Should You Buy Oracle Stock Before Dec. 8?

Key Points

Oracle has evolved from a stodgy legacy software company to a cloud-first service provider.

The company is winning massive multiyear cloud contracts with leading hyperscalers.

Oracle is taking on debt and burning through cash to fuel its data center build-out.

- 10 stocks we like better than Oracle ›

Oracle (NYSE: ORCL) is expected to report its second-quarter fiscal 2026 earnings on Dec. 8. It's a tough encore to the tech giant's last earnings report, which resulted in Oracle's largest single-day market cap gain in company history when Oracle surged from $686.3 billion in market cap to $933 billion on Sept. 10.

But Oracle has since given up all of those gains (and then some), even as the broader market has continued to rally.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Here's why the pressure is on Oracle to deliver on its promises to investors, and whether the red-hot artificial intelligence (AI) growth stock is a buy now.

Image source: Getty Images.

The rise of a cloud giant

Oracle's stock price surged in September because the company forecast an ambitious plan to grow Oracle Cloud Infrastructure (OCI) revenue over 14-fold, from around $10 billion in fiscal 2025 to $144 billion in fiscal 2030 -- which would be calendar year 2031. If that forecast comes true, Oracle could become the top cloud provider for AI workflows.

To understand why investors are so excited about Oracle, it's helpful to know about the company's history.

Oracle's success stemmed from its database and enterprise software. But Oracle was an advocate of on-premises software and initially resisted the transition to cloud. That all changed in the early 2010s as Oracle began rolling out infrastructure-as-a-service, platform-as-a-service, and software-as-a-service solutions. But it wasn't until 2016 that Oracle announced OCI.

Still, Oracle was a stodgy, relatively low-growth legacy tech giant -- like IBM and Cisco Systems, it was seen more as a dividend-paying value play in the sector. And it certainly wasn't top of mind for investors looking to invest in cloud computing stocks.

In December 2023, Oracle released its second-quarter fiscal 2024 results, which included plans to expand 66 of its existing data centers and build 100 new cloud data centers. Oracle said that it would be able to build these data centers rapidly and inexpensively, thanks to automation, consistent hardware, and remote direct memory access (RDMA) data transfer. And it didn't disappoint.

In its June 2025 quarter, Oracle said it had built 23 multicloud data centers and planned to build 47 more in the next 12 months. In September, Oracle said it had built 34 multicloud data centers, with only 37 coming online in less than a year.

Oracle's forecast through fiscal 2030 hits an inflection point in fiscal 2027 when the bulk of its multicloud data centers begin operations.

Big ticket AI contracts

Oracle has set lofty expectations for investors over the next few years. But the targets aren't made out of thin air. Rather, Oracle is landing legitimate cloud bookings. In recent months, it has announced mega deals with OpenAI and Meta Platforms.

The multicloud data centers buildout is a response to surging demand from cloud giants Amazon Web Services, Microsoft Azure, and Alphabet-owned Google Cloud. Oracle competes with these companies but also works with them by embedding its database products in data centers, reducing latency and costs.

Oracle's data centers are ideally suited for high-performance computing due to their AI-first structure -- making them a good fit for high-volume enterprise clients. OCI is especially cost-effective for clients who already use other Oracle services.

Risks worth monitoring

There's a lot of pressure on Oracle heading into its December earnings release. For starters, investors will want more details on the profitability of these AI megadeals. OCI's five-year targets are on revenue, not operating income. Oracle's pricing structure includes generous freebies and rewards that it claims achieve 50% lower costs for compute, 70% lower costs for block storage, and 80% less for networking. Part of those savings is due to the inherent structure of the data centers. But Oracle is undercutting its competitors on pricing, too. These deals aren't a bad idea, as Oracle can attract clients and get them more involved in its ecosystem. But they could also reduce margins and cash flow, which could hurt Oracle's profitability and delay its debt paydown.

Arguably, the biggest risk to Oracle's investment thesis is its highly leveraged balance sheet. Oracle closed out its latest quarter with over $100 billion in total net long-term debt. By comparison, Amazon,Alphabet, and Microsoft all have more cash, cash equivalents, and marketable securities than debt on their balance sheets.

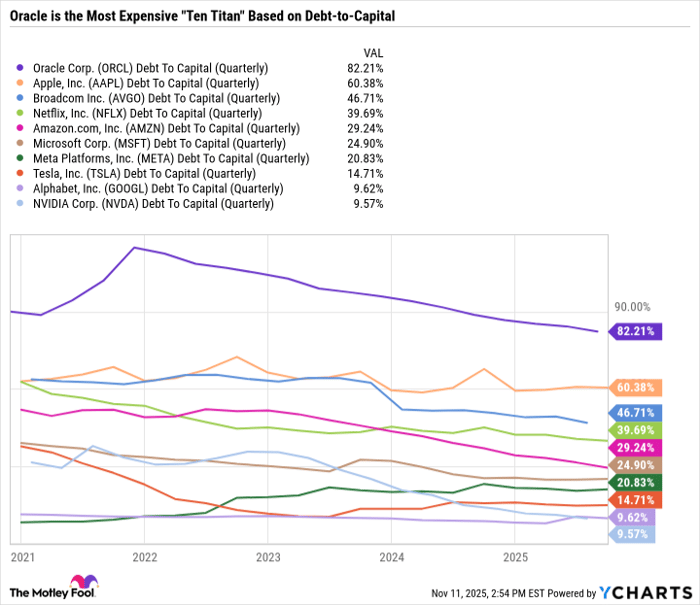

Out of all the "Ten Titans," which is a group of 10 leading growth stocks that make up 40% of the S&P 500, Oracle is by far the most leveraged, sporting a debt-to-capital (D/C) ratio over 80%.

Data by YCharts.

The higher the D/C ratio, the more a company relies on debt to finance its operations. But there's some nuance to this. Apple takes on a lot of debt, but it manages it responsibly thanks to its consistently high free cash flow (FCF) and stockpile of cash, cash equivalents, and marketable securities. By contrast, Oracle's trailing 12-month FCF turned negative due to surging capital expenditures.

Investors will tolerate leverage if it results in earnings growth. But if one or two key customers pull back on spending, Oracle may not be able to deliver on its promises.

The pressure is on

The faster OCI grows and the more Oracle can monetize AI cloud infrastructure, the more expensive the stock will probably become. Conversely, if Oracle stumbles, investors may be able to buy the stock at a much lower price.

Oracle remains a high-risk, high-potential-reward bet at the crossroads of software, cloud computing, and AI. With the stock having given up all of its post-first-quarter gains, investors are basically getting the five-year OCI revenue forecast for free -- which could be a compelling entry point for those who believe Oracle can make good on its targets.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $622,466!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,426!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Cisco Systems, International Business Machines, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.