Up Around 60% This Year, Is Broadcom Stock Still a Good Buy?

Key Points

Broadcom has been securing multiple high-profile deals in recent months.

Its recent growth has been choppy, but it's in line with its five-year average.

The stock currently trades at more than 90 times its trailing earnings.

- 10 stocks we like better than Broadcom ›

One of the hottest artificial intelligence (AI) stocks to own in recent years has been Broadcom (NASDAQ: AVGO). The semiconductor company serves many large tech giants (like hyperscalers), and it has experienced a surge in growth due to an increase in AI-related spending.

Since 2023, the stock has surged more than 550%, including this year's gains of around 60%. With so much of a rally, the stock's market cap is now around $1.7 trillion. Has Broadcom become too expensive a stock to own, or can it still rise even higher?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Broadcom continues to bring on new, big customers

Investors often look to news of deals as a way to gauge whether a company is going in the right direction, and if its growth rate will rise in the future. When Broadcom reported $10 billion worth of orders from an unnamed customer for its custom AI chips on its third-quarter earnings report, investors and analysts speculated on what company it might be. Analysts believed it was ChatGPT-maker OpenAI, which turned out to be false. The two companies announced their own custom chip deal last month, which involves the deployment of 10 gigawatts' worth of AI accelerators.

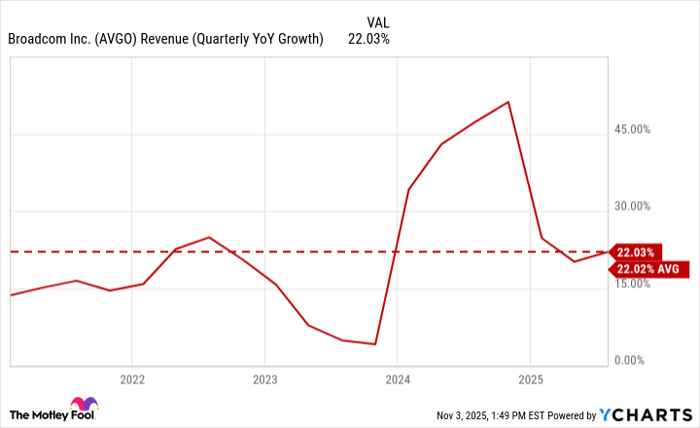

Broadcom's sales have been fluctuating in recent quarters, but its growth rate has remained in line with its five-year average, which is impressive at 22%. Investors may be anticipating an acceleration of this rate in upcoming quarters, given the recent announcements and its close relationship with many top tech companies, which continue to spend feverishly on AI.

AVGO Revenue (Quarterly YoY Growth) data by YCharts. YoY = year-over-year.

Is Broadcom's stock too expensive?

Broadcom is one of the most highly valued companies in the world, thanks to the recent AI-powered growth and bullishness from AI investors. But while its profits have been rising due to opportunities in AI, they have not been keeping up with the stock's mammoth gains.

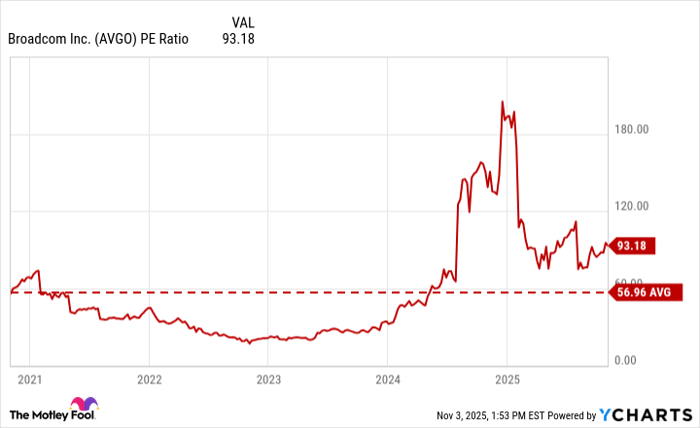

Although the company's growth rate was in line with its five-year average, it's a far different story for its price-to-earnings (P/E) multiple, which is getting close to triple digits.

AVGO PE Ratio data by YCharts.

When the multiple gets this high on a stock, it raises expectations and can make it much more difficult for the company to continue to impress investors when earnings come out. It creates a lot of downside risk for investors who buy the stock today.

The consensus analyst price target for Broadcom is around $373, which also suggests that there is limited upside from where the stock trades right now. Analyst price targets do change over time, but they can nonetheless be good indicators of how fairly priced a stock appears to be.

Why I'd avoid Broadcom's stock right now

Broadcom has been performing exceptionally well in recent quarters, but given its enormous valuation, the bar is inevitably going to climb higher for the business moving forward. Unless its earnings suddenly skyrocket, there could soon be some downward pressure on the stock. If it's trading at nearly 100 times earnings, I believe investors are likely going to expect a much stronger growth rate than 22%.

Meanwhile, the problem is that the company has a lot of exposure to hyperscalers. If there's any hint of a slowdown in AI-related spending, this could be a highly vulnerable stock to be holding. At such a high valuation, there's effectively no margin of safety for investors who invest in Broadcom today. In a time when there is so much uncertainty in the economy, now is arguably not the best time to be loading up on overpriced stocks.

I believe there are many other growth stocks to choose from in the market today that can offer investors a better mix of growth and value than Broadcom.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $592,390!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,196,494!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.