Bitcoin Price Forecast: BTC extends consolidation as Fed interest rate decision looms

- Bitcoin price has been consolidating within the $116,000-$120,000 over the past two weeks.

- Strategy has acquired around 21,000 additional BTC, while spot Bitcoin ETFs recorded a mild inflow of nearly $80 million.

- Traders should be cautious as the upcoming Fed interest rate decision could bring sharp volatility in crypto assets.

Bitcoin (BTC) has been trading sideways between $116,000 and $120,000 for more than two weeks. Despite the lack of a clear price direction, corporate and institutional demand remained strong, with Strategy (MSTR) adding nearly 21,000 additional BTC and fresh inflows in the spot Bitcoin Exchange Traded Funds (ETFs).

However, traders should keep a watch on the upcoming Federal Reserve’s (Fed) interest rate decision, which could bring sharp volatility in the crypto market.

Bitcoin consolidation ending soon

Bitcoin price has been trading sideways between $116,000 and $120,000 for the past two weeks after reaching a new all-time high of $123,213 on July 14. This prolonged consolidation may soon conclude, giving directional bias to the largest cryptocurrency by market capitalization, as market participants await the US Federal Reserve’s (Fed) interest rate decision this Wednesday, which could trigger significant volatility in the cryptocurrency market.

While markets broadly expect the Fed to keep interest rates unchanged, any comments from Chair Jerome Powell about what the central bank will do after the summer could move markets.

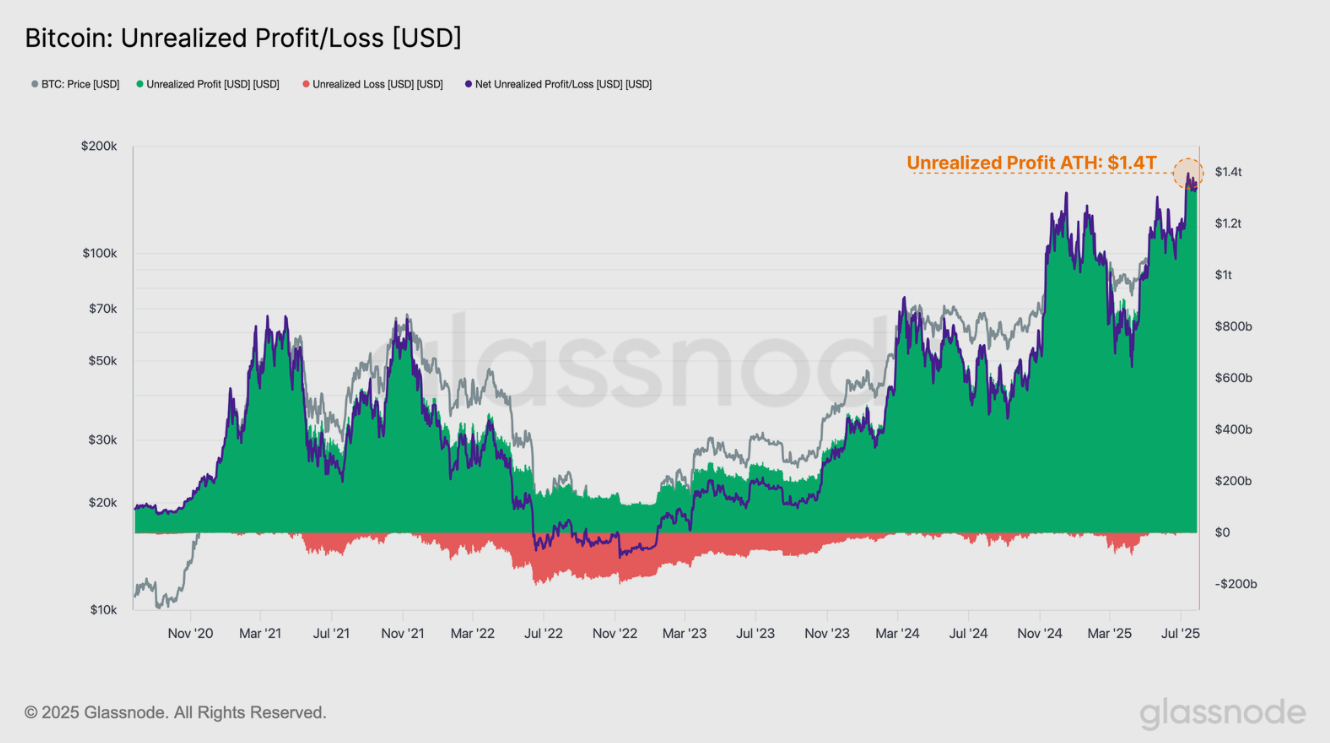

Glassnode’s report on Tuesday highlighted that the total US Dollar value of paper gains (unrealized profits) recently reached an all-time high of $1.4 trillion in aggregate. This underscores how the majority of investors are sitting on substantial paper gains and sets up an environment of potential future sell-side pressure should prices continue to rise further.

