Here Are My 2 Top Growth Stocks to Buy Now

Key Points

Nvidia continues to be the top option for AI computing hardware.

Taiwan Semiconductor is launching a new chip technology to solve the AI energy crisis.

- 10 stocks we like better than Nvidia ›

Growth stocks are still in style on Wall Street, and as long as the artificial intelligence (AI) trend is ongoing, I doubt there's much that will change that fact. The fastest-growing stocks are all involved in the AI boom, and there are multiple businesses that look like excellent buys.

My top two are Nvidia (NASDAQ: NVDA) and Taiwan Semiconductor (NYSE: TSM). Both of these companies are seeing huge growth thanks to the AI arms race, and their impressive performance doesn't seem to be slowing down anytime soon. I think these two are must-buys for every growth investor, especially heading into 2026 -- a year slated to see significant AI growth again.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Nvidia and Taiwan Semiconductor are integral to the AI arms race

Nvidia has been the go-to computing unit provider since the AI trend began. Its graphics processing units (GPUs) and the ancillary products that support them give Nvidia the best ecosystem in the industry, which is why it has dramatically outperformed AMD so far in the AI boom.

Additionally, it's holding its own against Broadcom, which is partnering directly with AI hyperscalers to develop its own custom AI chip that can outperform GPUs at a cheaper price point, but at the cost of flexibility. Nvidia clients love the flexibility that its products offer, and there's a good reason why its products are still the top-selling computing units in the AI megatrend.

Nvidia is known as a fabless chip company. It designs the product, then outsources the manufacturing work to others. One of those is Taiwan Semiconductor. Taiwan Semiconductor is the world's largest chip foundry business and boasts nearly every major AI company as a client. Without TSMC's production capabilities, none of the incredible generative AI technology we experience today would be possible.

Taiwan Semiconductor is also working to solve AI's biggest problem to date: energy consumption. AI hypercalers are spending hundreds of billions on data center capital expenditures, but they're about to run into the bottleneck of power capacity.

Taiwan Semiconductor is offering a solution to this problem by launching a new chip generation that consumes 25% to 30% less power when configured to run at the same speed as prior generations. That's a big deal, and it will allow companies like Nvidia to continue selling an immense number of high-powered computing chips because the grid can handle more of them.

With both companies benefiting massively from the AI buildout, the obvious question arises: When will it end? According to Nvidia, not for some time. Nvidia projects that global data center capital expenditures will rise to $600 billion this year, then increase to $3 trillion to $4 trillion by 2030. That's a massive runway over the next few years, and each company will be primed to benefit from this general opportunity if that project pans out. Even if it's a bit of an overestimation, the general direction is probably right, making Nvidia and Taiwan Semiconductor excellent buys now.

Neither stock is as expensive as it appears

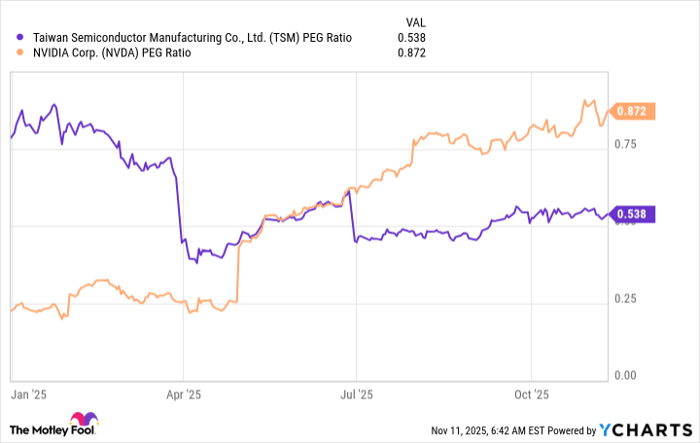

Both Taiwan Semiconductor and Nvidia often get tagged with the stigma of being expensive. However, that's not true. What investors fail to consider is the growth rate combined with the valuation. There's a metric for this, known as the PEG ratio. This factors in both growth and valuation, and any company with a PEG ratio under 1 is seen as undervalued.

TSM PEG Ratio data by YCharts

Both Nvidia and Taiwan Semiconductor are undervalued by this metric, making them seem like fairly attractive investments, especially if the AI boom keeps growing at the pace that it has in the past. With AI hyperscalers slated to spend even more on data centers in 2026 than in 2025, this trend seems likely.

As a result, both Nvidia and Taiwan Semiconductor look like excellent investments right now, and investors can be confident holding them throughout 2026 and beyond.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.