Dow Jones Industrial Average lurches into even higher highs, taps 39,880 on Thursday

- Dow Jones clips into its second all-time high in two days.

- US equities broadly higher in the back half of the trading week.

- DJIA climbs 0.8% on Thursday as traders extend Fed bid.

The Dow Jones Industrial Average (DJIA) tore into its second all-time high this week, climbing eight-tenths of a percent and tapping a fresh record peak of 39,889.05 as US equities broadly gain ground. Investor confidence is peaking after the Federal Reserve (Fed) held steady on interest rates at the March Federal Open Market Committee (FOMC) rate call on Wednesday. Still, Fed Chairman Jerome Powell nodded at the likelihood of rate cuts to come, sending broad-market risk appetite into the ceiling.

Of the 11 sectors that make up the US equities markets, all but one are in the green on Thursday, led by the Industrials and Financials Sectors, which are up around a percent. On the low side, Communications Services shed further weight, backsliding a third of a percent as investors pare back bets on telecoms.

Dow Jones news

The Dow Jones climbed around 300 points on Thursday as the index bears down on the 40,000.00 major price handle as the equity index trades above 39,800.00. Of the 30 securities listed on the DJIA, only six are in the red on the day, led by Apple Inc. (AAPL), which shed over 4% to trade into $171.00 per share after the US Department of Justice announced it was suing the company on the accusation that Apple’s iPhone ecosystem constitutes a monopoly. The Department of Justice accused Apple of anti-competitive practices in multiple areas of the megacompany’s mobile phone business. The AAPL ticker is down nearly 8% from recent all-time highs at $198.11 set last December.

Goldman Sachs Group Inc. (GS) is leading the charge up the Dow Jones market board on Thursday, climbing 4.25% on the day to trade above $413.00 per share. GS is followed by Home Depot Inc. (HD), which climbed over 2.5% to test $394.40. Caterpillar Inc. (CAT) is up a little over 2% ahead of the day’s market close, testing $364.00 per share.

Dow Jones Industrial Average technical outlook

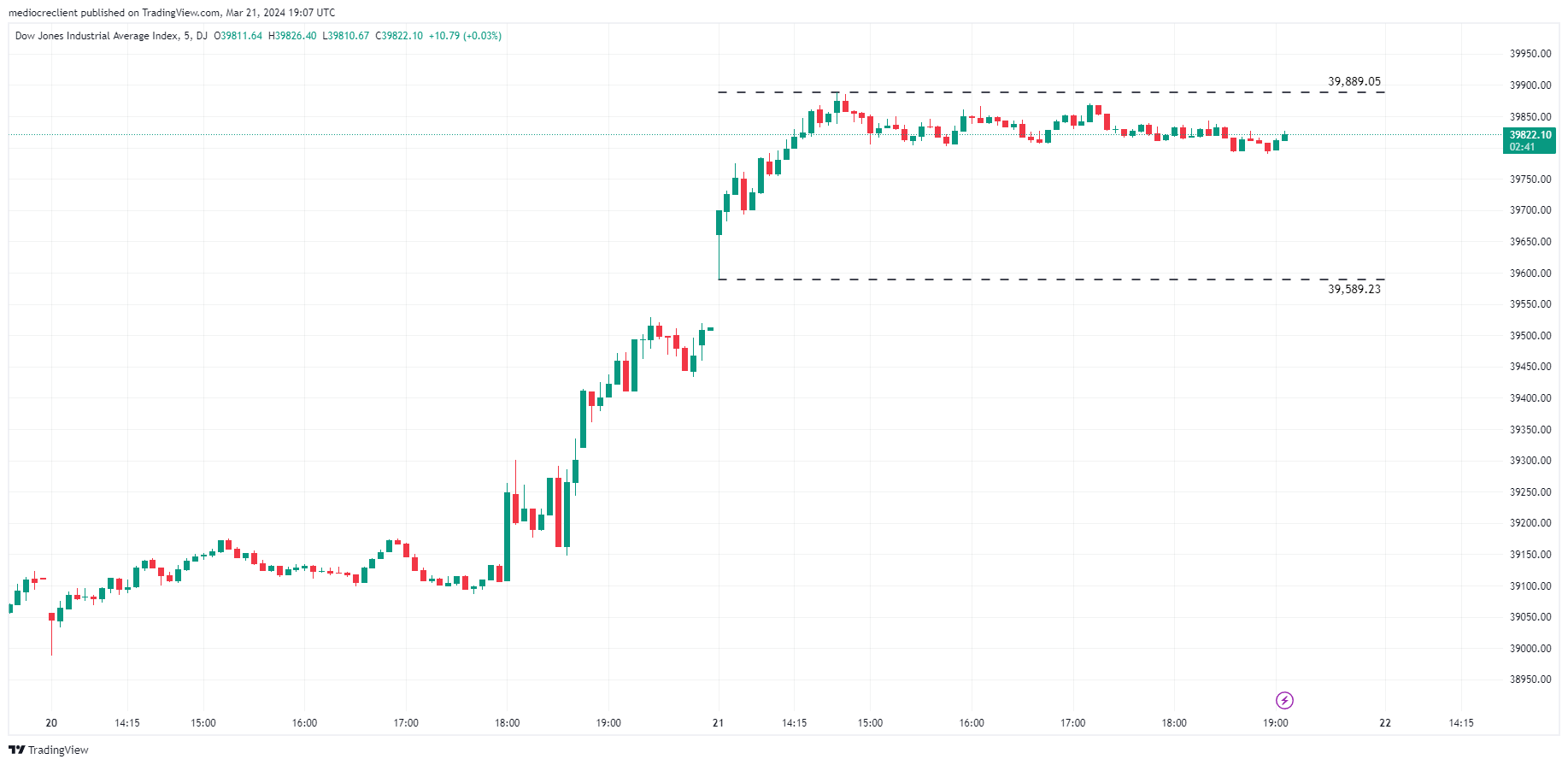

The Dow Jones kicked off Thursday’s US trading session with a topside gap as investors scrambled to bid up US equities, rallying into a fresh all-time record peak at 39,889.05 before settling into sideways trading between 39,840.00 and 39,820.00. The day’s low was set early in the trading session at 39,589.23.

Sellers looking to close Thursday’s opening bullish gap will need to drag the index below 39,520.00, which would open the Dow Jones up for a further decline into the last swing low into the 38,600.00 region.

Dow Jones Industrial Average 5-minute chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.