Cardano Price Forecast: ADA finds support as network growth fuels bullish outlook

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Bitcoin Rebounds After Falling to $62,500 Low, Crypto Market Still Extremely Fearful

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP post cautious recovery amid downside risks

Cardano price finds support around the previous broken trendline, signaling an upside move ahead.

Everstake is now an official Cardano DRep, highlighting the growing expansion of the ADA network.

Derivatives data support a recovery with positive funding rate and rising bullish bets.

Cardano (ADA) shows signs of recovery, trading around $0.85 on Friday after finding support around its previously broken trendline earlier this week. Everstake becomes an official Cardano Delegated Representative (DRep) on Thursday, showing Cardano’s governance expansion. Moreover, positive funding rates and rising bullish bets further strengthen the case for a sustained rebound.

Cardano’s governance continues to expand

Cardano announced on Thursday that Everstake is the official Cardano DRep (Delegated Representative).

“We’re excited to play an active role in Cardano’s on-chain governance and help shape the future of one of the most decentralized ecosystems in crypto,” said Everstake X post.

As a DRep, Everstake has a direct voice in Cardano’s governance, voting on critical proposals, protocol upgrades, and community initiatives on behalf of ADA holders, thereby highlighting Cardano’s growing network expansion.

Derivatives data show signs of a recovery

Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of Cardano will slide further is lower than those anticipating a price increase.

The metric has flipped a positive rate on Tuesday and rose to 0.0070% on Friday, indicating that longs are paying shorts. Historically, as shown in the chart below, when the funding rates have flipped from negative to positive, Cardano’s price has rallied sharply.

Cardano’s funding rate chart. Source: Coinglass

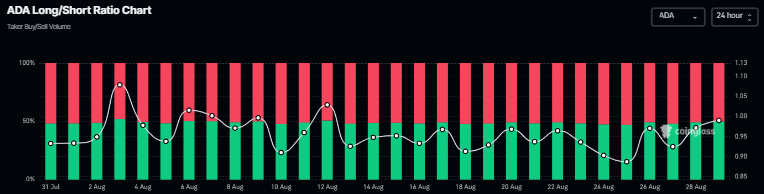

Apart from positive funding rates, Cardano’s long-to-short data also shows a rise in bullish bets among traders, further supporting the recovery view.

ADA long-to-short ratio chart. Source: Coinglass

Cardano Price Forecast: ADA steadies around key support zone

Cardano price retested the previously broken trendline, which roughly coincides with the 61.8% Fibonacci retracement level at $0.82 on August 22, and rallied by over 9%. However, ADA failed to sustain the upward momentum and declined 7% so far this week, steadying around the $0.82 support zone. At the time of writing on Friday, it hovers at around $0.85.

If the $0.82 continues to hold as support and ADA recovers, it could extend the rally toward its August 14 high of $1.02.

The Relative Strength Index (RSI) on the daily chart is hovering around its neutral level of 50, indicating indecision among traders. For the recovery rally to be sustained, the RSI must move above its neutral level.

ADA/USDT daily chart

However, if ADA closes below the $0.82 support level on a daily basis, it could extend the correction toward its next support level at $0.76, which is the 50% price retracement.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.