Prediction: This Stock Will Be the Ultimate Quantum Computing Winner

Key Points

Alphabet recently announced a massive breakthrough in its quantum computing division.

Alphabet doesn't need quantum computing to be a successful investment.

- 10 stocks we like better than Alphabet ›

Quantum computing stocks have taken investors on a wild roller coaster ride over the past two months. However, this has mostly been centered around the pure-play quantum computing companies, like Rigetti Computing (NASDAQ: RGTI) and IonQ (NYSE: IONQ). It hasn't included the company that I predict will be the ultimate quantum computing winner over the long haul: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

Alphabet recently announced what its in-house quantum computing solution can do, and it's wildly impressive. This announcement vaulted Alphabet into a leadership role, and it could easily maintain that position over the course of the quantum computing megatrend. I think it will be the ultimate quantum computing winner, and I also think it's the only quantum computing stock worth owning right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Alphabet is far less risky than some of its pure-play peers

All of the quantum computing pure-play investments carry the same risk: They could fail, and their stocks would fall to $0. This is a real risk that isn't discussed often enough, and could lose investors a ton of money if it occurs. This is also why these stocks are so volatile, as some investors saw their initial positions rapidly increase in price and wanted to take the gains rather than sit around and find out if these companies will produce a viable technology or not.

Alphabet doesn't have this risk. It has several viable businesses that generate a ton of cash, like Google Search and YouTube. Alphabet can use these funds for multiple purposes, and it's building out AI data centers right now. However, it's also using some of those funds to fuel its quantum computing research. If this pans out and Alphabet can use quantum technologies that it has developed in-house instead of needing to purchase equipment from an external vendor, it can boost its cloud computing margins. This would be a huge win for Alphabet, and it's already starting to see some of its investments pay off.

Last year, Alphabet announced that its Willow quantum computing chip had completed a task that would have taken a traditional supercomputer 10 septillion (10 to the 25th power) years to complete. While this was impressive, it was a test that was suited for quantum computing and has no commercial relevance. Recently, Alphabet announced another task that was completed 13,000 times faster than the world's most powerful supercomputer. This algorithm is the first verifiable algorithm to be run on a quantum computer, so this is a clear step toward proving commercial viability.

Alphabet is likely further ahead than the competition, as it doesn't need to announce every breakthrough like the pure plays do. It has all the funding it needs to complete its work. The pure plays must announce every success to keep potential investors interested. Alphabet can keep its cards close to its chest while the others have to play with them face up. This is a monster advantage that cannot be understated, and it's a primary reason I think Alphabet is the best quantum computing investment right now.

Alphabet doesn't need quantum computing to work out to be successful

In addition to its quantum computing pursuits, Alphabet has a growing cloud computing business, a thriving advertising business through its Google Search engine, and artificial intelligence endeavors. Alphabet is involved in seemingly all cutting-edge technologies, although it doesn't always get the respect it deserves.

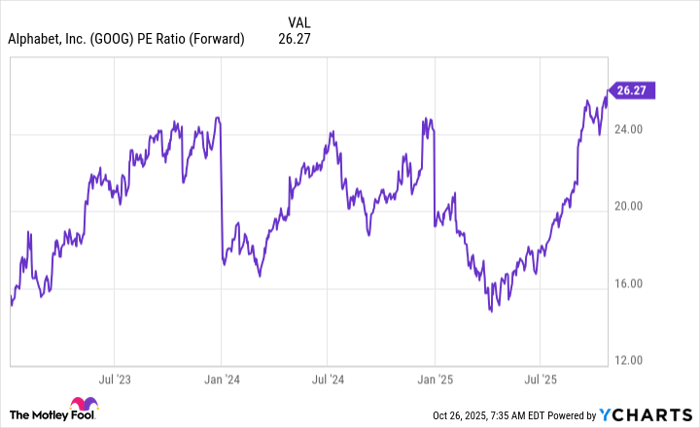

Alphabet produces the most profits of any big tech company, yet trades at a decent discount to many of its peers.

GOOG PE Ratio (Forward) data by YCharts

At 26 times forward earnings, it may not be historically cheap, but it's still at a lower price tag than many of its peers. Alphabet is just now getting recognized for its potential, and with strong quarterly results, it could still be an excellent investment.

I think Alphabet remains one of the best stocks to buy today in earnings, and if you're looking for a company with massive potential in the quantum computing realm, I think it's the best and safest investment by far.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.