Why Altria Stock Lost 15% in October

Key Points

Altria fell short of top-line estimates in Q3, reporting a decline in revenue.

Consumers are trading down to discount cigarettes due to discretionary spending pressures.

The company continues to face challenges with its pivot to next-gen challenges.

- 10 stocks we like better than Altria Group ›

Shares of Altria (NYSE: MO) were heading lower last month as the Marlboro-maker disappointed investors with its third-quarter earnings report.

Heading into the report at the end of the month, the stock was slumping, though there wasn't much news out on the stock. That may be a sign that investors thought the stock was overbought after it had soared earlier in the year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

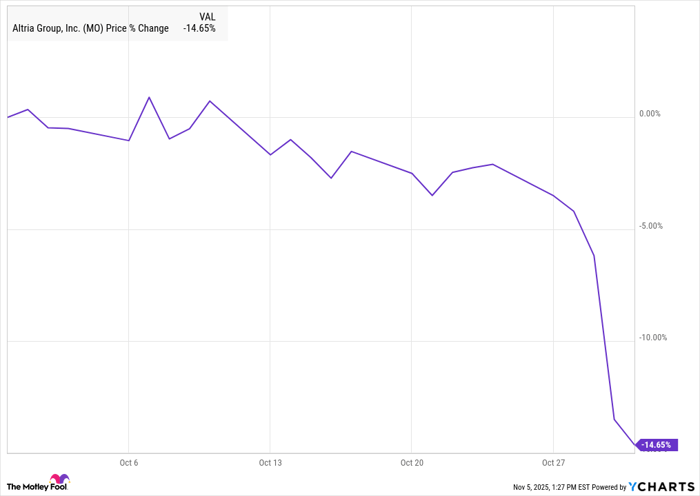

According to data from S&P Global Market Intelligence, the stock fell 15%. As you can see from the chart below, that decline came primarily after the earnings report.

MO data by YCharts

What's happening with Altria?

Altria stock fell 8% on Oct. 30 in response to its third-quarter earnings report. Its results were mostly in line with estimates, but declining growth seemed to spook investors.

Image source: Getty Images.

Revenue fell 3% in the quarter to $6.07 billion, and was down 1.7% to $5.25 billion, which missed the consensus at $5.31 billion.

Cigarette shipments continued to fall sharply, reflecting declining smoking rates in the U.S. Marlboro shipments declined 11.7% to 14.2 billion, and total cigarette shipments were down 8.2% to 16.2 billion. That included a 74.5% jump in discount cigarette shipments to 1.2 billion, showing that consumers are trading down in the face of discretionary spending pressures.

On the bottom line, adjusted earnings per share rose 3.6% to $1.45, which matched the consensus.

What's next for Altria?

The company did raise its full-year EPS guidance from $5.35-$5.45 to $5.37-$5.45, which was still below the consensus at $5.44. The company also raised its dividend by 3.9% to $4.24 annualized per share, marking its 60th increase in 56 years.

Meanwhile, Altria continues to struggle to pivot from cigarettes to next-gen products. After its $12.8 billion investment in Juul Labs blew up, the company acquired NJOY, a maker of e-vapor products and the only company to receive certain marketing authorizations from the FDA.

However, earlier this year, Altria was forced to pull the NJOY Ace refillable vape from the market after the U.S. International Trade Commission ruled that it had infringed on Juul patents.

The company touted progress in On!, its competitor to Philip Morris' Zyn, and it continues to make progress on getting approval for Ploom and Marlboro heated tobacco sticks.

The company is behind its tobacco stock peers like Philip Morris and British American Tobacco in that evolution, and it will eventually need to make progress there.

In the meantime, discretionary spending pressures seem likely to add to the company's top-line challenges.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,424!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,217,942!*

Now, it’s worth noting Stock Advisor’s total average return is 1,054% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.