Could Recursion Pharmaceuticals Be the Next Big Artificial Intelligence (AI) Stock?

Key Points

Management believes it can drastically cut down the time and cost to bring drugs to market.

The company is involved with multiple clinical trials, but none of them are in late stages just yet.

Its losses have been rising in recent years as has its share count -- a notable concern for investors.

- 10 stocks we like better than Recursion Pharmaceuticals ›

Artificial intelligence (AI) has the potential to transform all sectors and industries throughout the economy. Investing in companies that are involved in this transformation can potentially result in massive returns in the long run.

One healthcare company that is looking to leverage AI is Recursion Pharmaceuticals (NASDAQ: RXRX). It has been partnering with many big drug companies as it looks to revolutionize the process of drug discovery, which can help speed up innovation and reduce costs for pharmaceutical businesses.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With some intriguing opportunities ahead, could this be the next big AI stock to own, and is it worth investing in Recursion Pharmaceuticals today?

Image source: Getty Images.

The company's business is full of potential, but it's still unproven

It's not hard to see why investors may be bullish on Recursion's business when you hear its CEO hype up its potential. Last year, CEO Chris Gibson wasn't holding back on the savings he believed the healthcare company could help its partners achieve through its drug discovery platform, stating in an interview on CNBC, "To find the drug and get it into the clinic, I think we can shorten that from five or six years and hundreds of millions of dollars into, perhaps, one or two years and just $10 million or $20 million."

It's an impressive claim, but it's still an unproven one. While Recursion has been involved with multiple companies on developing treatments for cancer and rare diseases, none of them have reached late-stage trials, and there's by no means a certainty that they will end up obtaining approval. Until Recursion can show that it can get a drug across the finish line faster and more efficiently, hype and speculation will be the driving forces behind its share price.

In the meantime, however, it's incurring some incredible losses.

Recursion's financials are a problem

Although Recursion has been generating revenue, it hasn't been nearly enough to cover its massive expenses, particularly related to research and development (R&D). Over the trailing 12 months, the company's revenue has totaled $64.5 million while its R&D expenses have come in at $431.2 million, contributing to a net loss of $649.1 million.

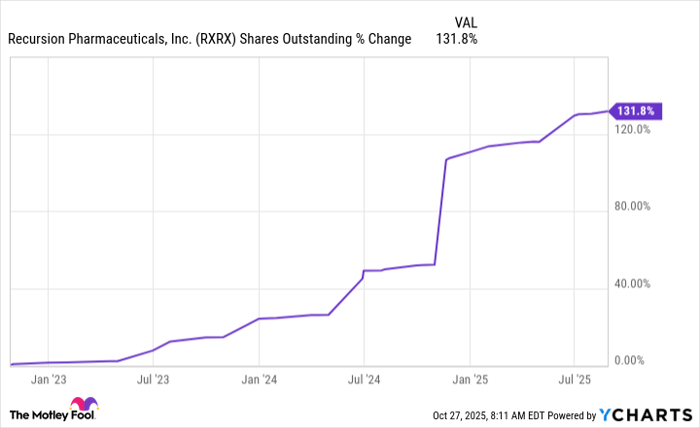

Its losses have been growing in recent years and as the company is burning through cash, it inevitably needs to raise more to continue fueling its growth. Unsurprisingly, Recursion's share count has risen significantly through stock offerings. This dilutes existing shareholders and puts downward pressure on the stock.

RXRX Shares Outstanding data by YCharts

Without an expectation that things will get better anytime soon, investors may need to brace for the high probability that this trend continues for the foreseeable future.

Recursion's stock is incredibly risky right now

In 2023, Recursion's share price got a boost as investors learned that chipmaker Nvidia had invested in it. While that led to a rally, it proved to be short-lived. Last year, the stock would decline by 31% and thus far in 2025, it's down another 11%.

This underscores the risk in investing in a company due to headlines and hype, and when the reality isn't matching up with expectations. Recursion may have the potential to be the next big AI stock, but only if it can come through on its ambitious claims. And when a CEO makes some aggressive claims about what it can do, that inevitably sets an extremely high bar, one that may be tough to reach.

Although the stock's valuation may look modest with Recursion's market cap being less than $3 billion right now, it's still not a safe investment to be hanging on to given its troubling financials and high risk for future dilution. This can be an intriguing stock to watch, but I wouldn't invest in Recursion today as there are still too many question marks around its business.

Should you invest $1,000 in Recursion Pharmaceuticals right now?

Before you buy stock in Recursion Pharmaceuticals, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Recursion Pharmaceuticals wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.