Prediction: This Artificial Intelligence (AI) Stock Will Soar After Nov. 4 (Hint: It's Not Palantir)

Key Points

Investors will be waiting eagerly to see what Palantir's upcoming earnings report has in store for them, but they should also take a look at another company that's going to release its results soon.

The need for high-speed connectivity in data centers has turned out to be a tailwind for the company discussed in this article.

Its growth rate has been accelerating, while its improving market share suggests that it could sustain its impressive growth rate in the long run.

- 10 stocks we like better than Arista Networks ›

Palantir Technologies has been one of the hottest stocks on the market in 2025, rising a stunning 140% as of this writing thanks to its accelerating growth that's being driven by the robust demand for its artificial intelligence (AI) software platform.

The software specialist is set to release its third-quarter results after the market closes on Nov. 3. There is a good chance that Palantir will be able to continue its run of impressive quarterly results, which could send the stock soaring the day after it releases its report. However, there's another AI company that could soar after Nov. 4.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Arista Networks (NYSE: ANET) is a critical player in the AI ecosystem that makes networking components, such as switches and routers, along with software-defined networking solutions that enable high-speed data transmission in data centers. The company is set to release its third-quarter results on Nov. 4. It won't be surprising to see Arista stock step on the gas and add to the 32% gains that it has already clocked so far in 2025 following its results.

Image source: Getty Images.

Arista Networks could deliver better-than-expected results once again

Arista stock popped significantly after it released its Q2 results in August, driven by the company's stronger-than-expected results and a substantial improvement in its full-year guidance. The networking equipment company benefited from the healthy AI-related demand for its hardware and software solutions, which are playing an important role in reducing latency in AI data center clusters.

Lower latency leads to faster transmission of data between servers. This leads to an improvement in the utilization rates of networking equipment and helps lower operating costs. As pointed out by Arista management on the August earnings call: "Poor networks and bottlenecks lead to idle cycles on GPUs, wasting both capital GPU costs and operational expenses such as power and cooling. With 30% to 50% processing time spent in exchanging data over networks and GPU, the economic impact of building an efficient GPU cluster with good networking improves utilization."

This explains why Arista reported a 30% year-over-year increase in revenue in the second quarter to $2.2 billion. That was nearly double the company's revenue growth rate in the year-ago period. The company also posted impressive growth of 38% in its bottom line as compared to the year-ago quarter. The solid showing encouraged Arista management to raise its full-year guidance by 8 percentage points, with the company now expecting its top line to jump by 25%.

Arista credits this improvement to a higher mix of cloud and AI customers. Even better, it won't be surprising to see Arista delivering another beat-and-raise quarter considering that the data center networking market could generate $155 billion in annual revenue in 2033 as compared to $38 billion last year.

That would translate into an annual growth rate of 17%. Arista, therefore, is growing at a much faster pace than the end market, suggesting that it is winning a bigger share of this space. According to one estimate, Arista's share of the high-speed networking space increased by almost tenfold between 2012 and 2024 to 33% at the end of last year. Even better, its 45% share of the AI-focused networking space puts it in a solid position to capitalize on the multibillion-dollar opportunity present in this space.

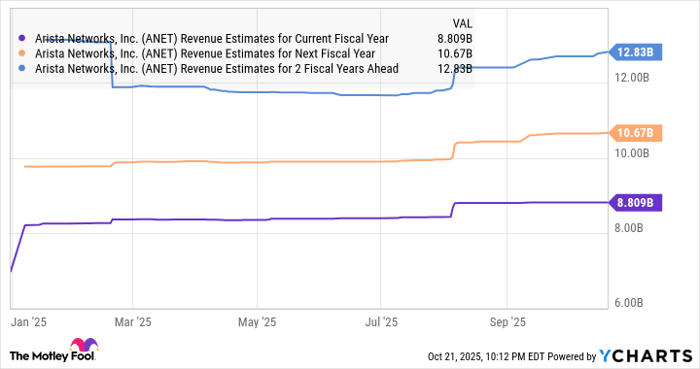

Arista's trailing-12-month revenue stands at just under $8 billion, which means there is terrific room for growth for the company. This probably explains why analysts have become upbeat about Arista's growth prospects and have raised their top-line expectations.

ANET Revenue Estimates for Current Fiscal Year data by YCharts

But what about the valuation?

Anyone looking to buy Arista Networks right now will have to pay a premium valuation. It has a trailing earnings multiple of 57, which is well above the tech-laden Nasdaq-100 index's average earnings multiple of 33. The forward earnings multiple of 44, however, points toward a nice jump in its earnings.

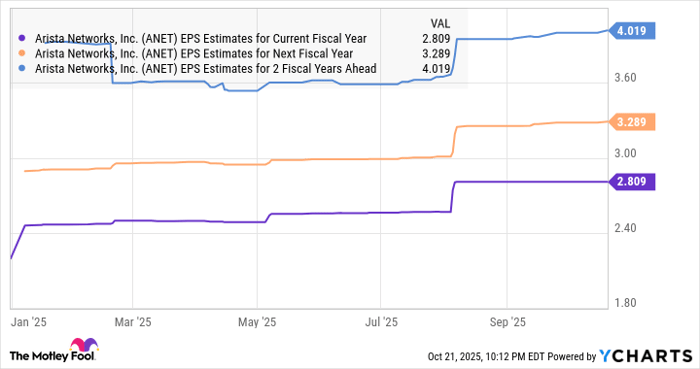

We have seen that Arista has significantly raised its guidance for the full year, and its earnings have been growing at a faster pace than its top line. That's why it won't be surprising to see Arista maintaining solid levels of earnings growth in the future that should allow it to justify its valuation. Analysts are forecasting its earnings growth rate to improve, a momentum that it can sustain for a much longer period, considering the huge end-market opportunity on offer in data center networking.

ANET EPS Estimates for Current Fiscal Year data by YCharts

That's why investors looking to buy a growth stock can consider going long Arista Networks before its earnings report, as it seems well placed to deliver solid results and guidance once again, which should be enough to give its rally a nice shot in the arm.

Should you invest $1,000 in Arista Networks right now?

Before you buy stock in Arista Networks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arista Networks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Arista Networks and Palantir Technologies. The Motley Fool has a disclosure policy.