1 Top Growth Stock Down 55% to Buy After Its Recent Pullback

Key Points

Remitly's stock is down even though the business is growing rather quickly.

The company is facing concerns over an immigration crackdown, but these issues are not showing up in the numbers.

Remitly stock is cheap for those with a stomach to hold for the long haul.

- 10 stocks we like better than Remitly Global ›

Immigration changes are a mounting concern for Remitly Global (NASDAQ: RELY) investors. These worries are not showing up in the underlying financial performance of this remittance disruptor. Revenue and transfer volume keep growing, along with profit margin expansion, which shows that the remittance market will do just fine despite increased crackdowns on illegal immigration in the U.S.

Shares of Remitly fell after reporting earnings earlier this month and are now down 55% from highs set earlier this year. Furthermore, the shares are down 75% since its initial public offering (IPO) in 2021, even though the business is as large as ever. This divergence between stock price and financial performance makes Remitly Global a top growth stock to buy on this recent pullback.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Fast growth, stealing market share

Last quarter, Remitly's monetary transfer volume grew 35% year-over-year to $19.5 billion, while revenue rose 25% to $420 million. The company earns a fee on every dollar sent across borders using its service, and it has recently expanded into serving more business customers. Larger transfer volumes per customer have driven down its take rate, which is why revenue is growing more slowly than overall volumes. However, this is a good thing as the company can offer lower fees while still generating solid unit economics, giving it scale that the competition cannot match.

Remitly is taking market share from legacy players like Western Union, and quickly. The overall remittance market is barely growing this year due to the immigration crackdown in the U. S., but despite this, Remitly's transfer volume continues to soar. Smart investors will look at the data instead of getting unnerved by headlines about the declines in the remittance business, which should recover once immigration trends normalize around the world. Plus, Remitly is not only focused on the U.S., serving many different markets with its remittance services.

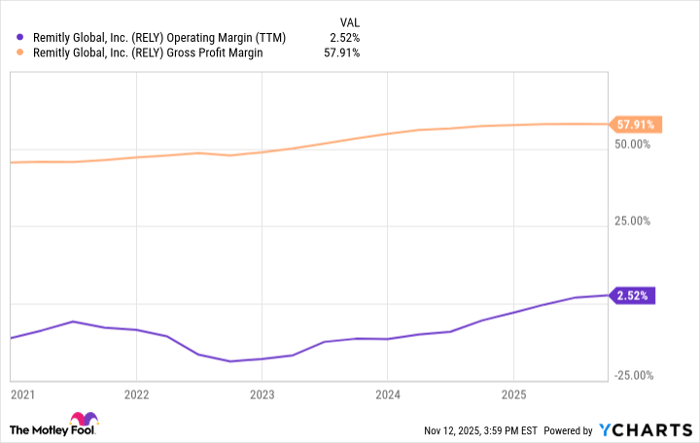

Profitability used to be a concern for Remitly, but it is now generating an operating margin of 2.5% in accordance with generally accepted accounting principles (GAAP). This is a slim figure, but one that should widen over time due to the company's high gross profit margin of 58%. Right now, the company is reinvesting for growth in new product development and marketing, which is paying dividends in transfer volume growth and market share gains.

Image source: Getty Images.

Don't focus on risks, look at new opportunities

Most investors are focused on risks facing Remitly's business, but the real opportunity should come from its increased exposure to new products in the international money transfer market. First, it is expanding its offerings for small businesses, which increases its addressable market from $2 trillion to $22 trillion. Many businesses send money abroad to contractors and freelance workers, giving Remitly a huge runway to target this large audience and drive transfer volume growth for years to come.

Second, Remitly is expanding beyond just taking a fee on international transfers. It has launched the Remitly One subscription service, which gives customers a Remitly Wallet to store funds, a debit card, and the ability to send now, pay later to give more flexible payment options. Remitly One enables Remitly to build more of a banking relationship with its customers, giving them 4% cash back in rewards and $5 bonuses for turning on features like autopay. Instead of just sending money, Remitly One enables Remitly customers to store and spend money, which will give it a better opportunity to generate revenue from its existing 8.9 million active customers.

RELY Operating Margin (TTM) data by YCharts

Why Remitly's stock is a buy today

With Remitly's stock sharply down from its highs, the shares look mighty cheap for this fast-growing remittance player. The company expects to generate $1.62 billion in revenue this year, with forecasts for high-teens percentage revenue growth in 2026. That will put the company at close to $2 billion in revenue next year, compared to a market cap of $2.6 billion as of Nov. 14.

Remitly is not generating much in profit today, but it has the potential to greatly expand its bottom-line margins because of the strong unit economics of the business. Once the business matures, I would expect 20% profit margins or higher, especially if the Remitly One products take off. A 20% profit margin on $2 billion in revenue is $400 million in earnings, giving it a forward price-to-earnings ratio (P/E) of just 6.5.

Again, Remitly is not likely to generate this much in earnings next year. However, it does have the underlying fundamentals giving it the potential to generate this amount of earnings, along with the potential for further revenue growth in 2027 and beyond. This makes the stock an easy buy today.

Should you invest $1,000 in Remitly Global right now?

Before you buy stock in Remitly Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Remitly Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Brett Schafer has positions in Remitly Global. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.