Archer Aviation: A Once-in-a-Decade Buying Opportunity?

Key Points

Archer Aviation is developing an electric air taxi to shave off travel time in major cities.

The company has an ambitious plan, but it's losing a lot of money today.

The concept is interesting, but Archer Aviation stock looks overvalued today.

- 10 stocks we like better than Archer Aviation ›

Electric battery technology has transformed the automotive space. Annual unit sales for electric vehicles are closing in on 20 million each year around the world. Now companies like Archer Aviation (NYSE: ACHR) with its electric vertical takeoff and landing (eVTOL) vehicles are poised to revolutionize travel through cities.

With electric power and quieter than a helicopter, eVTOLs can theoretically operate in dense residential urban areas without disturbing people below, creating a potential boom for point-to-point taxi networks in cities around the globe. Archer Aviation has begun test flights for its electric air taxi concept, meaning that it is close to finally debuting its product commercially.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Does that make the stock a once-in-a-decade opportunity at a trading price of just $8.45?

Are flying taxis actually here?

Flying cars have been promised as a future technology for decades now. But as we sit here in 2025, it seems electric batteries and vertical takeoff technology are bringing this science fiction dream to reality. Archer Aviation's Midnight aircraft is a piloted electric takeoff vehicle that can house four passengers and fly upward of 100 miles. In a recent test flight, a pilot flew 55 miles and averaged 126 miles per hour, all with a quiet electric motor for takeoff and landing.

The vehicle is not yet approved by the Federal Aviation Administration (FAA), but is in the final phase of approval that should lead to full commercialization shortly, with the vehicle already proving it can operate as intended. Once launched, Archer Aviation will either operate its own air taxi network or sell vehicles for other air taxi networks to operate, usually in foreign countries.

These point-to-point networks can shave an hourlong car trip down to 10 minutes, which is a huge value proposition for travelers. It may begin as a vehicle for wealthier people, but there should be a lot of demand for the Midnight once it gets FAA approval. It already has orders for electric air taxis in the United States as well as Japan, Korea, and the United Arab Emirates.

Image source: Getty Images.

Raising funds and future financials

While electric air taxi networks have a lot of promise, that is all there is today: promise. Archer Aviation is a prerevenue start-up that has lost money for years while building up its technology and flight infrastructure and moving through the FAA certification process. It has not been cheap.

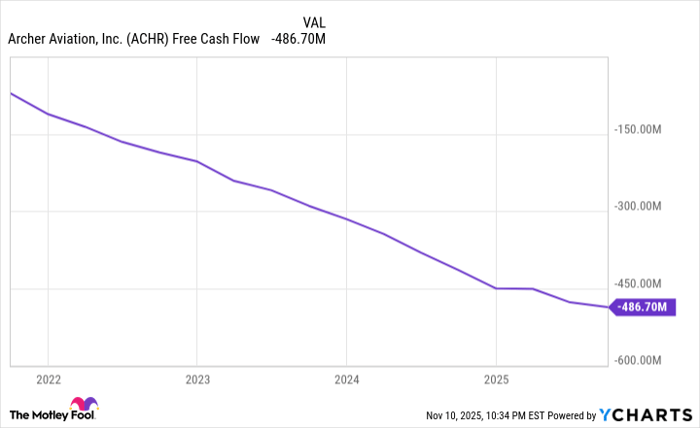

Archer Aviation's free cash flow was negative $487 million over the last 12 months, a record cash burn for the business. It has kept raising funds through stock offerings, recently selling 81.25 million shares at a price of $8, which raised $650 million in gross proceeds. This will help the company stay alive while it keeps chugging along with its electric air taxi build-out.

When Archer Aviation achieves more scale, we can predict what type of revenue it will earn due to estimated selling costs of the Midnight aircraft. Reports state that each vehicle will sell for $5 million. If it can scale manufacturing up to 100 vehicles a year, that is $500 million in revenue, not including any potential revenue from operating its own taxi network. However, today it is still at zero in revenue and will be for most of 2026 as well.

ACHR Free Cash Flow data by YCharts

Is Archer Aviation a once-in-a-decade opportunity?

As of Nov. 10, 2025, Archer Aviation stock trades at a price of $8.45 and has a market cap of $5.5 billion. With more share dilution coming down the line, this market cap will keep rising even if the stock price doesn't budge, presenting a long-term headwind to share price appreciation.

Even if Archer Aviation can scale up to 100 aircraft sales a year and $500 million in revenue, its earnings potential will not come close to realizing its current valuation of $5.5 billion (which, again, excludes share dilution). An optimistic 20% profit margin would bring in $100 million in earnings a year, or a price-to-earnings ratio (P/E) of 55 based on the current market cap. This is a high number and will not be reached for many years with the current production timeline.

Archer Aviation is not a once-in-a-decade opportunity. It is simply an overvalued prerevenue stock that is incredibly risky to buy at current prices.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.