Ripple Price Forecast: XRP decline accelerates amid cooling Open Interest and Brazil's VERT structured credit launch

- XRP extends decline from its record high of $3.66, reflecting headwinds in the broader cryptocurrency market.

- Brazilian securitization and fund management company debuts blockchain-based platform for managing private credit on the XRP Ledger.

- XRP futures Open Interest uptrend takes a breather as RSI decline suggests cooling in the spot market.

Ripple (XRP) price is extending an intraday red candle on Wednesday, trading at around $3.29 in the American session. The decline follows a rejection from Monday's swing, which stopped just shy of the token's record high of $3.66, reached on Friday.

XRP's technical outlook indicates a potential shift to bearishness in the short term, underpinned by a decline in futures contract Open Interest (OI) alongside a decrease in the Relative Strength Index (RSI).

Brazil's VERT brings tokenized credit to the XRP Ledger

VERT, one of the leading providers of securitization and fund management services, has launched a blockchain-based platform to manage private credit on the XRP Ledger (XRPL).

According to the announcement made by Ripple on Wednesday, the "platform was developed to digitally mirror securitization and fund operations, with on-chain records of key events and transactions."

VERT envisions robust capital markets in Brazil, fostering efficiency, transparency and accessibility with the backing of a secure digital infrastructure.

The blockchain platform has already conducted its first successful transaction, which entailed the issuance of an Agribusiness Receivables Certificate (CRA) valued at approximately $130 million.

A CRA refers to a regulated financial instrument used to bundle futures cash flows to create investment products. These investment products are popular in Brazil. They are used to finance agricultural products as well as exports.

The issuance of CRAs on-chain unlocks higher levels of security, transparency, traceability, and efficiency, while leveraging the regulatory-compliant features of the XRPL, including low-cost transactions. Ripple added that the adoption extends to the recently launched XRPL EVM Sidechain, which supports an Ethereum-compatible environment, with smart contracts for automation and reporting.

"We are enabling operation events to be recorded in the most granular way possible, ensuring traceability and transparency with event records increasingly closer to the moment they occur, approaching real time," VERT's Director of Digital Assets, Gabriel Braga, said.

Ripple continues to focus on supporting the tokenization of real-world assets (RWAs) by tapping the XRPL EVM Sidechain, which recently launched on the XRP Ledger mainnet.

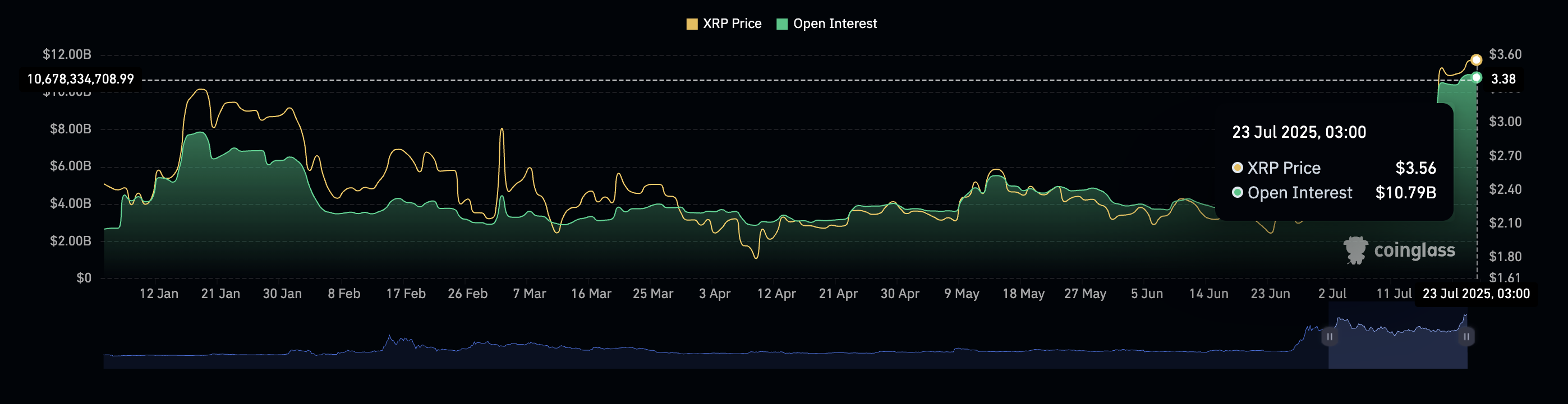

Meanwhile, interest in the XRP token on the derivatives market is slowing down, following a sharp rise in the futures Open Interest (OI) to $10.94 billion, the highest level this year.

XRP Futures Open Interest | Source: CoinGlass

CoinGlass data shows the OI averaging $10.79 billion on Wednesday, reflecting a minor drop in interest. The price decline has also seen a surge in liquidations, reaching $29 million over the past 24 hours.

Long position holders accounted for the lion's share of the liquidations at approximately $26 million, with $2.8 million of short positions wiped out.

XRP derivatives market's data | Source: CoinGlass

Technical outlook: XRP bleeds as the RSI drops

XRP price is trading at $3.29 after losing support at $3.40, its previous all-time high. The decline in the Relative Strength Index (RSI) from extremely overbought conditions at 88 to 68 underpins the changing market dynamics, possibly due to profit-taking and sentiment in the broader cryptocurrency market.

A further decline of the RSI would indicate a reduction in buying pressure, which may accelerate the losses in XRP toward lower support levels at $3.20, tested in late January, and $3.00, which was previously tested as resistance in early March.

XRP/USDT daily chart

Traders should also monitor the Moving Average Convergence Divergence (MACD) indicator for further signs of weakness, particularly when the blue line crosses below the red signal line. Such an occurrence would likely result in a sell signal, encouraging traders to reduce their exposure.

Still, the uptrend remains intact if bulls collect liquidity at the current level, keeping the bid for gains above the record high of $3.66 alive.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.