Bitcoin holds steady as Fed holds interest rates, Powell concerns tariff-driven inflation

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

- AUD/USD sticks to gains above 0.6600, highest since late October after Aussie trade data

- AUD/USD holds steady above 0.6600; remains close to two-month high ahead of US PCE data

The US Federal Reserve decided to keep interest rates unchanged on Wednesday.

Jerome Powell shared hawkish remarks amid President Trump’s ongoing tariff negotiations.

Bitcoin and top altcoins face volatility, while the Fear and Greed Index remains at high risk-appetite levels.

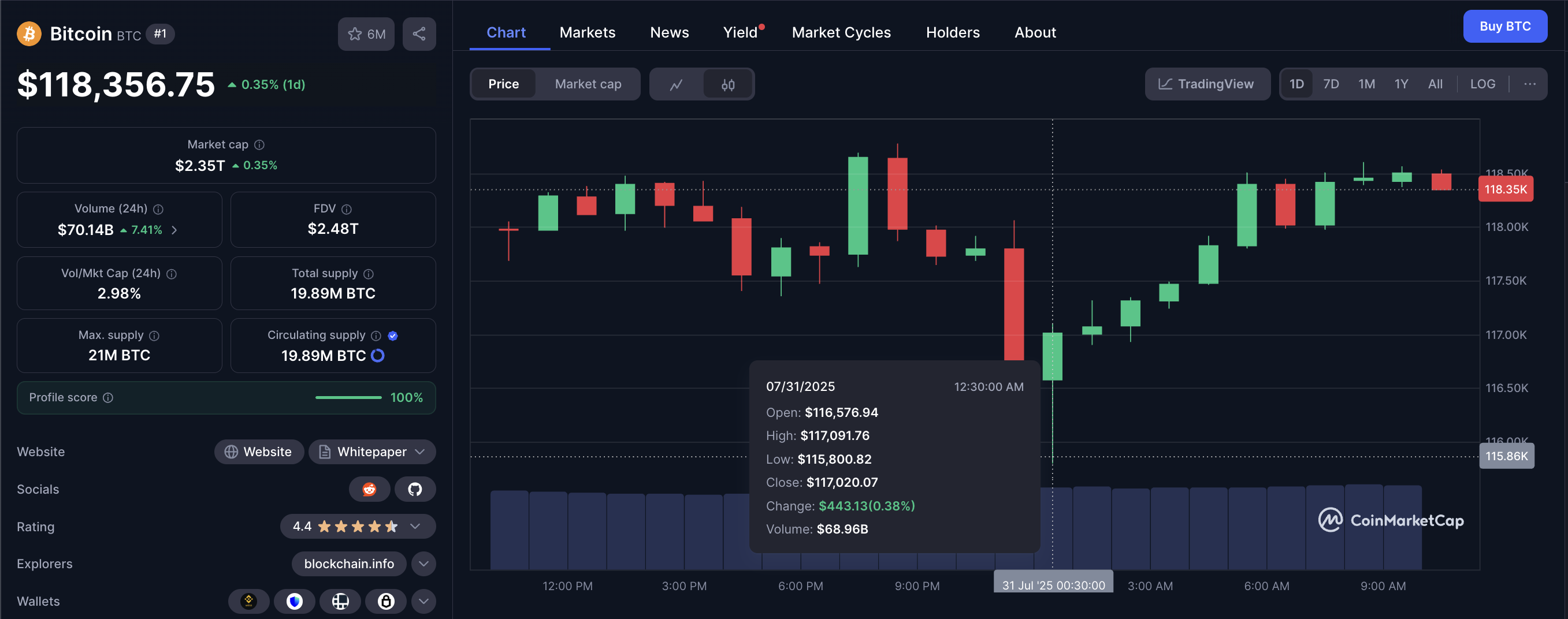

The US Federal Open Market Committee (FOMC) decided to keep interest rates unchanged on Wednesday, in line with market expectations. The US market flinched with minor losses while Bitcoin (BTC) briefly fell below the $116,000 level.

At the time of writing, BTC edges higher by 0.50% on Thursday, reclaiming the $118,000 mark. Top altcoins, such as Ethereum (ETH), Ripple (XRP), and Solana (SOL), are facing volatility as Powell tightens the reins.

Jerome Powell waits and assesses Trump’s tariff war

The broader market anticipated the Fed’s decision to keep rates unchanged at 4.25% to 4.50% for the fifth consecutive time, as inflation remains above target levels. Jerome Powell, chairman of the FOMC, made hawkish remarks in response to concerns about inflation triggered by tariffs.

The US President, Donald Trump, has imposed 25% tariffs on India on Wednesday, 15% on Japan and the European Union, and 30% on China. Powell said, "Increased tariffs are pushing up prices," which increased the possibility of increased inflation.

Donald Trump's post. Source: TruthSocial

As higher inflation usually leads to rate hikes to cool off demand, Powell said, "the Fed is looking through inflation by not hiking." However, as prices increase in response to higher tariffs imposed on global nations, the hawkish comments on rate hikes have increased broader market volatility.

Bitcoin holds steady amid unchanged rates

Bitcoin briefly tested levels below $116,000 on Wednesday in response to constant interest rates, and Powell’s comments on rate hikes, rising prices, and tariffs. Typically, a rate cut supports market demand by facilitating easy borrowing and fuels investors’ risk appetite for exposure to risky assets, such as Bitcoin.

Bitcoin market data. Source: CoinMarketCap

However, the decision to keep interest rates stable, paired with hawkish comments, led to momentary fear, leading to a pullback. If the rates are increased, the difficulty of borrowing money could decrease the demand for Bitcoin.

Until then, BTC and the top altcoins such as ETH, XRP, and SOL hold steady and recover from the momentary pullback on Wednesday. Ethereum edges higher by over 1% at press time on Thursday after a Doji candle on Wednesday. Ripple and Solana bounce back with nearly 2% at the time of writing, erasing losses of 1% and 2%, respectively, from the previous day.

Despite the gradual rise in volatility among altcoins, the broader market sentiment points to a bullish incline. CoinMarketCap’s Fear and Greed Index reads 62 in the “greed” or bullish zone, suggesting heightened investor sentiment unfazed by unchanged rates and hawkish comments.

Crypto Fear and Greed Index. Source: CoinMarketCap

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.