Meet the Newest Supercharged Growth Stock to Join Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta, and Taiwan Semiconductor Manufacturing in the $1 Trillion Club. It's Still a Buy Right Now, According to Certain Wall Street Analysts.

Key Points

Most stocks that have reached a $1 trillion market cap are being driven up by the artificial intelligence trade.

One stock that recently joined has been highly volatile over the past year.

This company is a battleground stock on Wall Street, but there are still several bulls who think the sky is the limit.

- These 10 stocks could mint the next wave of millionaires ›

Once upon a time, analysts and investors laughed at the idea of a stock reaching a $1 trillion market cap because it seemed so unfathomable. Today, there are 10 stocks that have accomplished the feat, most of which are being driven by the artificial intelligence (AI) trade. There are also a handful of other stocks that the market anticipates will reach $1 trillion in due time.

Meet the newest supercharged growth stock that earlier this year joined Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta Platforms, and Taiwan Semiconductor Manufacturing in the $1 trillion club. It's still a buy right now, according to certain Wall Street analysts.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

A volatile year

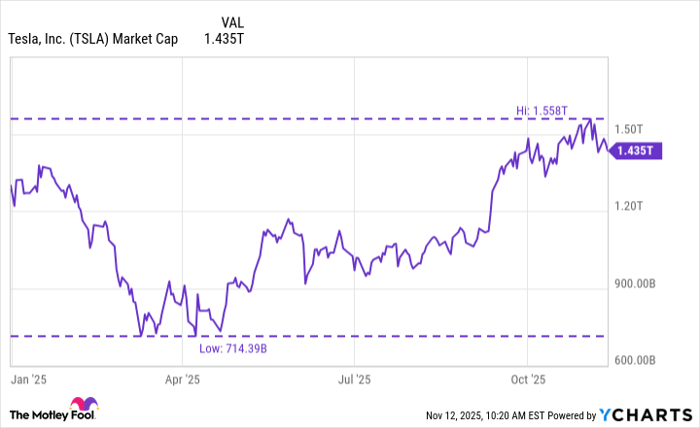

Ever since President Donald Trump won the presidential election back in November 2024, the electric vehicle and robotaxi company Tesla (NASDAQ: TSLA) has seen its stock experience extreme volatility.

It rocketed higher on Trump's win, likely due to Tesla CEO Elon Musk's ties to the Trump administration. Then the stock struggled due to tariffs and poor performance in the company's core EV business. However, the launch of the robotaxi business and general run in tech has brought the stock from well below a $1 trillion market cap to all-time highs.

TSLA Market Cap data by YCharts

After years of anticipation, Tesla soft-launched its robotaxi business in Austin and San Francisco. Media reports suggested the launches were geofenced and involved some sort of remote human monitoring.

However, other analysts believe Tesla will be able to scale this business faster and more efficiently than its robotaxi competitors, potentially making it a leader in a massive new market. Tesla recently confirmed that it's planning to roll out its robotaxi fleet in the coming months in Las Vegas, Phoenix, Dallas, Houston, and Miami. Tesla has also released full self-driving software available for purchase by individual Tesla owners.

It's a battleground stock, but several Wall Street analysts say to press the buy button

Over the past three months, 34 Wall Street analysts have issued research reports on Tesla. Of these, 14 rate the stock a buy, 10 say hold, and 10 say sell, according to TipRanks. Keep in mind that analysts usually try to avoid rating a stock a sell if they can because they don't want to ruin the chances of the bank they work for getting potential business from a company they cover in the future. The average analyst price target implies about 11% downside from current levels (as of Nov. 12).

Tesla is a true battleground stock on Wall Street. Some believe the company's valuation of 259 times forward earnings has simply gotten out of control, and has investors baking in too much success. Other analysts believe Tesla is the most innovative AI company of our time, and that robotaxis and the company's planned Optimus humanoid robots could significantly disrupt the world as we know it.

One of these analysts is Wedbush's Dan Ives, one of the more well-known and prolific tech analysts on the Street. Ives, who has long been bullish on Tesla, reiterated a buy rating on the company in late September and issued a $600 price target, implying about 40% upside from current levels and a $1.9 trillion market cap.

In his research note, Ives projected that Tesla would launch robotaxis in 30 U.S. cities within the next year, which will start to translate into material revenue for the company. "We estimate the AI and autonomous opportunity is worth at least $1 trillion alone for Tesla and we fully expect under a Trump White House over the coming year these key initiatives will now get fast-tracked," Ives wrote.

It's tough to say exactly who will be right in the Tesla debate, but I tend to err on the side of caution with the company trading at such a rich valuation that I believe could already factor in significant success from robotaxis and maybe even Optimus as well. I don't find the risk-reward proposition as attractive, due to potential challenges and hiccups the market may be overlooking.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $493,221!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $51,823!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $599,784!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of November 10, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.