Dow Jones Industrial Average hesitates on Thursday after key earnings misses

- The Dow Jones was eclipsed by other indexes on Thursday, bogged down by weak earnings reports.

- Political turmoil continues to cloud investor screens as the Trump-Fed feud continues to develop.

- Despite near-term weakness, the Dow Jones is still knocking on all-time highs.

The Dow Jones Industrial Average (DJIA) stumbled on Thursday, consolidating just below the 45,000 handle as earnings blunders drag down key overweighted stocks listed on the Dow Jones. Equities remain tilted firmly into the high side with all major indexes testing fresh record highs, but political storm clouds continue to gather as United States (US) President Donald Trump continues his campaign to replace his own pick for head of the Federal Reserve (Fed) ahead of schedule.

IBM, Honeywell, and UnitedHealth in the crosshairs

Key stocks on the Dow declined on Thursday, dragging the overall index lower for the day. IBM (IBM) plummeted 8% in overnight trading despite posting better-than-expected earnings after markets closed on Wednesday. IBM’s revenue, sales, and earnings metrics all continue to rise as the broad-market AI tech rally tide lifts all boats; however, IBM’s software segment growth underperformed its peers, growing at a comparatively sedate 10% annually.

Honeywell (HON) also stumbled following Wednesday’s after-hours earnings dump, falling 5% on Thursday despite a clean beat on earnings. Investors have noted some warning signs of weakening profitability, pushing HON down and punishing the tech conglomerate for only delivering 8% YoY growth and failing to raise forward guidance as much as analysts had hoped.

UnitedHealth (UNH) softened around 4% on Thursday after the insurance provider, with a strong history of leaning into coverage denials as a means of generating profits, admitted it was under investigation by federal authorities. Investigations are underway for both criminal and civil litigation surrounding UNH’s Medicare arm, citing issues with the use of questionable practices in gathering diagnoses from doctors and nurses to deny claims and bolster payments.

Labor data, business sentiment indicators signal still-strong economy

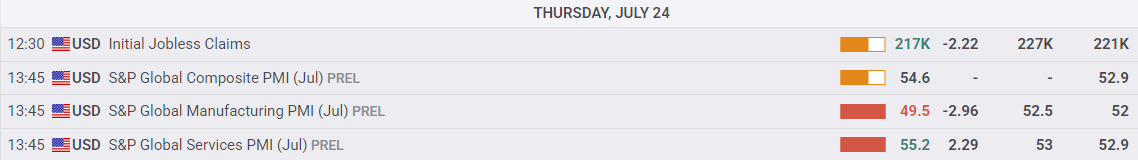

A strong beat in key US economic data also hampered an outright bull run on Thursday. Weekly Initial Jobless Claims eased to 217K, and the Services segment of US Purchasing Managers Index (PMI) aggregated survey results improved sharply in June. A firm labor market and business activity expectations still trucking along strongly make it difficult for the Fed to deliver rate cuts sooner rather than later.

Strong economic data trumps Trump's desire for lower interest rates

According to the CME’s FedWatch Tool, rate traders are still pricing in a 60% chance of at least a quarter-point rate cut on September 17, but hope is waning as the US economy continues to flout expectations of a steepening decline. Regardless, President Trump is still on the warpath as he rails against Fed Chair Jerome Powell. The Trump administration is actively pursuing ways to both replace Fed Chair Powell before the end of his term and force the Fed to arbitrarily lower interest rates.

Dow Jones price forecast

Thursday’s price action has the Dow Jones muddled in near-term congestion levels despite an overall bullish tilt to the major equity index. The Dow is still trapped just south of record highs above the 45,000 handle, but topside momentum continues to struggle with making meaningful progress.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.