Could Buying XRP (Ripple) for $2.50 Be Your Ticket to Becoming a Millionaire by 2035?

Key Points

XRP has become a popular asset among cryptocurrency enthusiasts.

XRP's value proposition as a bridge cryptocurrency could make it a disruptive player in the $320 trillion cross-border transactions market.

The argument for its utility is compelling -- but not as compelling as it might appear on the surface.

- 10 stocks we like better than XRP ›

When I began my investing journey a little more than a decade ago, virtually no one was talking about cryptocurrencies. The advice I got was to buy mostly blue chip stocks and avoid highly speculative assets.

With this template in mind, I was skeptical when Bitcoin and Ethereum started to gain some mainstream traction. However, one mistake investors commonly make is to remain overly rigid in their approaches -- closing their minds to alternative opportunities.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

During the past few years, Bitcoin and Ethereum have become more broadly accepted among both retail investors and institutional money managers. Perhaps unsurprisingly, many growth investors are now on the hunt for a cryptocurrency that could emerge as the next long-term winner.

One name that seems to constantly come up in such discussions is XRP (CRYPTO: XRP), which is trading for less than $2.50 as of this writing. Could buying XRP today be your ticket to becoming a crypto millionaire?

What catalysts does XRP have?

Corporations incur hefty fees when settling international transactions denominated in multiple currencies. On top of that, wire transfers across the SWIFT network -- the most widely used platform for international transactions -- can take days to settle, as the funds may have to move through a series of intermediary banks.

However, financial institutions using RippleNet have the opportunity to bypass this antiquated structure by using XRP for their transactions.

XRP offers lower transaction fees and quicker settlement times for international money transfers compared to incumbent solutions. XRP's status as a bridge cryptocurrency gives it a legitimate chance to revolutionize the cross-border spending -- an addressable market expected to grow from $195 trillion to $320 trillion by 2032, according to research from JPMorgan Chase.

Ripple Chief Executive Officer Brad Garlinghouse has suggested that the XRP ledger could acquire a market share equal to 14% of SWIFT's volume within the next five years. As it stands, SWIFT is the default settlement layer facilitating an estimated $5 trillion of transactions each day.

Image source: Getty Images.

Where could XRP be trading in a decade?

Assessing the opinions of Wall Street analysts can be a useful way to get a sense of an asset's value proposition and its potential price trajectory. Standard Chartered analyst Geoff Kendrick specializes in cryptocurrency, and he is quite bullish on XRP.

The pillars of Kendrick's thesis rest on the following ideas:

- If the Federal Reserve lowers interest rates further and the broader macroeconomic picture improves, fund inflows into cryptocurrencies from retail investors could rise.

- Institutional investors could accelerate their adoption of XRP-themed investments, such as exchange-traded funds (ETFs) that track the token.

- President Donald Trump has signaled that his administration will take a regulatory approach that is friendly to cryptocurrencies, and that he supports legislation that could bring enormous -- and potentially favorable -- changes to the industry.

According to Kendrick's forecast, XRP could soar to a price of $12.50 by 2028. This would amount to a compound annual growth rate (CAGR) of nearly 70% during the next few years.

Image source: Getty Images.

Will investing in XRP make you a millionaire?

For the sake of this analysis, let's assume that Kendrick's model is accurate. If that 70% CAGR persisted through 2035, XRP's price at that point would be roughly $500.

In order for that growth to turn you into a millionaire, you would need to invest about $5,000 into XRP today -- acquiring about 1,960 tokens. If XRP were to reach a price of $500, then your holding would be worth just shy of $1 million.

So, to answer the million-dollar question, yes, XRP could make you a millionaire. There are, however, some important caveats to explore.

First and foremost, businesses conducting transactions through Ripple do not need to buy XRP. This is a subtle detail that I think many investors overlook. The broader adoption of the Ripple network would not necessarily lead to a wider use of (or demand for) XRP. Financial institutions can use Ripple's infrastructure and still settle transactions in fiat currency. Against that backdrop, it seems unlikely that XRP could grow at a high-double-digit annual percentage rate for a decade.

This segues neatly into my next point. Although Bitcoin and Ethereum are considered popular assets by today's investment standards, neither has been widely adopted at a global scale in terms of utility. Despite their progress -- which has been impressive -- when was the last time you or someone you know paid for a good or service in Bitcoin, or used the Ethereum blockchain? My hunch is that actual usage of either cryptocurrency as currency is limited at most.

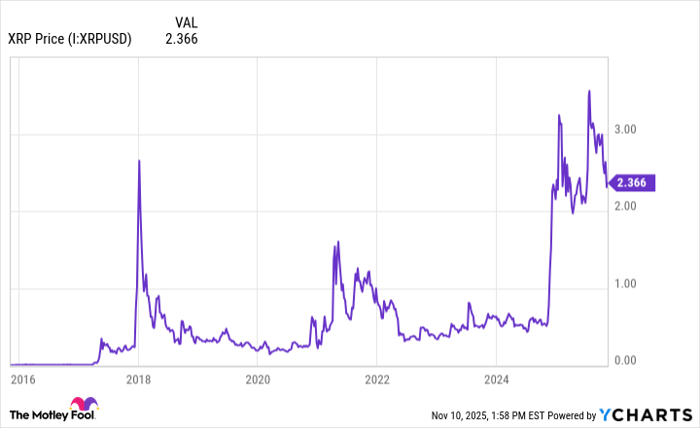

XRP Price data by YCharts.

Lastly, XRP's price history may be the most telling point of all. The token has exhibited extreme peaks and valleys, and has at times traded sideways for periods measured in years.

In my opinion, most of the millionaires XRP is ever going to create have already been minted. While XRP does have compelling utility, I am skeptical of its long-term potential to scale. For these reasons, I view XRP more as a meme coin and less as a durable opportunity poised to create millionaires in the long run.

Should you invest $1,000 in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,230!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,187,967!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Ethereum, JPMorgan Chase, and XRP. The Motley Fool recommends Standard Chartered Plc. The Motley Fool has a disclosure policy.