Bitcoin Cash Price Prediction: BCH hits $600, the highest level in 2025

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

Bitcoin Cash consolidates above $590 on Monday after hitting a new yeat-to-date high the previous day.

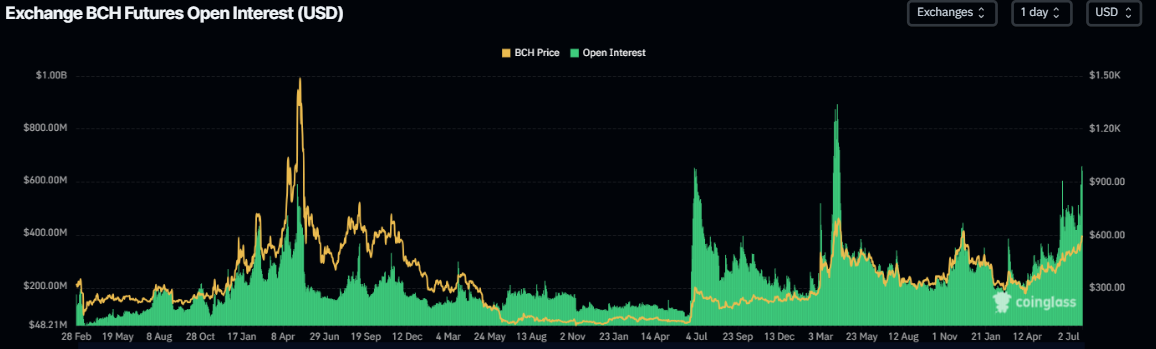

Derivatives data support the bullish case as BCH’s Open Interest reaches a level not seen since April 2024.

The technical analysis favors further upside, with bulls eyeing the next resistance zone around the $640 mark.

Bitcoin Cash (BCH) consolidates near $590 at the time of writing on Monday, after reaching its highest yearly level of above $600 the previous day. A bullish thesis in BCH is further supported by the rising Open Interest (OI) in the derivatives market, which has reached levels not seen since April 2024. Moreover, technical analysis suggests further upside, targeting the $640 mark.

BCH derivatives and on-chain data show bullish bias

CoinGlass’ data shows that the futures’ Open Interest in Bitcoin Cash at exchanges rose from $432.04 million on Thursday to $655.31 million on Monday, levels not seen since April 10, 2024. Rising OI represents new or additional money entering the market and new buying, which could fuel the current BCH price rally.

BCH open interest chart. Source: Coinglass

Additionally, CryptoQuant data, as illustrated in the graph below, indicates an increase in buying pressure on BCH. The Taker CVD (Cumulative Volume Delta) for BCH has been positive and has increased since early May. This indicator measures the cumulative difference between market buy and sell volumes over a three-month period. When a 90-day CVD is positive and increasing, it suggests the Taker Buy Dominant Phase, while a negative and decreasing value indicates the Taker Sell Dominant Phase.

(1)-1753686977942.png)

BCH Spot Taker CVD chart. Source: CryptoQuant

BCH Price Prediction: BCH hits yearly high above $600

Bitcoin Cash price broke above the daily resistance level of $542.50 on Friday and rallied, closing above the upper resistance trendline of a rising channel on Sunday, hitting a new yearly high of $608.20. At the time of writing on Monday, BCH consolidates recent gains and trades at around $590.30.

If BCH continues its upward trend, it could extend the rally toward its December 6 high of $640. A successful close above this level could extend additional gains toward the April 5, 2024, high at $719.50.

The Relative Strength Index (RSI) indicator on the daily chart reads 71, indicating strong bullish momentum in overbought conditions. The Moving Average Convergence Divergence (MACD) on the daily chart showed a bullish crossover on Friday, signaling a buy opportunity and suggesting an upward trend ahead.

BCH/USDT daily chart

On the contrary, if BCH faces a correction, it could extend the decline to retest its daily support at $542.50.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.