Huge News for GE Aerospace Investors (and Why It's Already Boosting Earnings)

Key Points

More engines are being serviced as material parts are becoming more available.

Engine production is ramping up as GE Aerospace improves its ability to ensure parts availability.

More installed engines mean more long-term parts and service revenue.

- 10 stocks we like better than GE Aerospace ›

In GE Aerospace's (NYSE: GE) latest earnings report, management raised its full-year guidance for revenue, earnings, and free cash flow. While that's great news in itself, the reasons behind the hike in expectations are what should excite both shareholders and the aerospace industry. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Two key takeaways from GE Aerospace earnings

First, here's a look at the progression of GE Aerospace's headline guidance through the year. It's an impressive development, and primarily driven by its commercial engines and services (CES) segment. However, there's been a slight improvement in the other segment, defense and propulsion technologies (DPT), as well: Management started the year expecting DPT operating profit of between $1.1 billion and $1.3 billion, but has since upgraded it to a range of $1.2 billion to $1.3 billion.

|

GE Aerospace Full-Year Guidance |

January |

April |

July |

October |

|---|---|---|---|---|

|

Revenue growth (percentage) |

Low double digits |

Low double digits |

Mid teens |

High teens |

|

CES operating profit |

$7.6 billion to $7.9 billion |

$7.6 billion to $7.9 billion |

$8 billion to $8.2 billion |

$8.45 billion to $8.65 billion |

|

Total operating profit* |

$7.8 billion to $8.2 billion |

$7.8 billion to $8.2 billion |

$8.2 billion to $8.5 billion |

$8.65 billion to $8.85 billion |

|

Earnings per share (EPS) |

$5.10-$5.45 |

$5.10-$5.46 |

$5.60-$5.80 |

$6-$6.20 |

|

Free cash flow |

$6.3 billion to $6.8 billion |

$6.3 billion to $6.8 billion |

$6.5 billion to $6.9 billion |

$7.1 billion to $7.3 billion |

Data source: GE Aerospace presentations. CES = commercial engines and services segment. *Total operating profit includes corporate costs and eliminations of $1 billion.

So the first key takeaway from the earnings report is the ongoing improvement in CES's profitability, which will be evident in its higher-margin services business, as discussed later.

The second key takeaway is the improvement in LEAP engine deliveries, as well as the equally significant increase in management's expectations for LEAP deliveries. GE Aerospace's joint venture with Safran, CFM International, produces LEAP engines for the Airbus A320neo family of aircraft (where it competes with RTX's Pratt & Whitney) and provides the sole engine option for the Boeing 737 MAX.

Management began the year expecting 15%-20% growth in LEAP deliveries, but has recently raised its estimate to 20%. However, that estimate may prove conservative, as it implies 1,688 LEAP deliveries in 2025; CFM has already delivered 1,204 in the first nine months, 511 of those in the third quarter.

The company needs to keep up the pace of LEAP deliveries to ensure that Boeing and Airbus can deliver aircraft. More importantly for GE Aerospace, it will expand the installed base of engines that can generate service revenue for decades.

In both cases -- improved CES services growth and LEAP engine deliveries -- there's one thing in common: what CEO Larry Culp described on the earnings call as "improved material availability." In other words, GE Aerospace is seeing real improvements in its supply chain, with material availability driving profit growth.

Why material availability matters

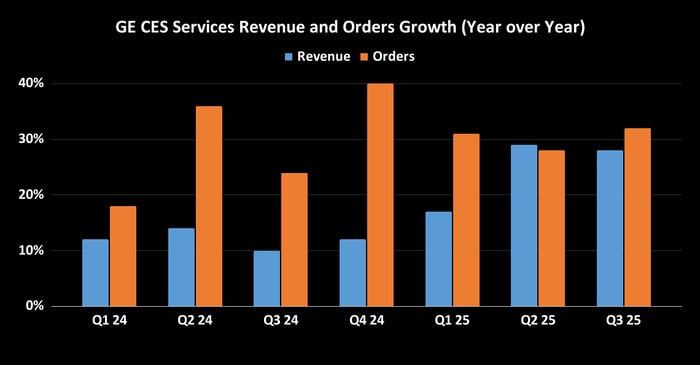

The improvement in CES revenue and orders is startling. CFO Rahul Ghai reiterated what Culp had said earlier, saying that "Improved material availability is driving higher volumes." In other words, airlines are sending engines in for shop visits more often now that more parts are available, which is boosting revenue.

Traditionally, service revenue and orders tend to be correlated with flight departures (which continue to be up by low-single-digit percentages). But the improvement in supply chains, which is driving the company's service revenue and LEAP delivery ramp-up, is providing an extra leg of growth for now.

Data source: Company presentations. Figures refer to services revenue and services orders. Chart by author.

What it means to investors

Putting it all together, it's clear that the aerospace industry is overcoming the supply chain issues that dogged it in recent years. While management expects CES services to return to a double-digit growth rate in 2026, that's still a positive development.

Image source: Getty Images.

On a similar note, improvements in LEAP engine deliveries are helping the company get back on track toward its long-term growth objectives. The improved supply chain also implies that Boeing and Airbus are well positioned to ramp up production, which is great news for airlines and suppliers like GE Aerospace.

Should you invest $1,000 in GE Aerospace right now?

Before you buy stock in GE Aerospace, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and GE Aerospace wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $587,288!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,243,688!*

Now, it’s worth noting Stock Advisor’s total average return is 1,055% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends GE Aerospace and RTX. The Motley Fool has a disclosure policy.