Bitcoin Unrealized Profit/Loss chart. Source: Glassnode

Strategy adds 21,021 BTC, spot ETFs record four-straight days of inflow

Bitcoin price has remained resilient despite Galaxy’s recent sell-off on Friday. Moreover, on Tuesday, Strategy acquired 21,021 BTC, bringing the total holding to 628,791 BTC.

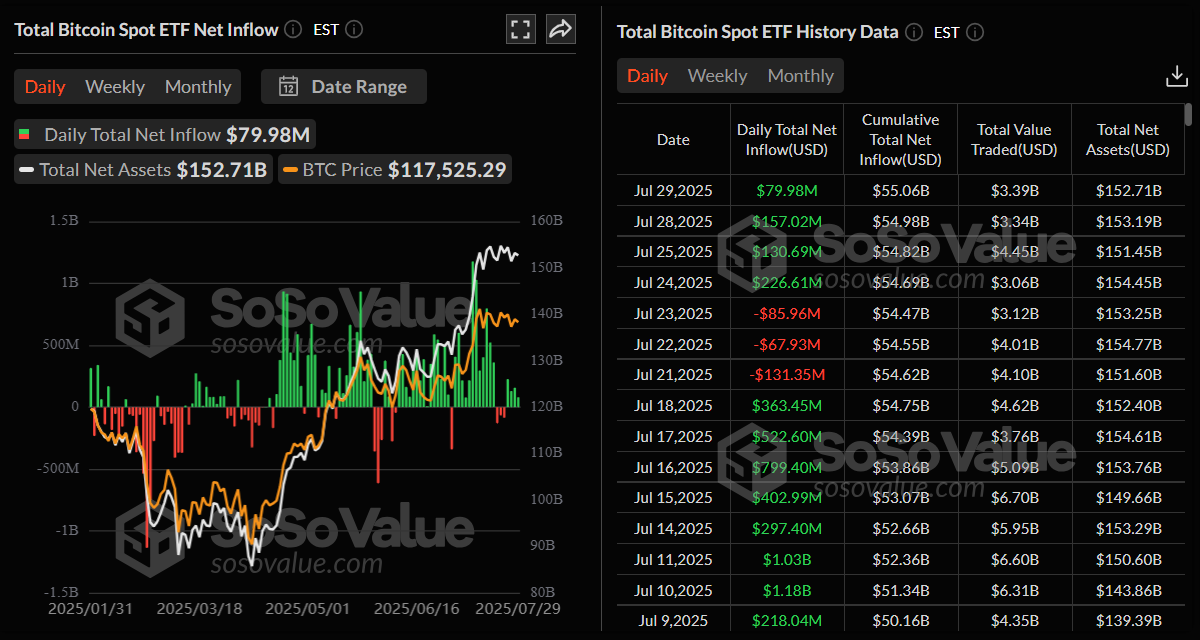

Looking down at the institutional demand, it also remains robust. According to the SoSoValue data, as shown below, US spot Bitcoin ETFs recorded an inflow of $79.98 million on Tuesday, marking the fourth straight day of positive net flows.

Total Bitcoin Spot ETF Net Inflow daily chart. Source: SoSoValue

US SEC gives green light to in-kind creations and redemptions for Bitcoin and Ethereum ETPs

The US SEC announced in its press release on Tuesday that it has voted to approve orders to permit in-kind creations and redemptions by authorized participants for crypto ETP shares.

This order is a departure from the previous cash-only mechanism used for spot BTC and ETH ETPs, which were limited to creations and redemptions on an in-cash basis. This development marks a regulatory shift from the previous cash-only mechanism used for spot Bitcoin and Ethereum ETPs, now aligning crypto products with traditional commodity-based ETPs like Gold and Oil.

Adding to this, the White House is set to release its first virtual asset policy report on Wednesday, which is expected to provide further direction for the digital asset space and the largest cryptocurrency by market capitalization.

Bitcoin Price Forecast: BTC trades in a range-bound pattern between $116,000–$120,000 range

Bitcoin price has been consolidating in the $116,000 to $120,000 range for the past two weeks, following a new all-time high of $123,218 reached on July 14. At the time of writing, BTC trades at around $118,000.

If BTC falls below $116,000 on a daily basis, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $112,736.

The Relative Strength Index (RSI) indicator reads 58 on the daily chart, which is above its neutral level of 50, but points downward, indicating fading bullish momentum. Moreover, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover last week, giving a sell signal. The rising red histogram bars below the neutral value also suggest a bearish momentum and a downward trend.

BTC/USDT daily chart

However, if BTC closes above $120,000 on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.