The AI Boom Could Empower This 4.3%-Yielding Dividend Stock to Add Another $10 Billion in Fuel to Its Growth Engine

Key Points

Kinder Morgan's earnings growth rate has started to accelerate.

Its growth should continue picking up speed as it starts completing projects from its $9.3 billion backlog.

It sees the potential to secure over $10 billion of additional expansion projects.

- 10 stocks we like better than Kinder Morgan ›

It wasn't long ago that it appeared Kinder Morgan (NYSE: KMI) would never grow again. The energy infrastructure giant's earnings were basically flat for several years after adjusting for asset sales and one-time items. Meanwhile, it had relatively few expansion projects in its backlog to fuel future growth.

However, thanks in part to surging gas demand from AI data centers and other catalysts, Kinder Morgan's expansion project backlog has ballooned from $1.4 billion at the end of 2021 to $9.3 billion. The company's growth engine could more than double in the coming years as it continues to capitalize on one of the best expansion opportunities in its history. That would give the pipeline company even more fuel to grow its 4.3%-yielding dividend.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Stomping on the accelerator

Kinder Morgan recently reported strong third-quarter results. The natural gas infrastructure giant generated nearly $2 billion of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). That's a 6% increase from the year-ago period, and a notable acceleration from prior years when its adjusted EBITDA had basically flattened out. Meanwhile, the company's adjusted earnings soared 16% to $0.29 per share.

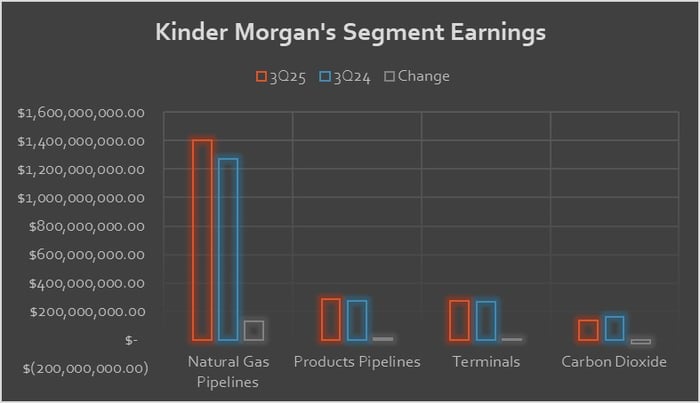

Fueling the company's strong third-quarter showing was increased contributions from its natural gas pipelines, product pipelines, and terminals businesses:

Data source: Kinder Morgan. Chart by author.

The primary driver was the company's gas pipelines. Earnings from these assets jumped 10%, driven by higher contributions on its Texas Interstate system and Tennessee Gas Pipeline. Kinder Morgan also benefited from its acquisition of Outrigger Energy. Volumes rose 6%, fueled by deliveries to liquefied natural gas (LNG) terminals, new contracts, and expansion projects.

The fuel to grow through 2030

Kinder Morgan's gas pipeline business should continue to fuel its growth for years to come. The company ended the third quarter with $9.3 billion of expansion projects in its backlog. That was flat compared to the second quarter, as the company completed $500 million in growth projects while adding a similar amount of new expansions.

Natural gas represents the bulk of its expansion backlog (about $8.6 billion). The company has secured several natural gas pipeline projects, including Trident ($1.8 billion), South System Expansion 4 ($1.8 billion), and Mississippi Crossing ($1.7 billion). It has projects on track to enter commercial service through the second quarter of 2030. These projects will support growing gas demand from LNG terminals and power plants, notably those supplying electricity to energy-intensive AI data centers, as well as new manufacturing plants and other growth catalysts. This backlog provides the company with significant visibility into its future earnings growth.

More growth coming down the pipeline

"With historic growth in global natural gas demand, a favorable federal regulatory landscape, and strong support from permitting agencies, the outlook for our company is exceptionally promising," stated CEO Kim Dang in the third-quarter earnings press release. She noted that the company is "seeing an opportunity set more robust than at any time in the company's history."

LNG is one growth catalyst for the company. Kinder Morgan expects to deliver 12 billion cubic feet per day (Bcf/d) of gas to LNG terminals by 2028, up from 8 Bcf/d today. It's pursuing several additional opportunities to support LNG demand.

Additionally, the company is actively exploring more than 10 Bcf/d of opportunities to supply more gas to the U.S. power sector. Given AI's tremendous electricity needs, natural gas stands out as one of the fastest and most cost-effective sources to deliver the high levels of stable power this technology requires. Kinder Morgan estimates it could approve more than $10 billion in additional gas projects in the coming years.

Meanwhile, gas isn't the company's only growth driver. Kinder Morgan recently partnered with refining giant Phillips 66 to potentially build the Western Gateway Pipeline. The pipeline would ship refined products, such as gasoline, from Texas to Arizona and California. Pending approval, this pipeline could enter commercial service in 2029, further enhancing and diversifying Kinder Morgan's long-term growth outlook.

The fuel to produce high-octane total returns

Kinder Morgan is entering a period of accelerating earnings growth. It has already secured $9.3 billion of expansions that will start fueling faster earnings growth next year. Meanwhile, it has an even larger set of potential projects in the pipeline to further enhance and extend its growth outlook. The earnings growth from these projects will give Kinder Morgan more fuel to increase its high-yielding dividend, which it has done for eight straight years. That combination of income and growth could help power high-octane total returns for shareholders in the coming years, making Kinder Morgan a very compelling long-term investment opportunity right now.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,380!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Matt DiLallo has positions in Kinder Morgan and Phillips 66. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool recommends Phillips 66. The Motley Fool has a disclosure policy.