Up 60% This Year, Can Lyft's Stock Continue Rallying?

Key Points

Lyft is far behind rival Uber when it comes to market cap.

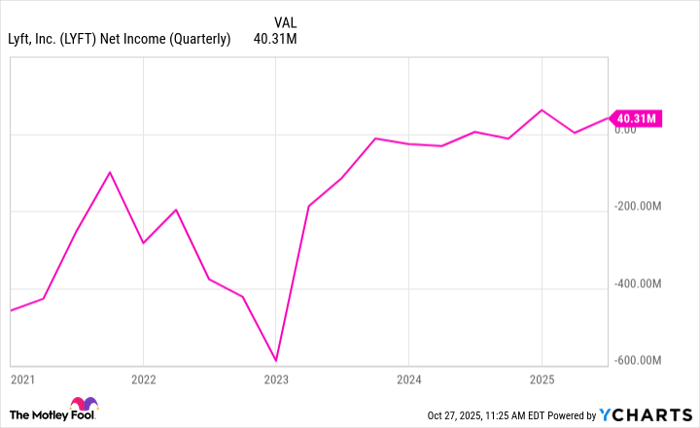

Lyft has struggled with profitability in the past, but it has now been in the black for three consecutive quarters.

The company has multiple catalysts that it can lean on for stronger growth in the future.

- 10 stocks we like better than Lyft ›

Lyft (NASDAQ: LYFT) is one of the top companies in the ride-sharing market, but at $8 billion in market cap, it's nowhere near the massive $200 billion that its far larger rival Uber (NYSE: UBER) is worth.

Investing in a smaller business can sometimes lead to better returns for investors, especially when there is such a significant gap between it and the market leader -- assuming, of course, that it delivers strong results.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

This year, shares of Lyft have risen by around 60%, which is comparable to Uber's growth. But with its valuation looking modest by comparison, could it still be a bargain buy right now?

Image source: Getty Images.

Lyft's financials have improved drastically

A big problem with Lyft in the past is that while it was a popular ride-sharing option, its business wasn't profitable. But in its last three quarters, the company's bottom line has been firmly in the black, which is a great sign for investors that it is going in the right direction.

LYFT Net Income (Quarterly) data by YCharts.

Through the first half of this year, the company's revenue totaled just over $3 billion, rising by 12% from the same period last year. Its net income over that stretch totaled $42.9 million -- a significant improvement from a loss of $26.5 million during the first two quarters of 2024.

Its profit margin of 1% is fairly small, but it's a considerable improvement nonetheless for Lyft. However, its ability to strengthen those margins in the future will ultimately be the big test of whether the stock can rally further. Uber, in comparison, averaged a profit margin of around 27% over the past 12 months.

Catalysts that could improve Lyft's financials even further

Lyft's management prides itself on offering "industry-leading service levels" to its riders. It's optimistic that this will lead to better growth in the future. The company is expecting that its rides growth will continue to be in the mid-teens for the third quarter. Another strong performance could set the stock up for further gains.

Its number of active riders hit an all-time high of 26.1 million last quarter. New initiatives could lead to even higher numbers. Riders with business accounts can earn Lyft Cash and travel points, providing them with more incentive to opt for its service. It also has a Lyft Silver service, aimed at older adults who may require more assistance and benefit from a simpler app. These are just a couple of the ways Lyft may be able to bring even more riders onto its platform in the near future.

If these efforts pay off and the company's growth is strong, and it's able to do so while expanding its margins, the stock may have much more room to run given its modest market cap.

Lyft could be a good stock to buy and hold

Lyft has been making some good progress in recent quarters, but it still has a long way to go in proving that it can keep up with Uber both in terms of popularity and financial performance. However, analysts are expecting significant improvement in the business in the long run. While Lyft trades at a hefty price-to-earnings (P/E) multiple of close to 90, its forward P/E falls to just 19, which is based on analyst expectations for how the business will do in the year ahead.

As the company continues to scale its operations and lean on new partnerships and opportunities, the business could become much more valuable in the long run. That's why, even though the stock has done incredibly well this year, it may not be too late to invest in Lyft.

Should you invest $1,000 in Lyft right now?

Before you buy stock in Lyft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lyft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $587,288!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,243,688!*

Now, it’s worth noting Stock Advisor’s total average return is 1,055% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool recommends Lyft. The Motley Fool has a disclosure policy.