2 Top Dividend Stocks I Plan to Buy Even More Of in November

Key Points

Wingstop is one the strongest restaurant businesses, and the stock has pulled back to a below-average valuation.

Universal Display has competitive advantages that should help it benefit from a growing opportunity over the next several years.

- These 10 stocks could mint the next wave of millionaires ›

Considering that retirement is still more than 20 years away for me, I'm not an investor who focuses on income -- I'm more concerned with growth. For this reason, it may sound strange that I have dividend stocks in my portfolio and on my radar to increase my investment in them.

However, dividend stocks and growth stocks aren't mutually exclusive ideas -- it's possible to get both in a single package. And if immediate income isn't a consideration, dividends can be automatically reinvested, boosting long-term returns significantly.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

For this reason, I do like growth companies that also pay dividends. And I believe that Wingstop (NASDAQ: WING) and Universal Display (NASDAQ: OLED) are two such stocks worth buying in November.

1. Wingstop

Fast-food stocks are performing poorly in 2025, generally speaking. And I'm taking advantage of this downturn by investing in what I believe is one of the strongest restaurant businesses available to investors with chicken-wing chain Wingstop.

Wingstop locations enjoy high sales volume, averaging $2.1 million annually. But most orders are digital, reducing the need for cashiers. And most orders are either take-out or delivery, reducing the need for in-restaurant service staff. The end result is that Wingstop locations are highly profitable.

This is good for the company considering it grows with a franchise model -- most locations are owned and operated by franchisees. And they want to open many more of these profitable restaurants. It's consequently enjoying a record pipeline of more than 1,000 new locations that are preparing to open in coming years.

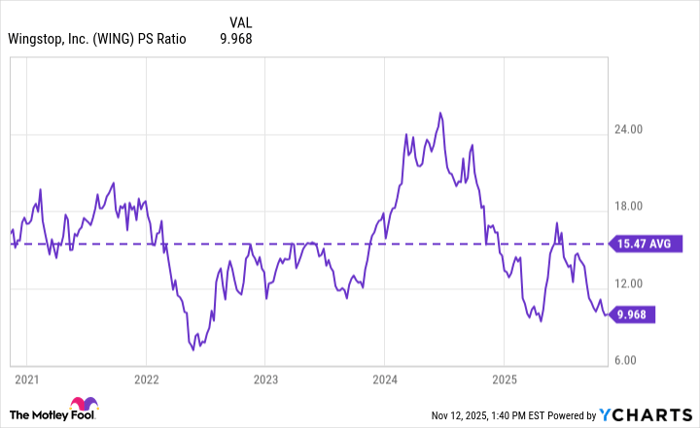

Wingstop stock is down more than 40% from last year's highs. And thanks to the drop, it trades at less than 10 times its sales, which is well below its five-year average.

WING PS Ratio data by YCharts.

The stock is facing headwinds -- you don't get a relative bargain without an accompanying problem. The company expects U.S. same-store sales to fall by 3% to 4% in 2025 compared to 2024. But considering U.S. same-store sales have gone up for 21 consecutive years, I'll give it the benefit of the doubt regarding its modest slip here in 2025.

To be abundantly clear, I'm most interested in Wingstop stock for its long-term growth potential. I believe its unit economics will keep franchisees lined up at the door for many years to come.

Today, there are nearly 3,000 locations. The pipeline has over 1,000 in progress. And management believes it can have 10,000 locations worldwide in the long term. This will provide enough growth for its stock to outperform the S&P 500, in my opinion.

For me, Wingstop's dividend is the cherry on top. It's small. But the company has increased its quarterly dividend for eight consecutive years, and it still pays out just a small percentage of its earnings (less than 20%), pointing to years of future increases.

2. Universal Display

I believe that Wingstop stock is worthy of an investment. But one could argue that restaurant chains don't enjoy competitive moats. And for some investors, competitive advantages are extremely important. That's why I want to highlight Universal Display as another dividend stock I would like to buy more of in November.

When it comes to the market for organic light emitting diodes (OLED), Universal Display has a stranglehold thanks to owning over 6,500 patents for the technology. This means that top device makers must license the technology and buy materials from the company. It's hard for others to gain a foothold in this space.

Thanks to this, it enjoys sensational profit margins. In the third quarter of 2025, the company reported a gross margin of 75% and an operating margin of 31%. As one might expect with financials such as these, it also has a stellar balance sheet with zero debt and about $1 billion in cash.

As with Wingstop, I'm less interested in Universal Display's dividend compared to its long-term growth potential. Through the first three quarters of 2025, revenue is down almost 2% from the same period of 2024. But things such as foldable smartphone screens and monitor upgrades are expected to more than double the size of the OLED market by 2028. This should be a tailwind in coming years.

Universal Display has paid and increased its quarterly dividend for eight consecutive years, just like Wingstop. And it could raise its dividend for many years to come considering it only pays out 38% of its earnings today. But its dividend yield of 1.5% is much better than Wingstop's 0.5%, which could give it the upper hand for some investors.

Wingstop and Universal Display are two dividend growth stocks that I own and would buy more of in November. The caveat is that, as a contributor to The Motley Fool, I personally have disclosure rules to comply with (see below), so I might not actually get another opportunity this month to buy shares. But rest assured, I still like both stocks today and would add to them when given a window of opportunity.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $493,221!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $51,823!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $599,784!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of November 10, 2025

Jon Quast has positions in Universal Display and Wingstop. The Motley Fool recommends Universal Display and Wingstop. The Motley Fool has a disclosure policy.