U.S. July PCE and Q2 GDP Preview: With Rate Cuts Looming, Will U.S. Stocks Continue to Rise?

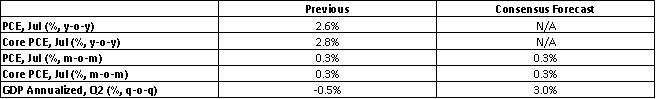

TradingKey - On 28-29 August 2025, the U.S. will release July PCE and Q2 GDP data. Market expectations suggest both headline and core PCE will rise 0.3% month-over-month, consistent with June figures. For growth, in line with the preliminary estimate on 30 July, the revised Q2 annualised real GDP growth rate is expected to remain at 3%.

Although July PCE is expected to remain elevated, looking ahead, the impact of tariff policies on PCE is likely to be less severe than market expectations, given smooth negotiation progress. While Q2 GDP is projected to show a significant rebound, this is largely due to a recovery in net exports driven by the reduced import rush in Q1. Given the unsustainability of this phenomenon, the broader trend of a slowing U.S. economy is expected to persist unchanged.

Looking forward, with limited reflation in the U.S. and ongoing economic slowdown, the Federal Reserve is highly likely to resume its rate-cutting cycle in September. Regarding the stock market, supported by accommodative monetary policy and reinforcing fiscal measures—such as rate cuts and tax reductions—we maintain a bullish outlook on U.S. equities.

Source: Mitrade

Main Body

On 28-29 August 2025, the U.S. will release July PCE and Q2 GDP data. Market consensus anticipates both headline and core PCE to increase by 0.3% month-over-month, unchanged from June. On the growth front, consistent with the preliminary estimate on 30 July, the revised Q2 annualised real GDP growth rate is expected to remain at 3% (Figure 1).

Figure 1: Market Consensus Forecasts

Source: Refinitiv, TradingKey

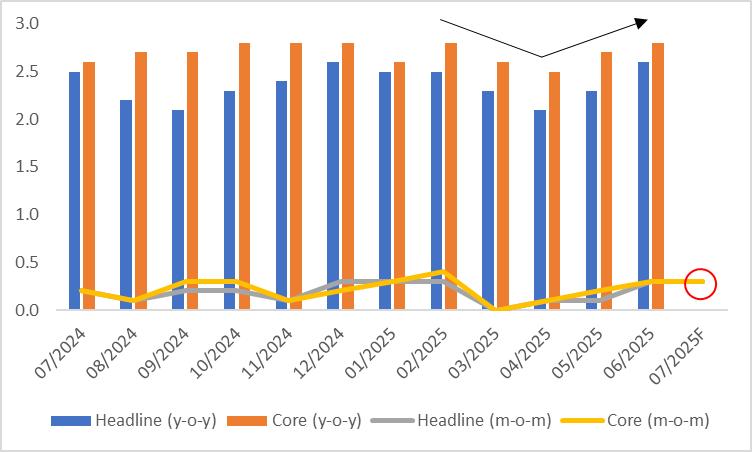

U.S. PCE data, after bottoming out in March, began to rebound starting in April (Figure 2). Specifically, both headline and core PCE rose from zero growth in March to 0.3% in June. July PCE is expected to remain elevated, primarily due to persistent inflationary pressures from tariffs, despite progress in related negotiations. Looking ahead, we believe that with ongoing successful negotiations, the impact of tariff policies on PCE will be less severe than market expectations, and reflationary pressures are likely to moderate after August.

Figure 2: U.S. PCE (%)

Source: Refinitiv, TradingKey

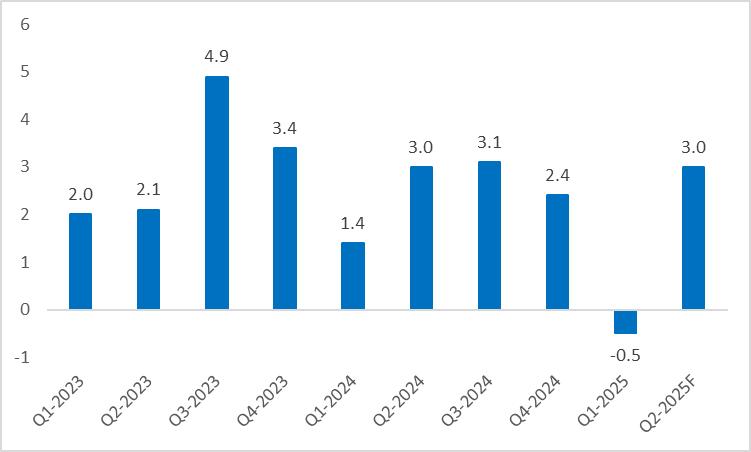

Both the initial estimate on 30 July and the projected revision on 28 August indicate that Q2 GDP will shift from negative to positive, reflecting a significant rebound (Figure 3). The primary driver of this change is a notable recovery in net exports. Specifically, during Q1, a large-scale import rush led to a substantial trade deficit, which was the main cause of negative GDP growth. In Q2, smoother progress in tariff negotiations reduced import rush activities, resulting in a significant increase in real GDP growth. However, this rebound does not signify an improvement in the intrinsic growth momentum of the U.S. economy. Looking ahead, we believe the broader trend of a slowing U.S. economy remains unchanged.

Figure 3: U.S. Real Annualised GDP (%, q-o-q)

Source: Refinitiv, TradingKey

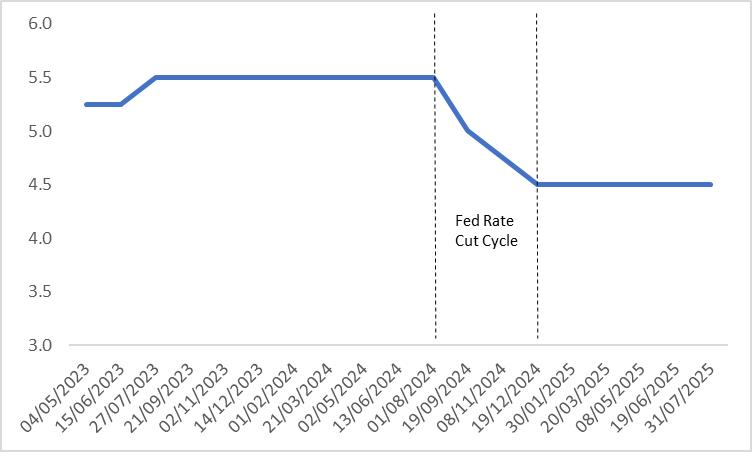

Looking ahead, given the limited scope of U.S. reflation and ongoing economic slowdown, the Federal Reserve is highly likely to resume its rate-cutting cycle in September (Figure 4). In the stock market, supported by accommodative monetary policy combined with reinforcing fiscal measures—such as interest rate cuts and tax reductions—we maintain a bullish outlook on U.S. equities.

Figure 4: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

Get Started