.

Image source: Getty Images.

Business is booming for Palantir

Palantir develops data analytics software used by government agencies and corporations. Organizations use Palantir's services for insights into their data and data-backed decision-making. There's an incredibly wide variety of use cases, including national security, vaccine distribution, and inventory optimization, and about 1,500 companies reportedly work with Palantir.

It's a robust business, based on earnings reports from the last year-plus. Revenue has been climbing higher -- Palantir just generated $1.2 billion in the third quarter, a new record and a 63% year-over-year increase. In that quarter, it also closed a record $2.8 billion in total contract value, up 151% year over year.

The company's biggest source of income is the U.S. government, with $486 million in Q3 revenue. In addition, U.S. commercial revenue in Q3 grew an impressive 121% year over year to $397 million. Overall, there's a lot to like about Palantir's finances. It makes money from government contracts and the private sector, it's rapidly increasing its earnings, and it has a great balance sheet with ample cash and without too much debt.

Palantir stock is extremely expensive

Palantir's earnings look good in a vacuum, but less so when you consider its massive market cap. Quarterly revenue of $1.2 billion isn't much for a company worth $410 billion. Currently, Palantir trades for 113 times trailing sales and a whopping 407 times trailing earnings.

Compared to other tech companies, including those that have surpassed $1 trillion, Palantir's valuation is very high. Nvidia, the largest company in the world, trades at 54 times trailing earnings. Microsoft and Alphabet are well below that. The chart below with trailing price-to-earnings (P/E) ratios over the past year demonstrates how much of an outlier Palantir is.

PLTR PE Ratio data by YCharts

To be fair, Palantir could find new ways to significantly ramp up revenue. It's an innovative company, and innovative companies are good at beating expectations. The risk is that Palantir will need to do that for its stock to keep rising. Lofty investor expectations are already priced in, and if it doesn't meet those expectations, the share price could take a hit.

$1 trillion before 2030 seems unlikely

Considering how much Palantir has grown over the last three years, reaching $1 trillion within the next three years might not seem like a huge stretch. However, growth is more difficult to come by the larger a company gets, and trading at over 400 times earnings isn't sustainable. At some point, Palantir will have a more reasonable valuation.

Let's say the market eventually values Palantir at about 50 times earnings -- in the same range as Nvidia right now. To be worth $1 trillion, it would then need $20 billion in net income. Over the trailing 12 months (TTM), Palantir has reported net income of $1.1 billion. Is going from $1.1 billion to $20 billion in three years possible? Sure. Is it likely? Definitely not.

The same is true about Palantir's odds of hitting $1 trillion before 2030. It's in the realm of possibility, but it's a long shot. The AI company could still do well without reaching that mark, of course. But the valuation makes it a high-risk, high-reward stock.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Lyle Daly has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.