EUR/USD finds temporary support near 1.1400 ahead of Eurozone HICP, US NFP data

EUR/USD finds cushion near 1.1400, downside looks likely as the US Dollar trades firmly.

Traders pare bets supporting interest rate cuts by the Fed in the September meeting.

Investors await the flash Eurozone HICP and the US NFP data for July.

The EUR/USD pair attracts some bids near the round level of 1.1400 during the Asian trading session on Thursday. The major currency pair finds cushion as the US Dollar (USD) takes a breather after a five-day winning streak.

The US Dollar (USD), which tracks the Greenback’s value against six major currencies, clings to gains near a fresh two-month high around 100.00 posted on Wednesday.

US Dollar PRICE This week

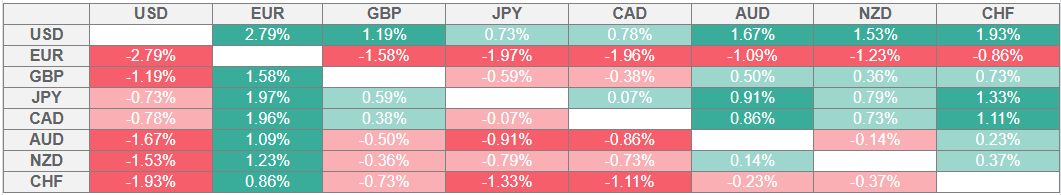

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The DXY gained sharply on Wednesday as upbeat flash Q2 Gross Domestic Product (GDP) data and upside inflation risks warned by Federal Reserve (Fed) Chair Jerome Powell in the press conference after the monetary policy decision forced traders to pare bets supporting interest rate cuts by the central bank in the September meeting.

According to the CME FedWatch tool, the probability for the Fed to cut interest rates in the September meeting has diminished to 43.2% from 63.3% seen on Tuesday.

Meanwhile, investors await the US Nonfarm Payrolls (NFP) data for July, which is scheduled to be released on Friday. Signs of stable labor market conditions would further support traders to pare Fed dovish bets.

In the Eurozone, investors await the preliminary Harmonized Index of Consumer Prices (HICP) data for July, which will be released on Friday. Price pressures are expected to have grown moderately. In Thursday’s session, investors will focus on the inflation data from Germany, France, and Italy. On Wednesday, flash Spain HICP data showed that price pressures deflated month-on-month.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.