Why This Arkansas-Based Company Could Be a Buy for Value Investors (Tyson Foods)

Key Points

Tyson Foods is a large producer of meat, including beef, pork, and chicken.

The stock has fallen deeply out of favor on Wall Street, down nearly 50% from its 2022 highs.

Tyson's earnings are under pressure, but its sales and book value hint at an attractive price.

- 10 stocks we like better than Tyson Foods ›

Tyson Foods (NYSE: TSN) hails from Arkansas, with its corporate offices located in Springdale. It is one of the largest producers of meat in the world, with operations in the beef, pork, and chicken categories.

But there's one notable problem for the company. The products it produces are largely commodities. However, that could be presenting value investors with a buying opportunity.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

What does Tyson Foods do?

Producing meat is actually a pretty messy business that most people don't want to think about. It is much easier to just pick up a chuck steak at your local grocery store's meat counter than it would be to raise an animal, slaughter it, and then butcher it into all of the different cuts that you see on display at the store. There is a lot of work going on behind the scenes.

Image source: Getty Images.

Cows, pigs, and chickens need to be housed somewhere, fed, and taken care of. There are huge costs associated with this. Then, when they are old enough, they need to be processed so the meat can be packaged for end customers. This is not an easy process and it is actually quite dangerous.

All in, Tyson performs a necessary service, since meat is an important food source for most people. The problem is that despite being a consumer staple, meat is still a commodity. Demand varies over time and given the nature of raising animals, Tyson can only shift so quickly to adjust. The bottom line of company's income statement tends to be a bit volatile. And while management's move to add more branded products into the portfolio has helped add stability, financial performance still swings quite a bit.

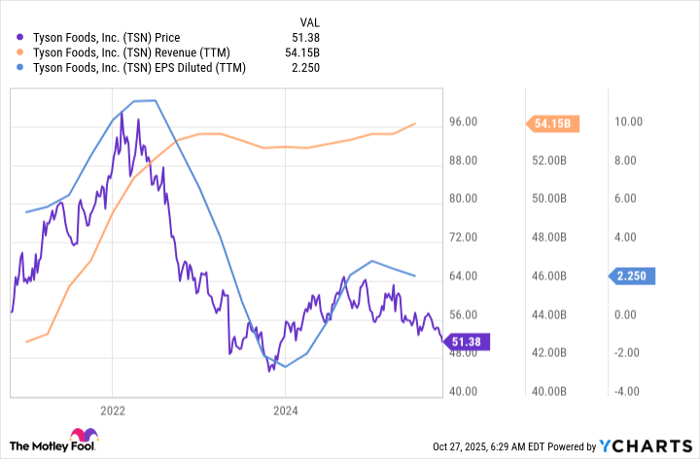

TSN data by YCharts

Tyson is deeply out of favor

As the chart above shows, Tyson stock has fallen dramatically along with earnings. That's not shocking, but revenue has largely held its own. The big problem has been that both the beef and pork markets have been weak, which has had a huge impact on the company's gross profit margin. Simply put, Tyson Foods isn't as profitable as it was a few years ago and investors have reacted as you would expect.

Tyson's management is working on the issues it faces as best it can, but a lot of what is going on is outside of the company's control. Indeed, it faces commodity volatility on both the cost side of the equation and on the sales side. But, given enough time, things are likely to improve.

For example, on a generally accepted accounting principles (GAAP) basis, Tyson's pork business had a rough run through the first nine months of 2025. But in the third quarter the division posted positive operating income (versus a negative figure in the prior year), perhaps signaling that the worst is over for the division.

This is where the opportunity lies for patient investors with a value focus. Earnings here can be volatile, leading to sizable stock price swings. But when Wall Street is negative, the stock could actually present an interesting buying opportunity. Right now Tyson's price-to-sales and price-to-book value ratios are both below their five-year averages.

Time to buy Tyson?

Conservative investors probably won't like Tyson Foods given the commodity nature of its business. However, knowing that commodities go in and out of favor (and that everyone needs to eat) could be an attraction for contrarians. Sure, Tyson Foods' business is facing headwinds today and the stock is out of favor, but in time that should change. And when it does, the stock could rise sharply. That, in fact, has been a fairly normal cycle over the past decade, suggesting that now could be a great time to buy this meat producer's stock.

Should you invest $1,000 in Tyson Foods right now?

Before you buy stock in Tyson Foods, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tyson Foods wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.