Fed October Meeting Preview: Rate Cuts to Break 4% and an Earlier End to QT

TradingKey - At the Federal Reserve meeting ending Wednesday, October 29, policymakers are widely expected to follow through on the rate-cutting path outlined in the September Summary of Economic Projections — delivering a 25-basis-point rate cut, the second of 2025. Simultaneously, with bank reserves falling sharply and liquidity risks rising, the Fed may officially end Quantitative Tightening (QT).

Rate Cut Almost Certain — First Sub-4% Since 2022

Wall Street consensus expects the FOMC to lower its target interest rate by 25 bps, bringing it to a range of 3.75%–4.00% — the first time below 4% since late 2022.

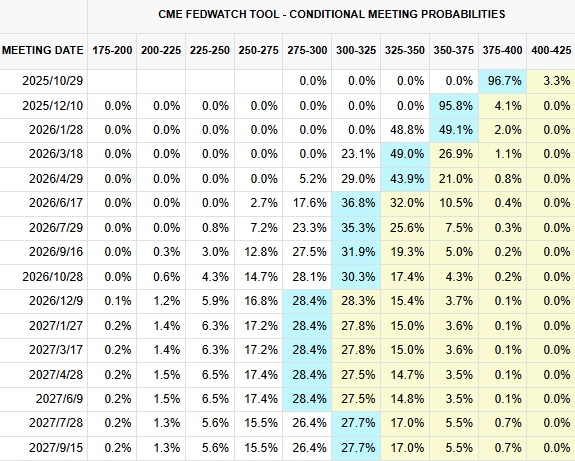

According to CME FedWatch Tool data as of October 27:

- Probability of a 25-bp cut: 96.7%

- No bets on larger cuts

- Odds of another 25-bp cut in December: ~96%

Fed Rate Expectations, Source: CME

This aligns with the September dot plot, where most officials projected two 25-bp cuts this year, citing slowing economic activity and rising downside risks to employment — despite inflation still above target.

Shutdown-Era Data: Mild Inflation, Weak Jobs

The U.S. government shutdown has now entered its fifth week, with no clear end in sight as Democrats and Republicans continue clashing over Medicaid and other spending issues.

Despite the impasse, the Bureau of Labor Statistics (BLS) managed to release the September CPI report — a surprisingly soft read that supports further easing.

Key highlights:

- Headline CPI YoY: Rose to 3.0% from 2.9%, but below the 3.1% forecast

- Core CPI YoY: Dropped to 3.0% from 3.1% — the lowest since June

- Monthly CPI: +0.3%, below expected and prior 0.4%

While much of the moderation came from volatile Owners’ Equivalent Rent (OER), the report still delivered positive news for dovish investors.

Nick Timiraos, Wall Street Journal reporter, noted that the September CPI weakens the case for hawkish resistance to rate cuts in October or December. He added that the data could reinforce a gradual, dovish stance at future meetings.

Employment signals were also weak. The ADP report showed a surprise loss of 32,000 private-sector jobs in September — the largest decline since March 2023 — versus an expected gain of 50,000.

Hawkish Voices Fade

Among the 19 officials who provided interest rate forecasts last month, eight projected two rate cuts within the year, while six anticipated no further rate reductions this year, indicating that a significant portion of policymakers do not view a December rate cut as necessary.

But recent developments have weakened this hawkish push.

Michael Feroli, Chief Economist at JPMorgan, said that while some officials want to signal that a December cut isn’t guaranteed, leadership may view such messaging as too aggressive.

With major uncertainties still looming — including Trump’s tariff threats, prolonged government shutdown, and geopolitical tensions — clarity remains elusive.

Earlier in October, Trump threatened to impose 100% tariffs on Chinese imports starting November 1, though these are likely to be withdrawn during the upcoming U.S.-China summit on October 30.

B Riley Wealth warned that a record-long government shutdown could pose real risks to growth.

Deutsche Bank noted that these headwinds may lead Chair Jerome Powell to keep options open rather than commit to a specific rate path.

Will QT End This Month?

Beyond rate cuts, a major focus is whether the Fed will officially end Quantitative Tightening (QT).

To normalize liquidity after pandemic-era balance sheet expansion, the Fed has been shrinking its holdings via QT. But now, excess liquidity is drying up:

- Overnight Reverse Repo (ON RRP) usage has plummeted

- Bank system reserves have declined for eight consecutive weeks

To avoid a repeat of the 2019 repo market crisis, ending QT is becoming urgent.

Months ago, Wall Street expected QT to end by year-end or early 2026. Now, with reserve levels falling faster than expected, Bank of America, JPMorgan, and TD Securities expect the Fed to announce the end of balance sheet runoff this month.

The Fed’s balance sheet has shrunk from a peak of $9 trillion two years ago to around $6.6 trillion. Analysts warn that if reserves fall further, it could trigger volatility in money markets.

Bank of America said that if signs of funding stress emerge, the Fed will prioritize ending QT to stabilize reserve supply and market expectations.

For markets, while rate cuts have historically boosted equities, the 25-bp cut is already fully priced in. Investors are now watching closely for any signal that QT will end — and possibly even reverse.

Barclays stated that the most market-moving outcome would be an immediate end to QT — coupled with signals of direct Treasury purchases to replenish bank reserves.