Forecasting the upcoming week: US inflation data to dominate

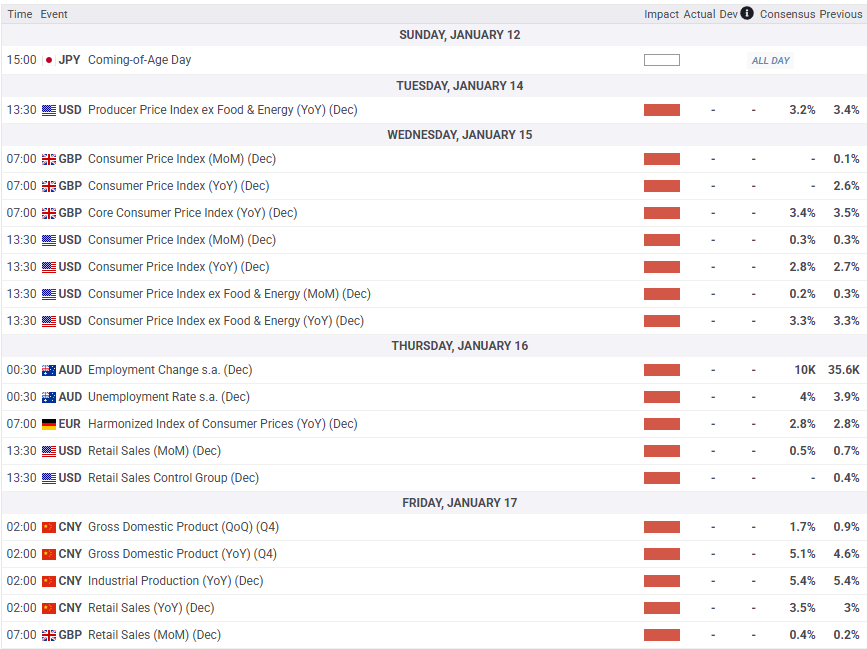

The US Dollar surged to a fresh 26-month high after US Nonfarm Payrolls (NFP) surged in December, devastating market hopes for more Federal Reserve (Fed) rate cuts in 2025. Investors will pivot to upcoming US inflation figures next week, but hopes for a sudden decline in Consumer Price Index (CPI) inflation remains limited.

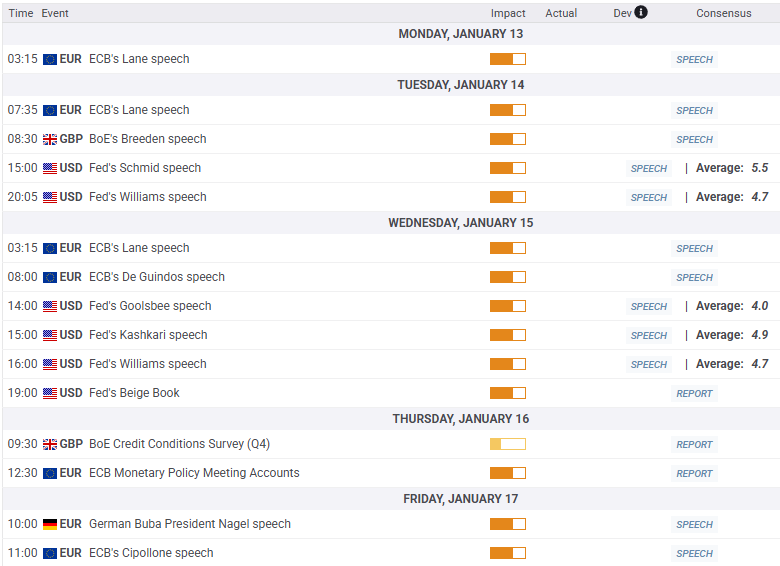

The US Dollar Index (DXY) lurched into its highest valuation in a little over two years after US NFP net jobs additions climbed to 256K in December, wiping out any remaining hopes for further rate cuts from the Fed in the near term. Rate markets are pricing in no moves at all on interest rates until June at the earliest, with only a quarter-point rate trim expected through the entire year. US CPI inflation will be next week’s key data print, but hopes for a sudden drop in inflation strong enough to spark additional moves from the Fed on rates remains next to non-existent.

EUR/USD found a fresh 26-month low and closed in the red for a sixth straight week as the Euro continues to lose ground against the Greenback. The upcoming week is notably thin on the European side of the economic data docket, and Fiber bulls will be stuck hoping for any kind of change in policy stance from a series of mid-tier appearances from members of the European Central Bank (ECB) next week.

GBP/USD found a 14-month low of its own this week, taking a fresh run at the 1.2200 handle. The UK will be delivering it’s own CPI inflation print next Wednesday, and while annualized headline CPI inflation is expected to tick down, overall UK inflation still remains well above Bank of England (BoE) targets on a YoY basis.

AUD/USD traders could see a tense outing next week. A smattering of Australian and Chinese figures will print throughout the week, culminating in a fresh update on Aussie labor figures early Thursday, with fresh Chinese Gross Domestic Product (GDP) and Retail Sales due on Friday. Australia’s Unemployment Rate is expected to tick up slightly to 4.0% from 3.9%, while officially reported Chinese GDP growth is miraculously expected to climb to 5.1% YoY in Q4 2024 from Q3’s 4.6%, despite waffling consumption, demand, investment, and spending figures, though another upswing in government subsidy plans are sure to help matters further.