Stock-Split Watch: Is D-Wave Quantum Next?

Key Points

D-Wave Quantum hasn't carried out a stock split before.

It has raised money through equity offerings, diluting shareholder positions.

Low revenue and heavy losses make D-Wave a risky investment.

- 10 stocks we like better than D-Wave Quantum ›

Quantum computing could potentially be the next major tech innovation, and that has driven increased investment in pure-play quantum computing companies, including D-Wave Quantum (NYSE: QBTS). Over the last year, its share price has increased by over 3,000%.

Companies that are skyrocketing in value sometimes decide to carry out stock splits. Case in point, market leader Nvidia has split its stock twice from 2021 to 2024. This can be exciting for shareholders, so let's see whether D-Wave is likely to do the same.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

What's the point of a stock split?

A stock split is a way for a company to modify its number of shares and, in turn, its share price. In a forward stock split, the company divides its shares and lowers its share price. Say it trades at $2,000 per share and executes a 10-for-1 stock split. Shareholders would get 10 shares for every one that they owned before the split, and the share price would drop to $200. Even though the share price changes, the value of each shareholder's position doesn't.

Share prices don't indicate how expensive a stock is -- that would be the valuation metrics -- but a high share price can keep prospective investors away. Some people want to invest a few hundred dollars at most, not thousands, and not everybody's broker offers fractional shares.

However, D-Wave's share price isn't scaring off anybody right now. It's affordable for most investors, so we're not in forward split territory here.

There is another type of stock split: a reverse split. The company reduces its number of shares and increases its share price. Companies sometimes execute reverse stock splits if they're in danger of being delisted from a stock exchange because of a low share price. The New York Stock Exchange requires companies to maintain an average closing price of $1 per share, and D-Wave is well above that mark.

D-Wave has diluted shares instead of splitting them

D-Wave hasn't conducted any stock splits before. However, it has diluted shares through at-the-money (ATM) equity offerings. Like the rest of the pure-play quantum computing companies, D-Wave has been operating at a loss. Equity offerings allow it to take advantage of its growing share price to raise money.

In January, D-Wave completed a $150 million ATM equity offering. That was followed by a $400 million offering in June.

Like a stock split, an equity offering increases a company's number of outstanding shares. The downside is that previous shareholders' positions lose value, as they make up a smaller portion of the company. But equity offerings generate cash, while stock splits don't, so they make more sense for D-Wave's current situation.

A stock split would require even more growth from D-Wave

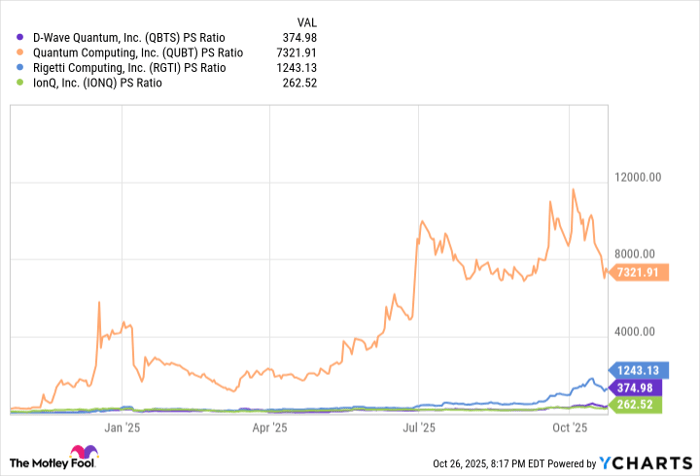

D-Wave has a long way to go before it needs to consider a stock split, and it's hard to see that kind of growth happening without some major developments. The company has generated $22 million in trailing revenue and is trading at a hefty 375 times sales, at the time of this writing.

In fairness, this isn't out of the ordinary for a quantum computing company. Of the four big names, only IonQ is trading at a lower sales multiple right now, while Rigetti Computing and Quantum Computing are much higher.

QBTS PS Ratio data by YCharts. PS Ratio = price-to-sales ratio.

Pure-play quantum computing stocks are speculative investments. They're not profitable -- D-Wave has a net loss of $282 million over the trailing 12 months (TTM) -- and likely won't be until the end of the decade, if not later.

If you think quantum computing is the future and believe in D-Wave's quantum annealing technology, then a small investment could be appropriate. The company's small revenue numbers indicate that it hasn't generated much demand for its technology yet, but that could change down the road. If so, we may see D-Wave one day announce a stock split, but don't expect that to happen in the near future.

Should you invest $1,000 in D-Wave Quantum right now?

Before you buy stock in D-Wave Quantum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and D-Wave Quantum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $587,288!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,243,688!*

Now, it’s worth noting Stock Advisor’s total average return is 1,055% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Lyle Daly has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.