Meet My Top Artificial Intelligence (AI) Stock Pick for 2026

Key Points

Companies like Nvidia, Broadcom, and AMD are in a heated race to see who can provide the best computing unit.

Taiwan Semiconductor supplies chips to all three of these companies.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

As we approach 2026, investors need to start thinking about what the biggest investing trends will be. I think that nothing has changed over the past three years and that artificial intelligence (AI) investing will still be the dominant theme, even though it started in 2023.

The reality is the AI buildout is far from over, and AI hyperscalers are planning to spend hundreds of billions of dollars on AI computing infrastructure in 2026, breaking records they just set in 2025. Several companies benefit from these massive capital expenditures, but only one is a guaranteed winner.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

That company is my top AI stock pick for 2026, and it may come as a slight surprise.

Image source: Getty Images.

The computing unit suppliers are deadlocked in a fierce competition

The easy answer to which company is benefiting from the AI boom the most is Nvidia (NASDAQ: NVDA). Nvidia has been one of the best-performing stocks in the market since the AI megatrend kicked off in 2023 and has propelled the company to become the largest in the world by market cap. I think Nvidia will continue its dominance, but clearly, competition is rising.

AMD (NASDAQ: AMD) is stepping up its game by improving its software in collaboration with OpenAI. Broadcom (NASDAQ: AVGO) continues to announce partnerships with AI hypercalers to develop their own custom AI chips that can outperform GPUs at a cheaper price point. While Nvidia is still the leader in this realm, the competition is heating up.

It's impossible to know which company will do the best over the next few years, but there is a way to invest in all three without worrying about which one will be the ultimate winner: Taiwan Semiconductor (NYSE: TSM).

Taiwan Semiconductor is the world's leading chip foundry, and a significant portion of the high-end chips used in devices from all three of these suppliers originates from TSMC's factories. Taiwan Semiconductor has risen to this level thanks to continuously launching cutting-edge technologies and being able to manufacture them at impressive yields.

One new technology that Taiwan Semiconductor is launching is its new 2nm (nanometer) chip node. This offers massive improvements over the previous 3nm generation. When configured to run at the same speed, the 2nm chip consumes 25% to 30% less power. That's a big deal because energy consumption is a huge focus in the AI buildout right now. If companies can use a lot less power and be able to retain their computing power plans, Taiwan Semiconductor will be able to charge a nice premium on these chips that AI hyperscalers will be happy to pay.

Those chips are entering production right now, so it may be a few quarters before we see technology launched with 2nm chips from AMD, Nvidia, or Broadcom, but their benefits are real and they're coming quickly. Even without this advanced chip node, TSMC is still doing incredibly well and has growth rates that rival the best in the AI revolution.

Taiwan Semiconductor is growing rapidly

During Q3, TSMC's revenue rose 41% year over year. That's faster than Broadcom and AMD's growth rates, and only trails Nvidia's most recent quarter (Nvidia grew at a 56% pace during that quarter).

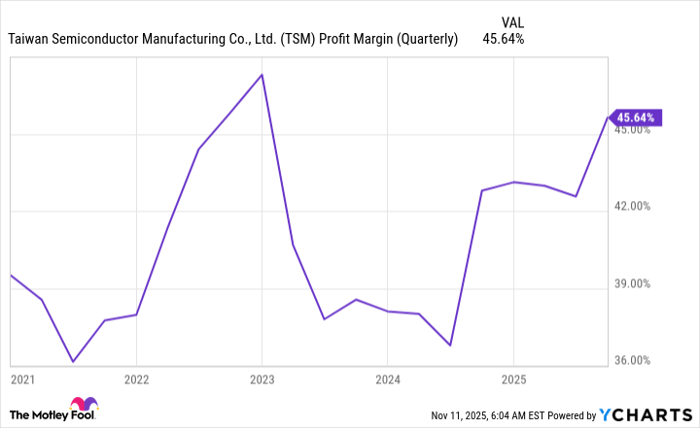

Taiwan Semiconductor is also squeezing more profitability out of its business, despite massive expansion plans that include building several facilities in the U.S. and around the world.

TSM Profit Margin (Quarterly) data by YCharts

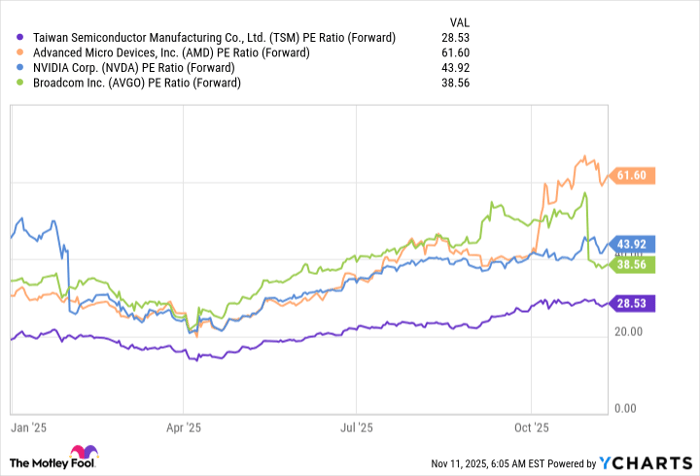

Despite all of these impressive factors, Taiwan Semiconductor trades for a far lower price tag than any of the computing unit trio it supplies chips to.

TSM PE Ratio (Forward) data by YCharts

With Taiwan Semiconductor growing faster than most of its competition and trading at a far lower price tag, I think it's a no-brainer buy to take advantage of the AI buildout. Taiwan Semiconductor is an integral part of the AI arms race and deserves the same premium that the computing suppliers get. Because it isn't valued at the same premium as its peers, I think it's an excellent stock to buy now and should be a top performer during 2026.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $622,466!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,426!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.